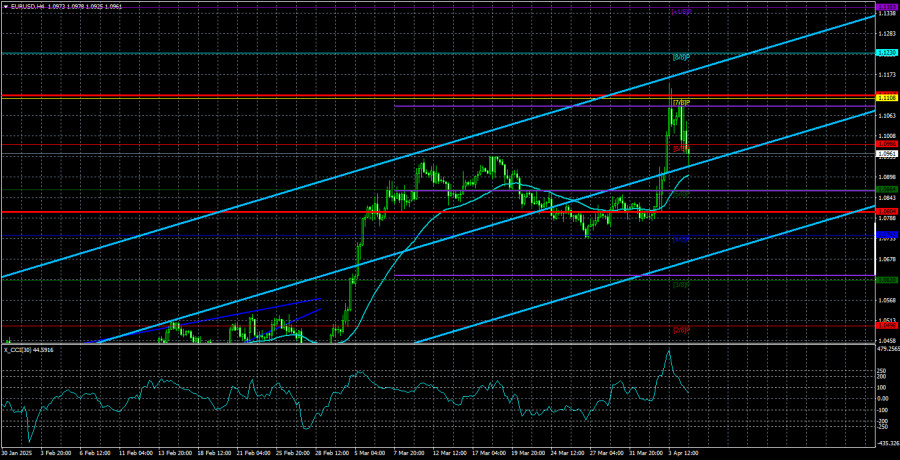

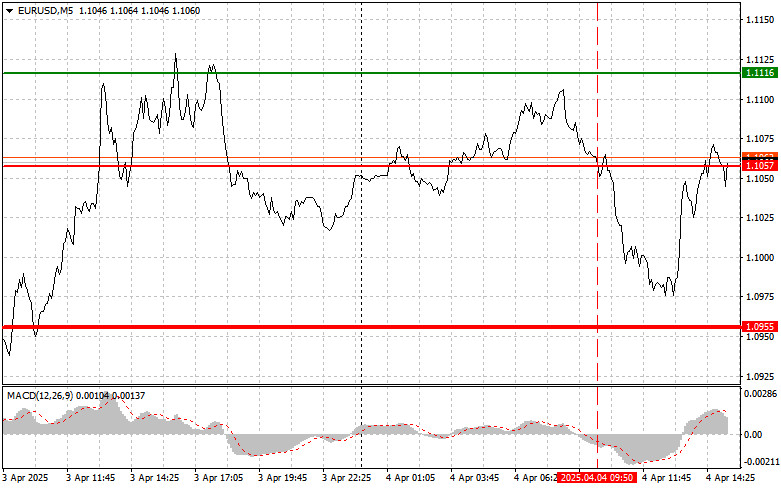

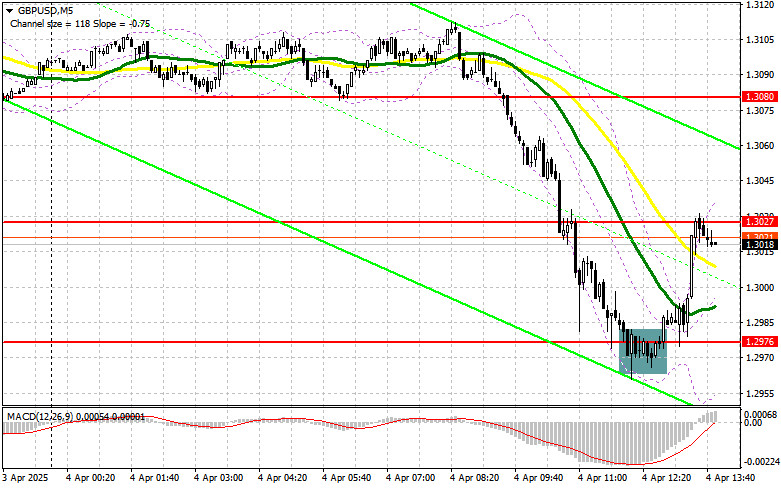

Another attempt to attack the 4th figure ended in failure. On Monday, EUR/USD bulls hit a five-month price high at 1.0498. However, the pair did not stay at this level for long - the price fell during the US session and finished the trading day at 1.0340. If the impulsive growth was unreasonable and unusual (despite the news from China), then the downward momentum was provoked by quite a specific person - European Central Bank President Christine Lagarde.

Lagarde delivered her semi-annual report to members of the European Parliament Committee on Economic and Monetary Affairs. The theme of the report was directly related to monetary policy, so the speech triggered increased volatility in the pair. And it was not in favor of the euro. It's notable that Lagarde voiced quite contradictory rhetoric. There were different ways to evaluate her speech, both in its favor and against. In the end, traders chose the second option: as a result, the euro weakened not only against the greenback, but also in many cross-pairs.

![Exchange Rates 29.11.2022 analysis]()

So, on the one hand, Lagarde said that the ECB will continue to raise rates, despite the slowdown in business activity in the eurozone. She acknowledged that high levels of uncertainty, tighter financial conditions, and declining global demand are putting pressure on economic growth in the European Union. But the record growth of inflation in the eurozone, according to her, is forcing the ECB to move on. Lagarde expressed doubt that the consumer price index in the eurozone has reached its peak values. She noted that the cost of wholesale energy supplies continues to rise (which is the main driver of headline inflation), so a slowdown in CPI growth in November seems extremely unlikely.

Lagarde said that she "would be surprised" if inflation reached its peak in October.

Certainly, the talking points are hawkish. In other circumstances, EUR/USD bulls would have taken advantage of the situation and rushed upwards, building on their success (i.e. in our case they would have settled in the area of the 5th figure).

If it were not for one "but".

The fact is that Lagarde made it clear in the European Parliament that slowing down the pace of interest rate increases in December is still a matter of debate. In doing so she took a neutral position in the corresponding dispute of many ECB representatives. Mario Centeno, Philip Lane, Francois Villeroy de Galo and Klaas Knot, among others, spoke publicly in favor of a lower rate of monetary policy tightening. Whereas the hawkish wing of the central bank, such as Robert Holzmann, Isabelle Schnabel and Joachim Nagel, came out in favor of a 75-point rate hike in December. Lagarde stayed "above the fray." According to her, the central bank will make an appropriate decision based on many factors: "...it will be based on our updated outlook, the persistence of the shocks, the reaction of wages and inflation expectations, and on our assessment of the transmission of our policy stance". Based on a comprehensive analysis of these factors, the ECB will decide how far rates should be raised and how fast.

Such statements sobered up the EUR/USD bulls and then the price rolled back and headed to the daily lows, to the area of the third figure. Even in the first half of Monday, the ball was on the side of euro-dollar pair bulls, which took advantage of the weakening of the greenback and the strengthening of the hawkish mood regarding the ECB's further actions. But the diplomatic wording of Lagarde, which allows for various scenarios (both dovish and hawkish) did not allow the bulls to consolidate their success. The bears took the initiative and pulled the price back to its previous positions.

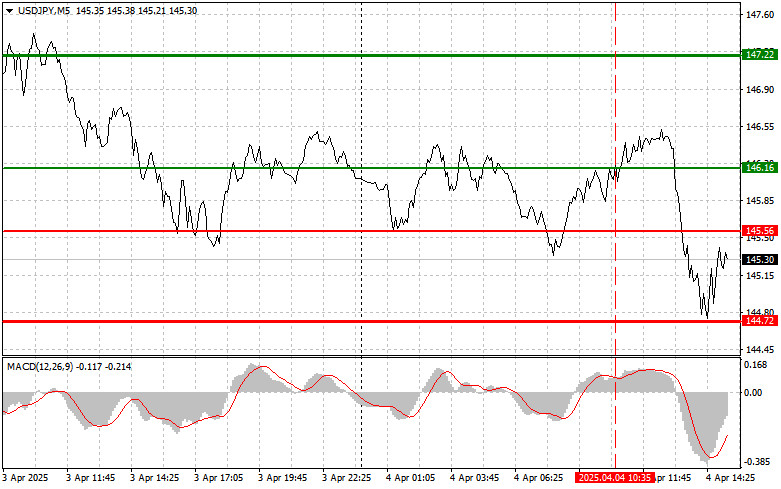

On top of that, in the afternoon, the market finally reacted to events in China, which unfolded too dynamically and unexpectedly.

First, the number of coronavirus cases in China is surging. Last Thursday, Beijing reported 31,000 new infections, noting that this was the strongest daily rate of increase in the history of the pandemic. But a little later, it turned out that PRC anti-records are updated almost daily. For example, the number of diseases has already exceeded the 40,000 mark on Monday. COVID outbreak in China is fraught with another wave of lockdowns. Strict quarantine has already been imposed in many cities across the country, with millions of people locked in their homes. Enterprises and firms have moved their employees to remote work schedules (where this is possible due to the nature of their work). China is known to have a "zero tolerance" policy for the Coronavirus, so it is not surprising that the authorities reacted to the situation with the utmost severity. And this circumstance gave rise to a second problem: Anti-Coronavirus protests broke out in China.

![Exchange Rates 29.11.2022 analysis]()

At the moment, it is difficult to talk about the prospects of the protest movement. In most cases, people are protesting against the "zero Covid" policy, which, in their opinion, does not bring results, but hits hard on the pocket. However, in some cases, demands for the resignation of Chinese leader Xi Jinping are also heard among the demonstrators. In any case, these protests are already considered the largest in China for the last 33 years, since the 1989 protests (the events on Tiananmen Square).

Judging by the dynamics of the dollar index, traders are wary of the unfolding events. The situation is, in a sense, a stalemate: on one side of the coin - possible turbulence in the markets due to the protests, on the other side of the coin - negative consequences from large-scale lockdowns in major cities of China.

Thus, the current fundamental background is clearly not favorable for the euro's upward movement (first of all, if we speak about a stable development, but not an impulsive breakthrough). Therefore, it is better to either take a wait-and-see position or consider short positions. The main bearish target is still at 1.0210 (the middle line of the indicator Bollinger Bands on the daily chart). Crossing this target will pave the way for the bears to reach the parity level.