Despite the positive report from the U.S. Labor Department, the dollar declined on Friday and continued to decline in the first half of today's trading day. The Bureau of Labor Statistics reported Friday that nonfarm payrolls rose 223,000 in December, exceeding the forecast growth of 200,000. Unemployment fell to 3.5% from 3.6% in November, which was also better than the forecast of 3.7%.

The weak point in the report was the data on wage growth. Average hourly earnings growth was 4.6% (annualized), down from 4.8% in November, versus a forecast of 5.0%. This data indirectly suggests that inflationary pressures are easing due to more modest increase in U.S. wages.

The ISM report released later on Friday showed that the Services PMI came in at 49.6 for December, worse than the estimate of 55.0 and the previous reading of 56.5.

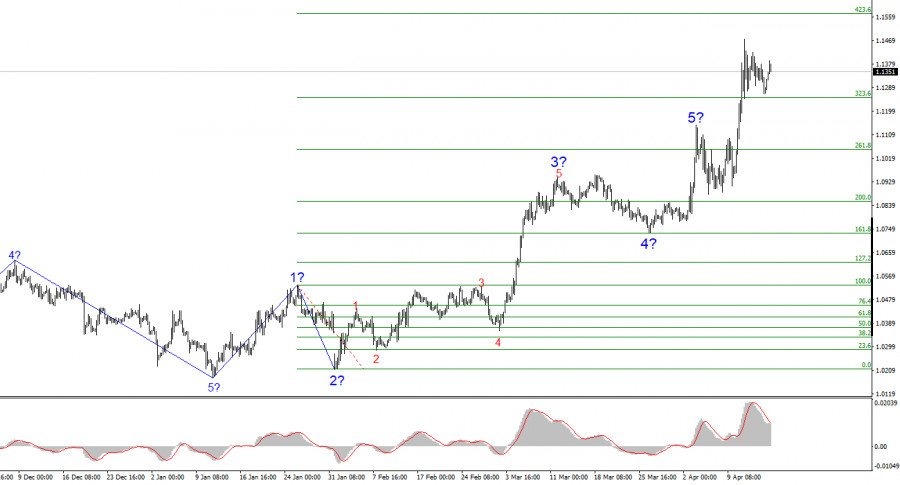

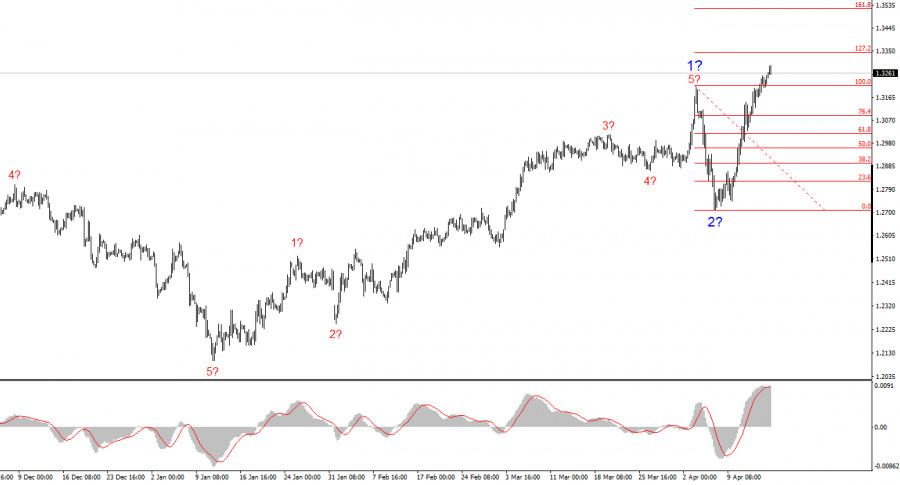

The U.S. macroeconomic statistics released last Friday strengthened investors' belief that the Fed will further slow down the pace of tightening its policy and, possibly, will go for its easing in the near future.

If the U.S. inflation statistics shows another slowdown on Thursday, it will further strengthen the Fed's tendency to wait and see after the harsh actions in 2022, when the interest rate was raised immediately by 4.25% (from 0.25% at the beginning of the year), to 4.50%.

As follows from the minutes of the December meeting of the U.S. central bank published last week, its leaders have so far maintained a tough stance, confirming their readiness for further monetary policy tightening. Fed officials believe that disruptions in the global supply chain, and increased inflation risks, will persist for at least another year, which means that the interest rate will be raised again at the next meeting (January 31–February 1) with a high probability. The question so far is how strong this increase will be, and the inflation data expected this week will allow market participants to draw certain conclusions on this matter.

There are no important publications in today's economic calendar. However, there will be a speech from Atlanta Federal Reserve President Raphael Bostic at 17:00 GMT. If he makes any unexpected statements regarding the Fed's monetary policy outlook, volatility in the dollar will rise again. Tomorrow, market participants will focus on the speech of Federal Reserve Chairman Jerome Powell at 14:00 GMT.

Following the results of the December meeting, as we recall, Powell stated that "much more evidence is needed to be sure of a decrease in inflation." At the same time, the "greatest pain," in his opinion, will be the inability to raise rates high enough. "The FOMC's view is that we need to keep rates peaking until we are really confident that inflation will come down in a sustainable manner," he said.

Powell's other key quotes suggest that "the 4.7% unemployment rate is still a strong labor market," the Fed "hasn't reached a sufficiently restrictive level of policy yet," and "there is some rate hike to go." However, "the FOMC continues to view inflation risks as upside."

The general conclusion from the December FOMC meeting is that the U.S. interest rate will continue to rise, at least to the 5.1% level (by the end of 2023), but much will also depend on the current economic and labor market conditions and inflation dynamics. If it declines steadily further, the pace of interest rate hikes will also slow down. "Our decisions will depend on incoming data in their totality," Powell said.

It will be interesting to hear his views on this now. If he confirms the Fed's inclination to continue the cycle of super-tight policy, even if at a slower pace, the dollar may regain much of its lost ground on Friday and today.

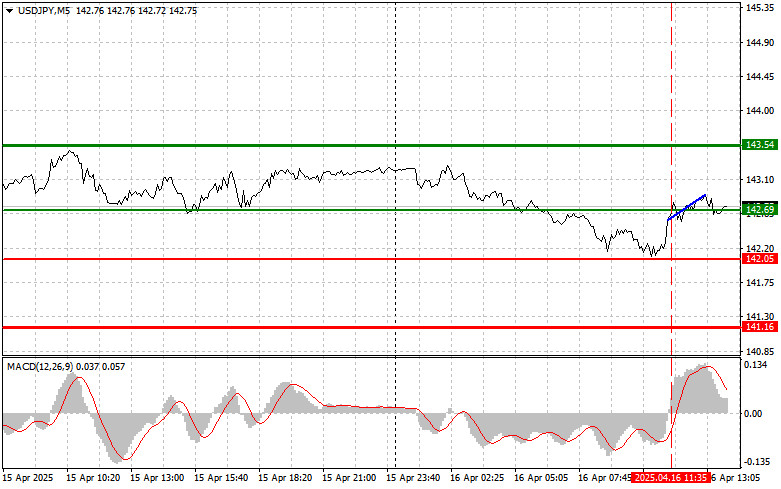

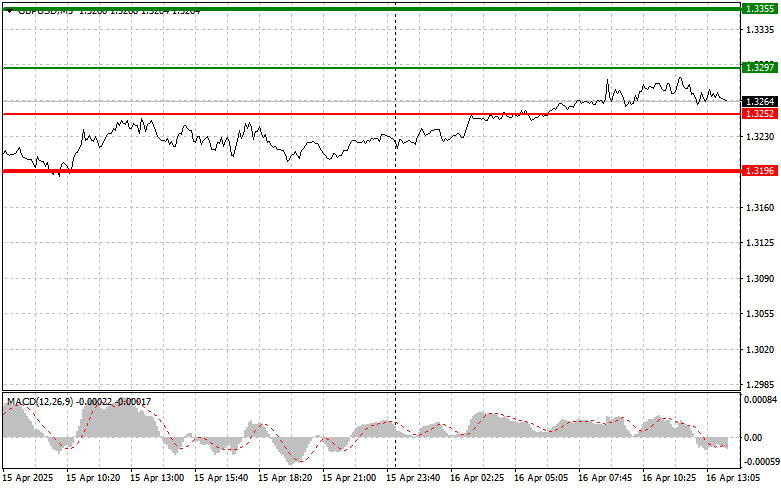

As of writing, DXY (CFD #USDX in the MT4 trading terminal) is trading near 103.72, having managed to update today's and 4-day lows at 103.40 before that.

From a technical point of view, DXY is trading in the medium-term bear market zone, below the key resistance levels 104.30, 105.40. It is worth noting that the DXY has approached the 103.40 support level four times in the last five incomplete trading weeks. The conclusion suggests that in case of a confirmed breakdown of this level, the DXY decline may accelerate towards the key long-term support levels 100.00, 98.55. A break of the 93.00 support level will return the DXY to the long-term bear market zone.