USD has been steadily declining in recent months as investors were betting that the US economy would slide into a recession, inflation would ease and the Fed would end its rate hiking cycle.

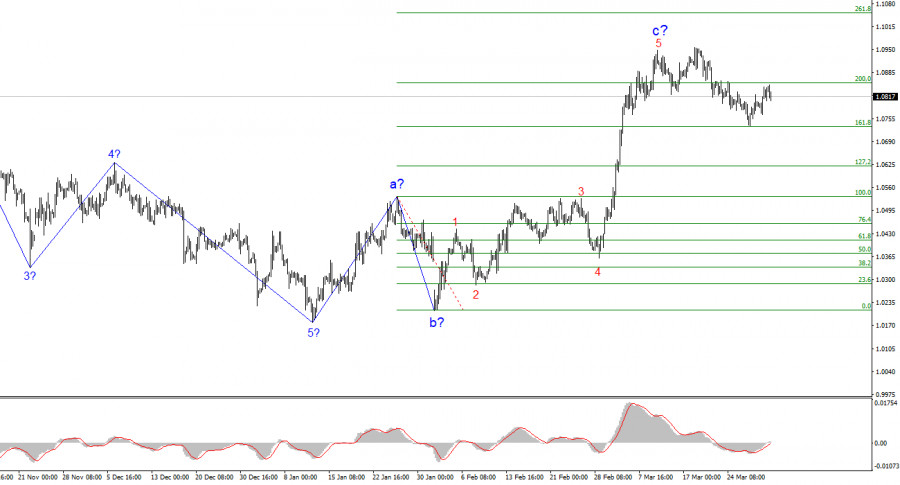

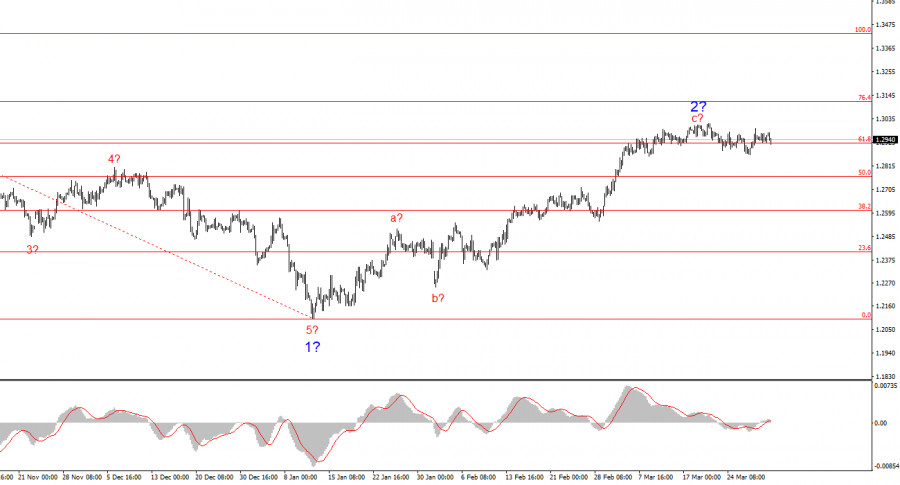

Taking advantage of a weaker US dollar, the euro managed to noticeably recover from twenty-year lows recorded at the end of September in the area of 0.9535.

The strengthening of the single European currency was supported by improved expectations for economic growth in the eurozone and as fears about the energy crisis in the region faded.

In August last year, the average settlement price for gas in Europe exceeded $2,450 per thousand cubic meters, which was a record price in the history of gas hubs in Europe since 1996.

However, quotes began to decline in autumn. Experts attributed this to the high level of gas in the gas storage facilities in the region and reduced demand due to energy savings and warm weather.

On January 17, exchange prices for gas in the EU fell below $600 per thousand cubic meters for the first time in 16 months.

Since January 30, quotations have been fluctuating in the range of $600-680 per thousand cubic meters.

The euro received an additional driver when China reopened after covid. China is a key market for industrial exports in the euro area.

In addition, the ECB's announcement in December that it would raise rates faster than previously expected pushed eurozone yields higher, thus supporting the euro.

As a result, on February 2, EUR/USD rose to its highest level since April last year -to the area of 1.1030. But then there was a pullback of about 360 points. This made some analysts think that the recent strong bounce in the single currency will be reversed.

"We remain bullish on the dollar and bearish on the euro," Danske Bank strategists said.

According to them, almost everything that could be positive for the euro has happened over the past month.

"We think the EUR rally has started to lose steam. The decline in the value of the euro is well grounded, and we look for more to come," they said.

The EUR/USD exchange rate has peaked for now, unless the Eurozone's energy crisis can be truly considered solved, analysts at Societe Generale said.

"The euro may consolidate unless European confidence improves. And the key to that may be the extent to which consumers and economies are confident that the energy crisis is behind us," they noted.

"Economic agents will not easily ignore Europe's dependency on imported (and in particular Russian) energy," Societe Geneale added.

Nevertheless, the bank maintains its forecast for the EUR/USD pair at the end of 2023 at 1.1200.

"If markets are persuaded, rightly or wrongly, that the energy crisis is solved and won't return, EUR/USD could trade back to 1.20, based on where we think bond yield differentials are heading," Societe Geneale experts said.

Economists at Intesa Sanpaolo believe that EUR should be trading higher against the US dollar.

They expect the ECB to raise interest rates more than the Fed during 2023, and this should support the euro.

"We have kept unchanged our forecasts for the exchange rate, in the near term as well, at EUR/USD 1.10-1.12 on a 1-3 month horizon and at 1.14-1.15 over a twelve-month timeframe," Intesa Sanpaolo said.

"Markets expect the Fed to start cutting rates later in 2023, but the ECB will not do so due to the eurozone's more robust inflation profile. This would further boost the euro. At the same time, the actual size of the final divergence between the ECB and the Fed will be important, since it will determine the levels of the EUR/USD exchange rate," bank experts said.

Last Thursday, the ECB raised its deposit rate by another half a percentage point to 2.5%.

"We know that we still have a lot to do, we know that we are not finished," said ECB President Christine Lagarde at a press conference.

The final communique of the ECB said that in March the rate hike would be the same size. At the same time, the regulator is open to other options.

"The Governing Council of the ECB intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March, and then it will evaluate the further course of its monetary policy," the ECB said.

"What happens next will depend on the economic data," Lagarde said.

Markets interpreted the news as a hint that the euro zone's monetary tightening cycle may soon be ending and interpreted the central bank's lack of guidance on the next steps as evidence that its commitment to fighting inflation is waning.

After the ECB meeting, the derivatives market started to price in a scenario according to which the deposit rate will reach a peak in the range of 3.25%–3.5%, which implies just a few points after a rise in March and by the end of the tightening cycle in the middle of the year.

"By and large, we can be relatively confident in the final rate of 3.25%-3.50%," UBS economists said.

"Most likely, we will face external weakness penetrating the European economy, so that we will be at a point where the ECB can say: "we have done enough," they added.

Although the ECB confirmed that interest rates will continue to rise in March and indicated that it will pursue its fight to bring inflation down to a target level of around 2%, these statements did not impress investors.

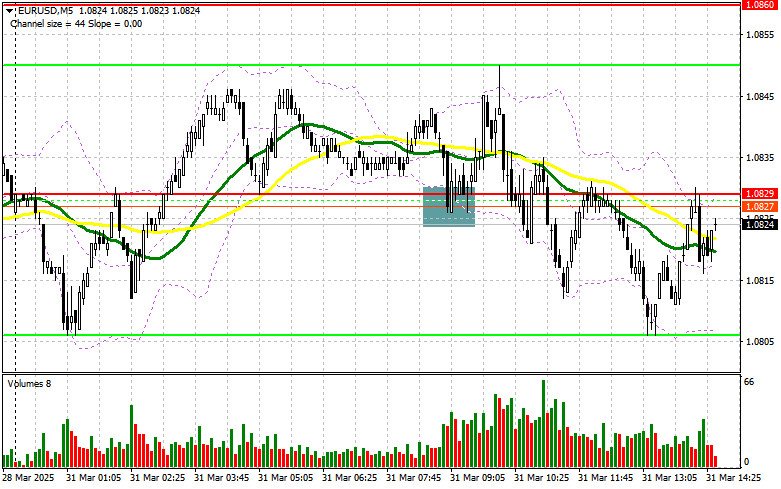

As a result, the EUR/USD pair was forced to retreat from multi-month highs last Thursday.

On Friday, it received another blow when a very strong report on the US labor market for January was released. The data made market participants reassess the US policy on interest rates and expect their further growth.

The market started to price in a further increase in Fed rates by 50 basis points.

At the same time, the likelihood that the peak value of the federal funds rate could be higher than 5% has increased.

"Against the backdrop of Friday's labor market data and ongoing concerns about a US labor shortage, we have revised upward our forecast for the upper end of the Fed's rate target range to 5.5% from 5.0%. This reinforces our expectations that the EUR/USD pair will return to 1.0600 in a three-month perspective and possibly to 1.0300 in six months," Rabobank strategists said.

After falling about 1.5% against the euro in January, the dollar has recouped all those losses in the first week of February.

On Monday, the greenback continued to rise against its European counterpart, taking into account the comments of the head of the FRB of Atlanta, Rafael Bostic.

He said his base scenario was to raise the federal funds rate to 5.1%. At the same time, the official did not rule out that the Fed would have to increase the rate more.

However, after Fed Chairman Jerome Powell confirmed on Tuesday that the process of disinflation is continuing, refusing to strongly resist market expectations for policy easing, USD lost its strength and retreated slightly.

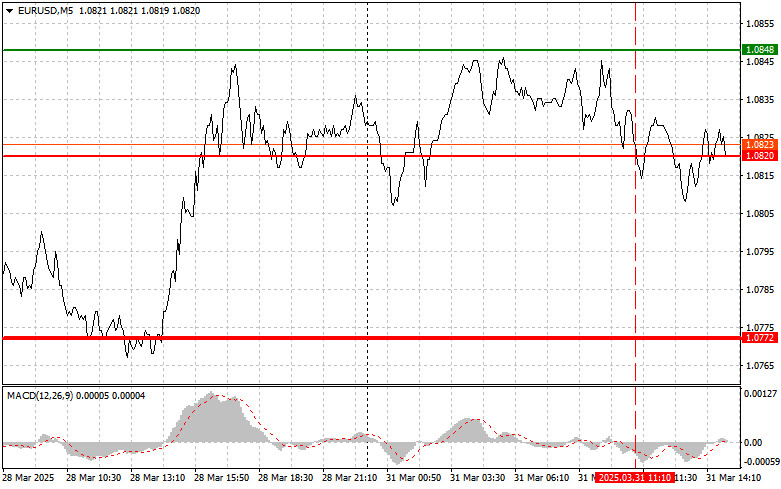

Taking advantage of the fact that the dollar loosened its grip, the EUR/USD pair managed to win back some losses, recovering from the lowest levels since January 9 in the 1.0670 area.

On Wednesday, a number of Jerome Powell's colleagues pointed out that additional interest rate hikes are needed to bring inflation fully under control.

"Moving to a federal funds rate in the range of 5.00% to 5.25% seems like a very reasonable view of what we will need to do this year to reduce the imbalance between supply and demand," the president of the New York Fed, John Williams, said.

Meanwhile, Minneapolis Fed chief Neil Kashkari said he still believes the federal funds rate will need to be raised to 5.4% or even higher if the data warrants it.

However, the dollar failed to benefit from these comments.

"Markets see the current moment as the peak of the Fed's hawkish comments and are now looking for opportunities to return to USD short positions at more attractive levels. However, there is still some room for hawkish repricing of US rate expectations, and a recovery in risky currencies may be premature," ING said.

"We believe a more patient trading environment could return after the surge in risk appetite and hold out until the important US inflation report on Tuesday. On Forex, it looks like it's too early for the dollar to start a steady downtrend again," they added.

The EUR/USD pair settled just above 1.0700. Experts at Commerzbank are pointing to key data that will determine the further movement of the pair.

"The focus will be whether the ongoing imbalances will be reflected in price data, in particular next week's US consumer price report for January. In this case, it will be easy for the Fed hawks to pull the market over to their side. The 1.0700 level in EUR/USD is clearly not a solid bottom," they said.

The major currency pair bounced off the key support at 1.0681-1.0669, which makes it more likely for the pair to stay in the range for the next few weeks with key resistance at 1.1000-1.1035, Credit Suisse strategists said.

"EUR/USD holds key support at 1.0681-1.0669. This confirms our base case for a long period of a range-bound market. This level is expected to define the lower boundary of the new range," they said.

"The possibility of sideways trading is also reinforced by the recent false break above the key resistance at 1.0944 (the 50% Fibonacci retracement level of 2021-2022). At the same time, a sharp decline is likely to significantly change the balance," Credit Suisse specialists said.

"It is expected that 1.1000-1.1035 will act as the upper end of the range. Conversely, a break below 1.0681-1.0669 would see another fall, with no meaningful support to 1.0483-1.0463, where we would again expect a bottom to form," they added.