At the end of the week, the US dollar managed to make a comeback, pushing back its European counterpart. The euro significantly weakened in response to the European Central Bank's (ECB) decision on interest rates. However, analysts anticipate a gradual recovery for the euro, which is currently struggling to rise from its lows.

On Thursday evening, September 14, the ECB raised its benchmark interest rate by 25 basis points to 4.5%. From Wednesday, September 20, the rate on the marginal lending facility will also increase to 4.75%, and the rate for the deposit facility will go up to 4%. The ECB has long-term goals, specifically aiming to return inflation to 2% by 2025.

According to ECB representatives, inflation within the Eurozone continues to decline but will remain high for an extended period. The Governing Council is committed to ensuring a timely return to the targeted 2% inflation rate. To achieve this target, the bank has decided to raise its three key interest rates by 25 basis points.

The ECB statement emphasized that they believe the rates have reached a level that will facilitate the timely return of inflation to the target level. Future decisions will be geared towards maintaining these key rates for as long as needed to curb economic activity.

Beyond the rate decision, the ECB released a new macroeconomic forecast. Growth projections for the Eurozone GDP from 2023-2025 appeared slightly worse than previously anticipated. According to the revised estimates, the Eurozone's economy will grow by 0.7% in 2023, 1% in 2024, and 1.5% in 2025. The GDP forecast's deterioration is attributed to reduced credit demand caused by tighter financing conditions and worsened international trade conditions.

The bank has also revised its inflation forecast. The ECB now expects a price increase of 5.6% by the end of 2023, 3.2% in 2024, and 2.1% in 2025. The revised inflation forecast for 2023-2024 reflects the soaring energy prices. Price pressure remains robust, though most indicators have started to decrease. Experts agree that the increased forecast for this year and the next relates to rising energy prices.

The prevailing situation bolstered the US dollar's confident rise and caused a noticeable dip in the euro. The euro's efforts to stay afloat proved futile. Nevertheless, the single European currency continues to defend its stance, striving not to plummet further.

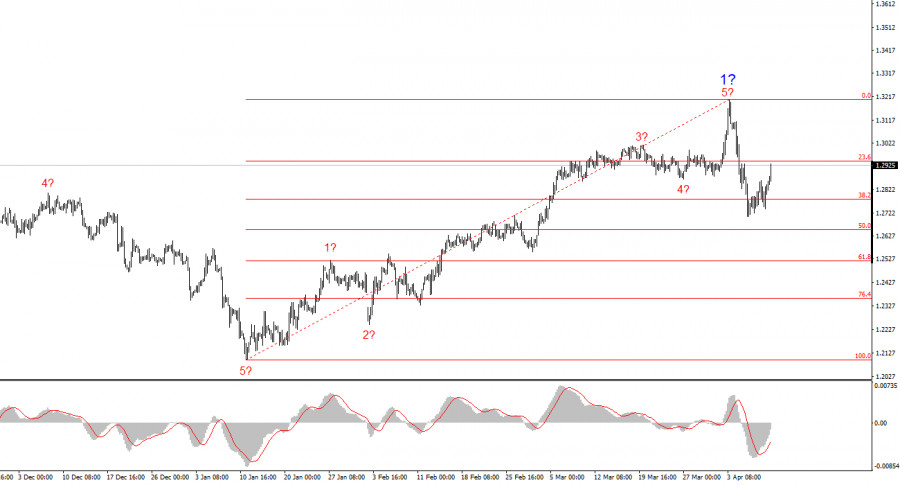

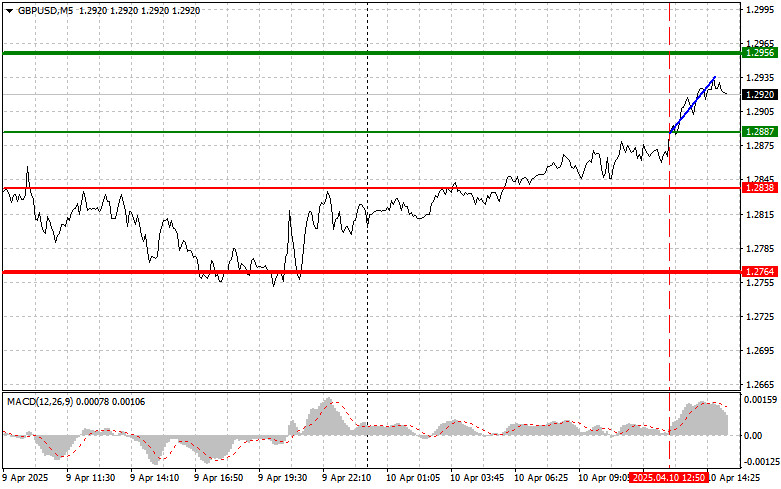

Following the ECB's decision on the key rate, the EUR/USD pair fell from 1.074 to the key level of 1.0700, and then even lower. The statement that interest rates have reached a level that "will make a significant contribution to a positive situation" suggests a potential end to the tightening cycle. This serves as a bearish factor for the euro. On Friday morning, September 15, EUR/USD was trading at 1.0656, losing a significant portion of its gains.

When the ECB raised the key rate by 25 basis points to 4.5%, contrary to analysts' forecasts, the markets perceived this as a signal that the rate had peaked. According to ECB officials, the current rates are sufficient to return inflation to the target of 2%. However, the main driving force for the markets came from the comments about the ECB decision.

The market's reaction was almost instantaneous: the euro came under massive selling pressure, approaching 1.0650. As a result, the euro was just one step away from the lows of March 2023. The ECB's downward revision of economic growth forecasts and comments on the swift transmission of tighter monetary conditions were perceived by the markets as a negative signal. Inflationary pressure in the eurozone remains strong, with high energy and food prices posing significant risks.

The contrast between the EU and the US was highlighted by the latest batch of macroeconomic data from the US, where retail sales, producer prices, and the labor market situation demonstrated a relatively stable economy. Experts believe that US inflation data was soft enough to halt the recent rise of the greenback, which is trying to develop an upward spiral.

Against this backdrop, the EUR/USD pair will drift downwards, analysts at Societe Generale believe. Currency strategists at Danske Bank agree, stating that the ECB's dovish stance and the prolonged growth of the US market are putting pressure on the EUR/USD pair.

Danske Bank maintains its previous forecast for the EUR/USD pair, predicting a decrease "based on current trading conditions, real rates, and relative labor costs". At the same time, the bank believes that "the relative strength of the US economy will put pressure on the EUR/USD pair in the coming months, as the growth differential plays a leading role here". Over the next 6–12 months, the EUR/USD pair will continue to decline and will trade in the wide range of 1.0600–1.0300, Danske Bank claims.

Regarding a possible increase in the Federal Reserve's key rate at the regulator's meeting scheduled for next week, the markets do not expect a rise. Many experts are confident that the Federal Reserve will keep the interest rate at the current level. The economic stability of the US, confirmed by recent macro reports, may prompt the Federal Reserve to reduce the key rate no earlier than 2024. Implementing such a scenario would contribute to the further strengthening of the dollar, analysts believe.