Outlook on June 17:

Analytical overview of popular currency pairs on the H1 chart:

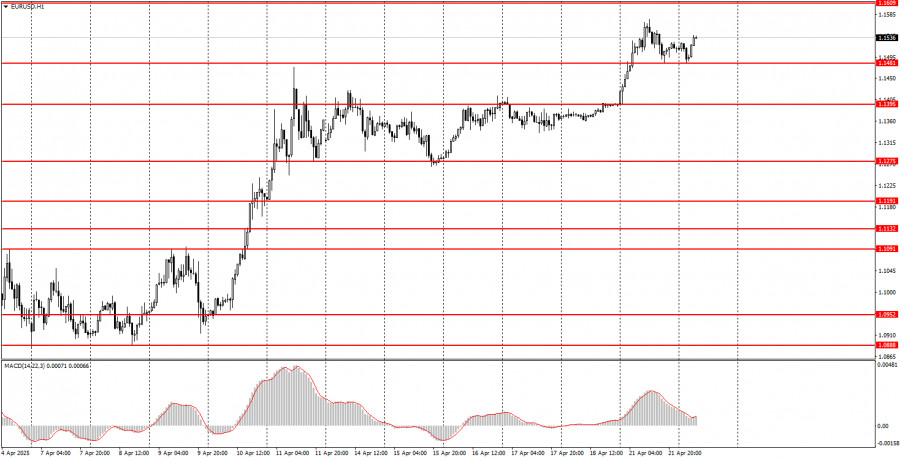

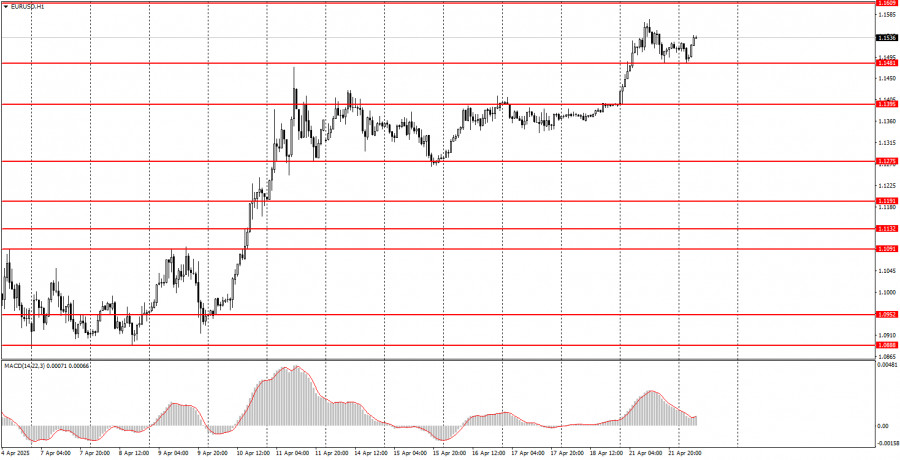

The key levels for the EUR/USD pair are 1.2051, 1.2019, 1.1999, 1.1958, 1.1920, 1.1892, and 1.1834. The price has been moving in a downward trend since June 9. We expect this trend to continue after the level of 1.1958 is broken. The target is set at 1.1920. After that, a short-term decline and consolidation in the range of 1.1920 - 1.1892 will occur. The final potential downward target is 1.1834. After reaching it, the price may pull back upwards.

A short-term growth, in turn, can be expected in the 1.1999 - 1.2019 range. If the latter breaks down, a deep correction will develop. The target is set at 1.2051, which is the key support level.

The main trend is the local downward trend from June 9 (mid-term initial conditions for June 1 low).

Trading recommendations:

Buy: 1.1999 Take profit: 1.2019

Buy: 1.2021 Take profit: 1.2050

Sell: 1.1956 Take profit: 1.1920

Sell: 1.1919 Take profit: 1.1894

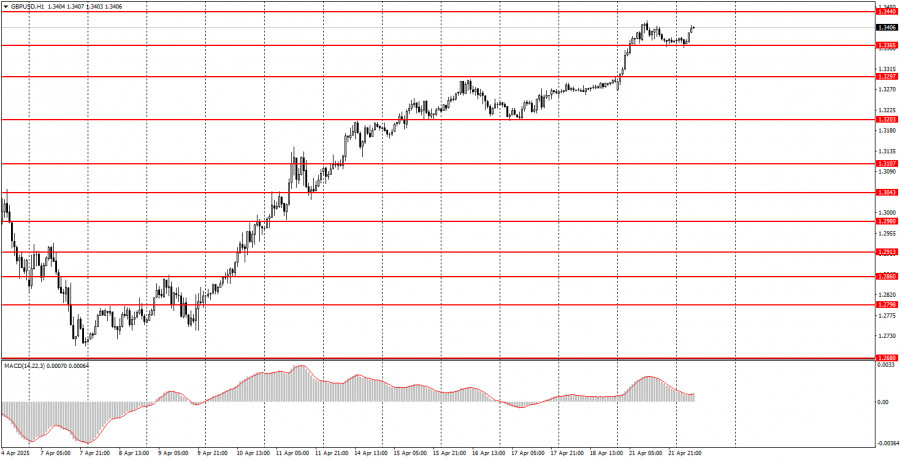

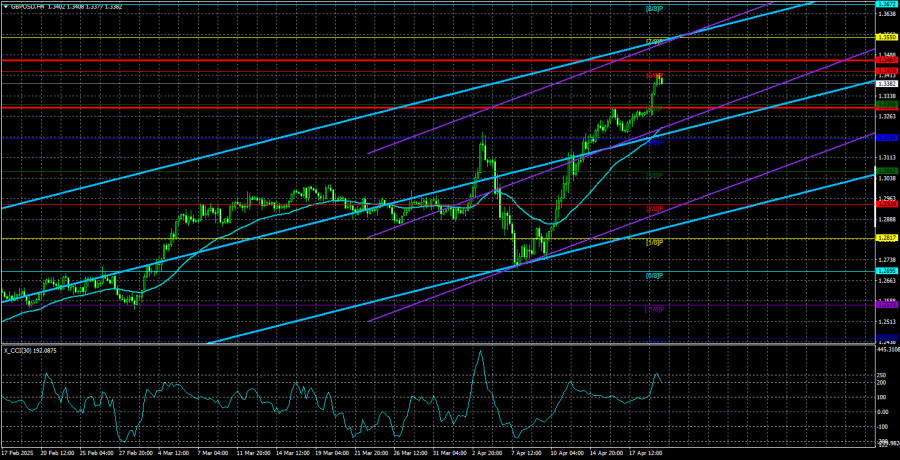

The key levels for the GBP/USD pair are 1.4126, 1.4059, 1.4029, 1.3985, 1.3964, 1.3922, 1.3893, and 1.3831. The price has been moving in a bearish trend since June 1. We expect the main trend to further develop after the price breaks through the range of 1.3985 - 1.3964. The target is set at 1.3922. After that, a short-term decline and price consolidation can be expected in the range of 1.3922 - 1.3893. The ultimate potential downward target is 1.3831. After reaching it, an upward pullback can be expected.

Short-term growth is possible in the range of 1.4029 - 1.4059. If the last value breaks down, it will lead to a deep correction. The potential target is seen at 1.4126.

The main trend is the downward trend from June 1.

Trading recommendations:

Buy: 1.4029 Take profit: 1.4057

Buy: 1.4061 Take profit: 1.4120

Sell: 1.3963 Take profit: 1.3922

Sell: 1.3920 Take profit: 1.3895

The key levels for the USD/CHF pair are 0.9192, 0.9168, 0.9154, 0.9121, 0.9090, 0.9072 and 0.9044. The price has been moving in an upward trend since June 9. We expect this trend to resume after the level of 0.9121 is broken. The target is set at 0.9154. After that, a short-term growth and price consolidation are possible in the 0.9154 - 0.9168 range. The final potential upward target is 0.9192. After reaching it, a downward pullback may follow.

A short-term decline is likely in the range of 0.9090 - 0.9072. If the latter is broken, a deep correction can be expected. The target is 0.9044, which is also the key support level.

The main trend is the upward trend from June 9.

Trading recommendations:

Buy: 0.9124 Take profit: 0.9154

Buy: 0.9155 Take profit: 0.9168

Sell: 0.9090 Take profit: 0.9072

Sell: 0.9070 Take profit: 0.9045

The key levels for the USD/JPY pair are 111.55, 111.34, 111.21, 110.91, 110.76, 110.56, 110.36, and 110.10. The price is following the development of the local upward trend from June 7. We expect the growth to continue after the price breaks through the 110.76 - 110.91 range. The target is set at 111.21. The price may consolidate in the range of 111.21 - 111.34. The final potential upward target is 111.55. After reaching it, the price may pull back downwards.

On the other hand, the short-term decline is possible in the 110.56 - 110.36 range. If the last value is broken, a deep correction will occur. The target is set at 110.10, which is also the key support level.

The main trend is the local upward trend from June 7.

Trading recommendations:

Buy: 110.91 Take profit: 111.20

Buy: 111.35 Take profit: 111.55

Sell: 110.56 Take profit: 110.38

Sell: 110.34 Take profit: 110.10

The key levels for the USD/CAD pair are 1.2376, 1.2354, 1.2303, 1.2278, 1.2241, 1.2222, and 1.2188. The price has been moving in a bullish trend since June 1. Now, we expect a short-term growth in the 1.2278 - 1.2303 range. If the last value is broken, strong growth will continue to the next target of 1.2354. The price may consolidate around it. The ultimate potential upward target is 1.2376. After reaching it, a downward pullback can be expected.

Meanwhile, a short-term decline can be expected in the range of 1.2241 - 1.2222. If the level of 1.2222 is broken, a deep correction will follow. The target is set at 1.2188, which is the key support level.

The main trend is the upward trend from June 1.

Trading recommendations:

Buy: 1.2305 Take profit: 1.2353

Buy: 1.2355 Take profit: 1.2376

Sell: 1.2240 Take profit: 1.2222

Sell: 1.2220 Take profit: 1.2190

The key levels for the AUD/USD pair are 0.7709, 0.7677, 0.7657, 0.7608, 0.7595, 0.7567, 0.7549 and 0.7509. The price has been moving in a bearish trend since June 11. We expect this trend to continue after the price breaks through the range of 0.7608 - 0.7595. The target is set at 0.7567. After that, a short-term decline and price consolidation can be expected in the 0.7567 - 0.7549 range. The final potential downward target is 0.7509, After reaching it, an upward pullback may follow.

Short-term growth is possible in the range of 0.7657 - 0.7677. If the last value is broken, a deep correction will occur. The target is set at 0.7709, which is also the key support level.

The main trend is the downward trend from June 11.

Trading recommendations:

Buy: 0.7657 Take profit: 0.7675

Buy: 0.7678 Take profit: 0.7707

Sell: 0.7595 Take profit: 0.7568

Sell: 0.7564 Take profit: 0.7550

The key levels for the EUR/JPY pair are 133.12, 132.83, 132.60, 132.17, 131.77, 131.59, and 131.10. The price has been moving in a downward trend since June 15. We expect the downward movement to continue after the level of 132.15 is broken. The target is set at 131.77, After that, a short-term decline and price consolidation can be expected in the range of 131.77 - 131.59. The ultimate potential downward target is 131.10. After reaching it, the price may pull back upwards.

Alternatively, a short-term upward movement is expected in the range 132.60 - 132.83. If the level of 132.83 is broken, a deep correction will occur. The target is set at 133.12, which is also the key support level.

The main trend is the downward trend from June 15.

Trading recommendations:

Buy: 132.60 Take profit: 132.80

Buy: 132.85 Take profit: 133.12

Sell: 132.12 Take profit: 131.80

Sell: 131.56 Take profit: 131.10

The key levels for the GBP/JPY pair are 156.00, 155.28, 154.95, 154.08, 153.90, 153.52. 153.13 and 152.87. We expect the main downward trend from May 28 to resume after the price breaks through the range of 154.08 - 153.90. The target is set at 153.52 and the price may consolidate near it. The breakdown of the level of 153.50 will allow us to move to the potential target of 152.87, near which a consolidated movement and an upward pullback can be expected.

In turn, short-term growth is possible in the range of 154.95 - 155.28. If the latter breaks down, it will favor the development of an upward trend. The potential target is 156.00.

The main trend is the downward trend from May 28, correction stage.

Trading recommendations:

Buy: 154.95 Take profit: 155.26

Buy: 155.34 Take profit: 156.00

Sell: 153.90 Take profit: 153.54

Sell: 153.50 Take profit: 153.15