- China has warned countries against making deals with the United States that could harm Beijing's interests, raising the stakes in the ongoing trade war with Washington. On Sunday, the Chinese

Author: Jakub Novak

11:25 2025-04-22 UTC+2

32

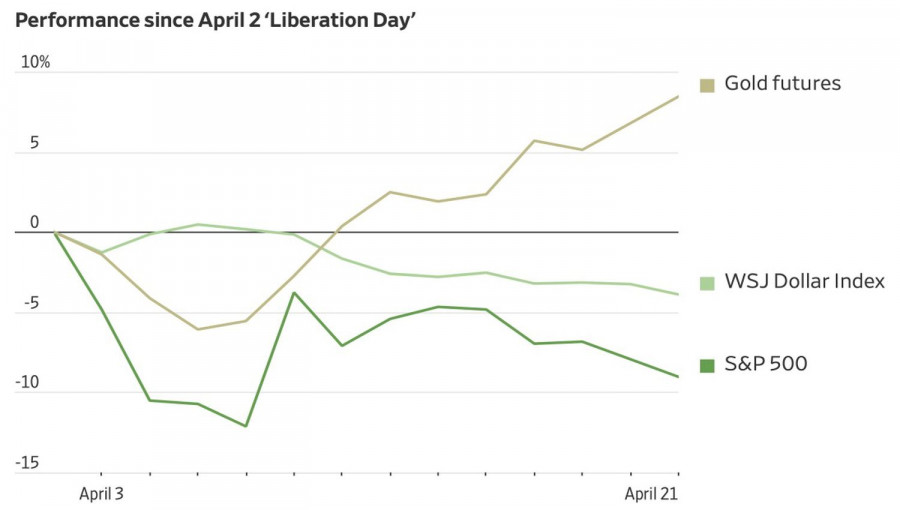

The S&P 500 and Nasdaq 100 continue to slide as mounting concerns over slowing economic growth and the impact of trade tariffs weigh on sentiment. The market remains volatile, withAuthor: Ekaterina Kiseleva

11:13 2025-04-22 UTC+2

13

The U.S. dollar fell to its lowest level since January 2024 after President Donald Trump's criticism of the Federal Reserve sparked concerns over the central bank's independence. The dollar weakenedAuthor: Jakub Novak

11:12 2025-04-22 UTC+2

37

- Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Author: Sebastian Seliga

10:08 2025-04-22 UTC+2

37

Fundamental analysisLoss of Confidence in the Fed Will Pressure the Dollar (Bitcoin Likely to Continue Rising, USD/CAD to Decline)

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topicAuthor: Pati Gani

09:00 2025-04-22 UTC+2

14

It's impossible to inject capital into an economy destabilized by politics. Capital continues to flow out of the United States, and Donald Trump's attacks on the Federal Reserve only accelerateAuthor: Marek Petkovich

08:52 2025-04-22 UTC+2

17

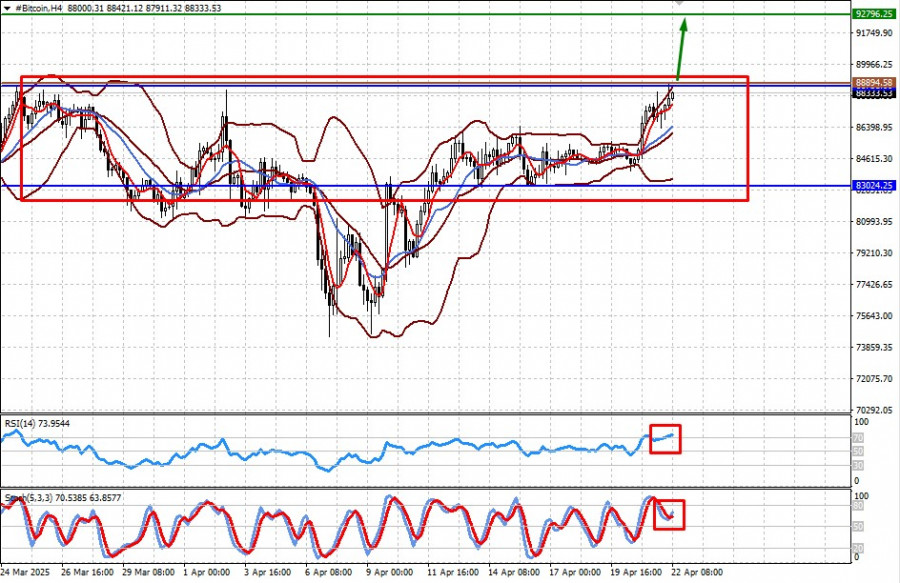

- Bitcoin Returns to the $88,000 Zone, but Ethereum Is Facing Challenges Yesterday's sell-off during the U.S. session, once again triggered by a decline in American stock indices, was offset

Author: Miroslaw Bawulski

08:18 2025-04-22 UTC+2

10

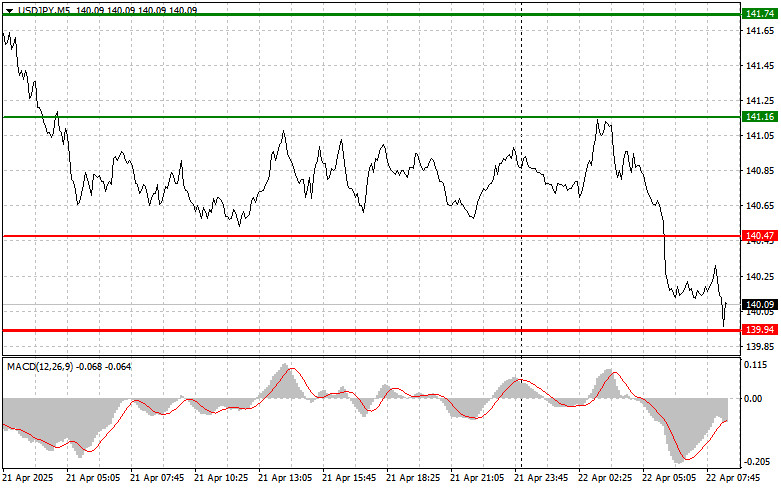

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on April 22. Review of Yesterday's Forex Trades

There were no tests of the levels I had marked in the second half of the day, as the yen's volatility dropped significantly. Today's data shows that the BankAuthor: Jakub Novak

08:11 2025-04-22 UTC+2

18

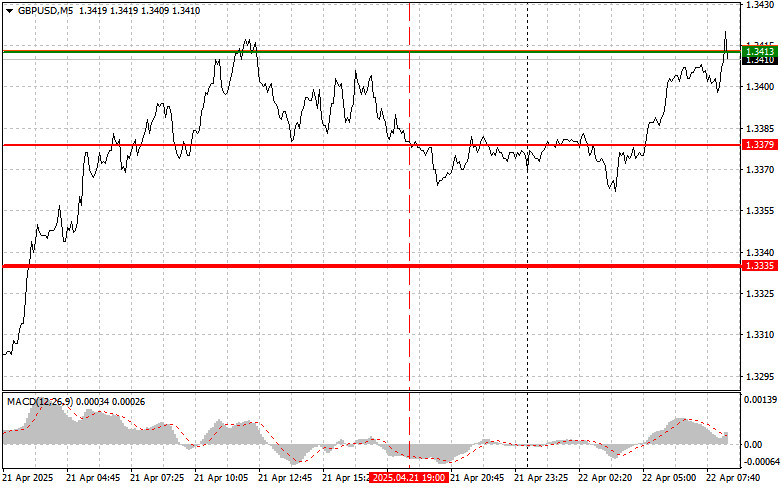

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on April 22. Review of Yesterday's Forex Trades

The price test at 1.3379 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downside potential. For this reasonAuthor: Jakub Novak

08:11 2025-04-22 UTC+2

21