In the previous week, the greenback fell by about 0.7% against its main competitors, including the euro.

The US dollar was fluctuating wildly as investors revised their expectations regarding US interest rates.

On March 8, following the hawkish statements by Fed Chairman Jerome Powell in Congress, markets assumed there was an 80% possibility of a 50-basis-point rate hike at the next meeting.

However, in a matter of days, those expectations disappeared, and on March 13, federal funds rate futures showed that the probability of no Fed rate hike next week shot up to as high as 44%.

Strategists at Goldman Sachs, PIMCO, and Barclays said they expect the Fed to maintain the status quo when it announces its verdict on monetary policy on March 22.

Nomura economists expect the Fed to cut its key rate by 0.25% at the next meeting.

On Monday, the US dollar index fell by nearly 0.9% to 103.20 as market participants began to bet that the Fed would slow down or stop raising interest rates amid signs that aggressive monetary tightening cracked the banking system of the country.

The greenback came under intense pressure following the collapse of a number of US banks. This required urgent action by the Fed, the US Treasury, and the FDIC.

The decision of the US authorities to protect deposits at Silicon Valley Bank and Signature Bank, which is noticeably smaller in size, showed a firm intention of Washington to prevent similar problems in other US banks. However, traders seem to consider these measures insufficient. As a result, the dollar lost ground against its major rivals.

Last Monday, the euro closed above $1.07 for the first time in a month. The European currency rose strongly against the dollar as eurozone supervisors said they see limited impact on the region's banks from the collapse of US creditors, while stressing the need to keep a close eye on any further spillover effects.

However, on Tuesday, the greenback rebounded amid strong consumer price data in the United States which suggested that the Fed may raise interest rates at the next meeting. Moreover, quick actions by the US authorities raised hopes that they will be able to stop the spread of the systemic crisis in the financial sector.

US annual inflation went up to 6% last month after rising to 6.4% in January. On a monthly basis, the index rose by 0.4% after accelerating by 0.5% in January.

The data pointed to the need for further monetary tightening as inflation is not slowing as fast as the regulator would like and remains well above its 2% target.

But since the possibility of a 50-basis-point rate hike at the next FOMC meeting was virtually out of the question, the dollar's strength faded rather quickly.

USDX ended the second day of the week with a modest increase of 0.05% to 103.25, and the EUR/USD pair closed the day almost unchanged.

After hitting multi-week highs around 1.0760 on Wednesday, the major currency pair reversed and turned lower as concerns about the state of the banking sector spilled over to Europe, where Credit Suisse gave distress signals.

This came after a major investor announced that it no longer intends to provide capital to the Swiss lender due to regulatory issues, and raised fears of a new financial crisis in the world.

Against the backdrop of banking turmoil, the market changed its expectations regarding rate hikes by the European Central Bank.

Traders priced in a 60% chance of a 25-basis-point rate hike at the next ECB meeting, up from a 90% chance of a 50-basis-point rate hike expected earlier.

Investors also factored in a 60% chance that the FOMC will not raise rates at its policy meeting on March 21-22.

Nevertheless, the dollar managed to outperform its European counterpart, taking advantage of the safe-haven asset status.

On Wednesday, the US dollar index rose by more than 1% to 104.40, retreating slightly from the daily high of 104.70.

Meanwhile, EUR/USD lost about 160 pips and ended the session in the 1.0575 area.

On Thursday, the US currency lost its bullish momentum due to improved market sentiment and a number of factors.

First, the Swiss National Bank threw a lifeline to Credit Suisse with a $54 billion bailout package.

Secondly, the American First Republic Bank, which faced an outflow of investor funds from deposits due to the situation with Silicon Valley Bank, received a $30 billion bailout from 11 major US banks, including Bank of America, Citigroup, JPMorgan, and Wells Fargo.

The Fed, in turn, expressed its readiness to provide liquidity to banks that meet the necessary criteria.

Finally, the ECB announced a rate hike of half a percentage point, as promised earlier, despite the turbulence in the financial sector. The firm position of the regulator has served as a kind of anchor for the markets and instilled confidence in investors.

ECB President Christine Lagarde said they have the tools to deal with a potential liquidity crunch and noted that banks in the euro area are resilient.

At the same time, the regulator said little about what can be expected in the coming months.

However, the euro edged up nearly 0.3% against the dollar to 1.0605 as markets generally calmed down on Thursday.

USDX fell by 0.15% to 104.10, reflecting increased demand for risk assets.

On Friday, the US dollar continued to lose ground, and the single European currency retained a positive attitude.

The data released at the close of the week showed that headline inflation in the euro area fell to 8.5% in February from 8.6% a month earlier.

At the same time, core inflation continued to accelerate, jumping to 5.6% in February from 5.3% in January.

This data provided support for the euro as market participants recalled the statements made by Christine Lagarde at a press conference the day before.

The head of the ECB announced that the regulator intends to fight inflation and bring it back to 2%.

According to Lagarde, the central bank still has a lot to do in terms of policy tightening.

Meanwhile, the University of Michigan report showed that US inflation expectations for the year ahead fell to 3.8% from 4.1% in February. Over the five-year horizon, the indicator dipped from 2.8% to 2.9%.

Lowering inflation expectations not only gives the Fed some room to make a rate decision but also puts less pressure on the regulator to raise rates. This is bad news for the dollar.

At the end of the session on Friday, the US dollar index fell by 0.5% to 103.50. Taking advantage of the weakening dollar, EUR/USD extended the previous day's bounce, adding about 60 pips and closing the day in the 1.0665 area.

On Monday, the dollar declined for the third day in a row as investors cut bets on US monetary tightening.

The Fed announced over the weekend that it would be offering daily swaps to the Bank of Canada, the Bank of Japan, the Swiss National Bank, and the European Central Bank to ensure they have enough liquidity to continue operations.

"The network of swap lines among these central banks is a set of available standing facilities and serves as an important liquidity backstop to ease strains in global funding markets," the Fed said in a note released on Sunday.

The Fed's recent moves suggest officials are more concerned about the risk of financial contagion, and Wednesday's FOMC rate hike is even more doubtful, strategists at LH Meyer said.

Fed Chairman Jerome Powell and his colleagues will meet on Tuesday for a two-day meeting on monetary policy.

"We still expect the Fed to increase borrowing costs by 25 bps, but any rate hike is likely to be accompanied by neutral or dovish rhetoric that leaves the outlook for rates depending on how the economy and banking sector develop next. The dollar will continue to weaken if the market believes that the regulator is close to the end of the tightening cycle," specialists at Scotiabank said.

The euro will benefit if the Fed does not say anything new on Wednesday.

If the Fed announces its decision to leave the cost of borrowing unchanged, the single European currency could outperform its US rival.

However, if the Fed raises the key rate and also indicates its readiness to raise it further, confirming its commitment to fighting inflation, this will be a bullish factor for the dollar and a bearish factor for the euro.

"A pause in rate hikes should lead to a weakening of the greenback, but this would be understandable after the recent banking failures. If the Fed raises the key rate by 25 basis points, and the dot plot of the regulator's projection does not bring surprises, we should not expect too much volatility. Meanwhile, raising rates by 50 basis points will be a very favorable outcome for the dollar. In this case, the EUR/USD pair may well be trading under a strong support level at 1.0500 on this news," ING experts said.

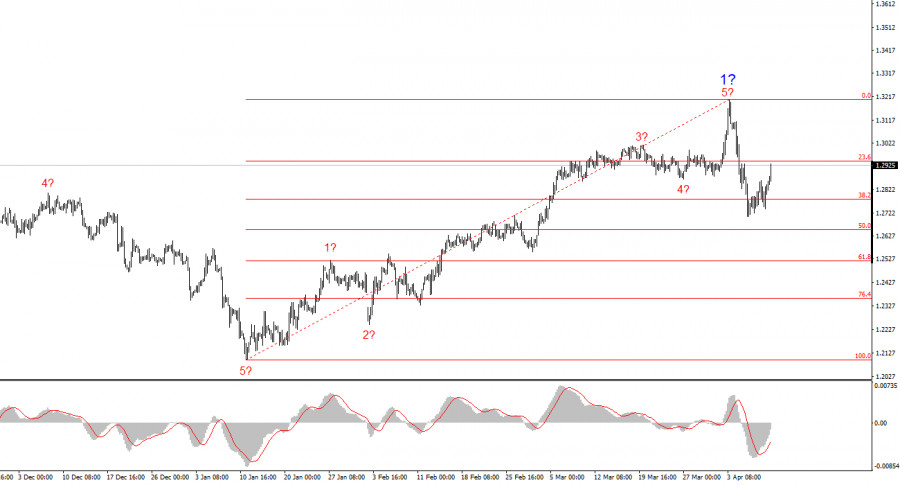

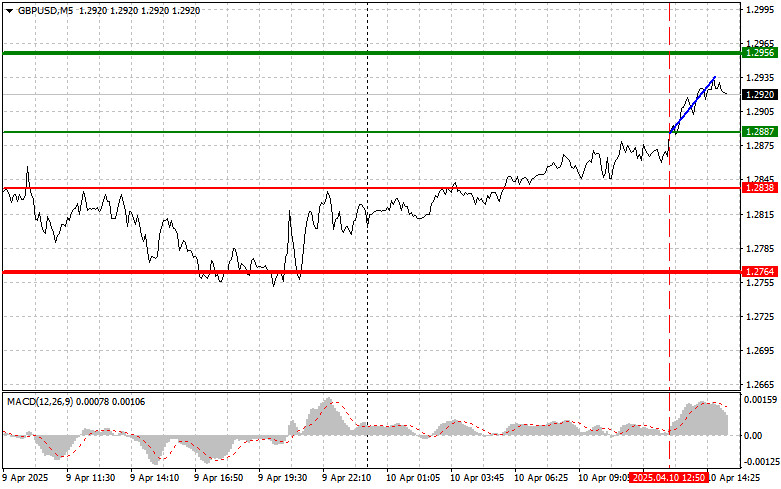

On Monday, the greenback extended its losses to the area below 103. This serves as a tailwind for EUR/USD.

The next downside barrier for the US dollar is found at 102.60 (the weekly low of February 14). A breakout of this level may trigger a deeper pullback, namely to a low of 100.80 recorded on February 2.

However, investors prefer to wait for the Fed's verdict on monetary policy before betting on further weakening of the dollar.

As for EUR/USD, its initial resistance lies at 1.0750, followed by 1.0790 and 1.0830.

On the other hand, the nearest support is located at 1.0680 and followed by 1.0640 and 1.0600.