EUR/USD Technical Analysis: Navigating Through Mixed Market Signals

Key Takeaways:

- The EUR/USD is trading in a bullish channel, with technical indicators showing a predominant buy signal.

- Market sentiment remains bullish, but caution is warranted as key pivot points approach.

- Recent fundamental data suggests mixed economic signals, impacting investor outlook and currency strength.

Market Brief:

Recent sessions on Wall Street ended on a high note, with Nasdaq100 gaining 3.01% and Nvidia shares jumping by 16.5%. This positive momentum carried over to Asia, particularly in Japan, where the Nikkei rose over 2%. However, Chinese indices closed flat despite the upbeat mood. In the housing market, China saw a 0.7% drop in new home prices, and Singapore's CPI indicated a 0.7% decline, contrasting with the previous increase.

In Europe, the futures contracts are slightly down, although the sentiment is buoyed by higher futures on Wall Street. The UK consumer sentiment dipped more than expected, which could weigh on the European currencies. Comments from the Fed's Lisa Cook and Patrick Harker suggest a near-term cut in interest rates, which aligns with market expectations for the second half of the year.

The EUR/USD is currently flat, trading around 1.0822, and the USD/JPY consistently holds above 150 points. Precious metals are losing ground except for palladium, while cryptocurrencies show negligible response to the Wall Street rally, with Bitcoin below $51,500. German insurer Allianz reported Q4 earnings that beat expectations, along with a €1 billion share buyback.

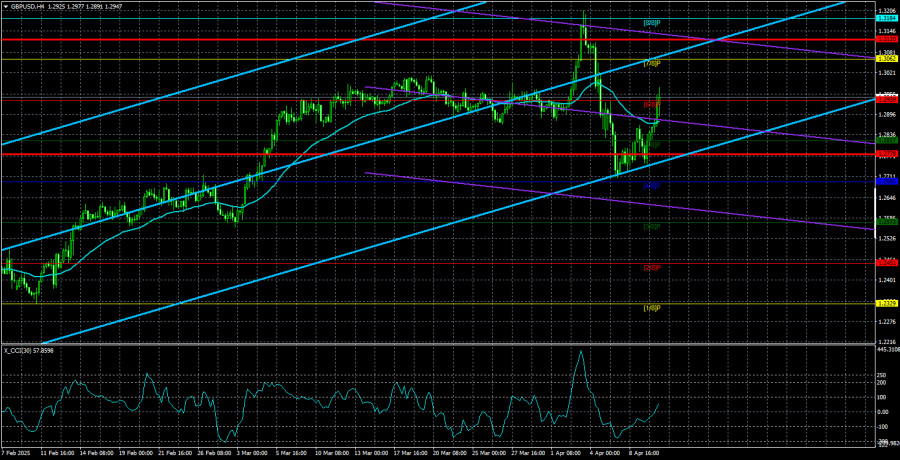

Technical Analysis:

The EUR/USD H4 chart shows a clear bullish trend within an ascending channel, supported by 13 out of 18 moving averages signaling 'Buy'. The RSI is above the midpoint at 59.17, suggesting bullish momentum but not yet overbought. A bullish engulfing pattern indicates potential continuation of the uptrend, with the currency pair testing a supply zone near the 1.0920 mark.

- Trend Analysis:

- The price appears to be in an uptrend within a rising channel. This is identified by higher highs and higher lows, a classic sign of a bullish trend.

- Pattern Identification:

- There's a clear Bullish Engulfing pattern marked at the beginning of the channel, which is a bullish reversal pattern.

- The upward trend is confirmed by consecutive green (bullish) candles within the channel.

- Support and Resistance:

- The chart shows marked supply and demand zones. The demand zone near the bottom of the channel acts as support, while the supply zone at the top acts as resistance.

- The currency pair is trading near the middle of the channel, between the dynamic support of the EMA (Exponential Moving Average) and the upper resistance line.

- Moving Averages:

- The 100-period EMA is below the current price level, indicating that the short-term trend is upwards.

- The 50-period DEMA (Double Exponential Moving Average) is slightly above the current price, suggesting some resistance ahead.

- Indicators:

- The Relative Strength Index (RSI) is around 59.17, which is below the overbought threshold of 70. This suggests that there might still be room for upward movement before the currency pair becomes overbought.

- Elliott Wave Theory:

- The chart has labeled points W, X, Y which could indicate the waves within an Elliott Wave sequence. If this is an Elliott Wave pattern, it looks like the price could be in a corrective phase (X to Y) after an impulse (W to X).

Summary: The technical analysis of the EUR/USD pair suggests a continued bullish trend within the rising channel. The presence of bullish candlestick patterns and the price position relative to moving averages support this. However, the approaching resistance and the RSI's position suggest that traders should be cautious of potential pullbacks or consolidation.

Traffic Light Indicator:

- Green: The overall trend, RSI position, and bullish candlestick patterns indicate a bullish sentiment.

- Amber: The price nearing the upper resistance line and a slight downturn in RSI suggest caution.

- Red: Not immediately visible, but a break below the channel could indicate a trend reversal to watch out for.

Please remember, this analysis is based on the information provided in the chart and should not be taken as trading advice. Always do your due diligence before making any trading decisions.

Market Scenarios:

Bullish Scenario:

If EUR/USD sustains its position above the Weekly Pivot Point (1.07824) and surpasses the WR1 (1.07902), we could expect a push towards the supply zone at 1.0821. A break above WR2 (1.07970) may strengthen the bullish case, possibly extending gains towards the WR3 (1.08116).

Bearish Scenario:

A drop below the Weekly Pivot Point could see the pair test the WS1 (1.07756) for support. If bearish momentum increases, falling below the DEMA 50 and WS2 (1.07678) could signal a more substantial shift in sentiment, with a potential move towards WS3 (1.07568) and possibly exiting the bullish channel.

Conclusion:

The EUR/USD pair demonstrates resilience despite mixed fundamental signals. Traders should watch pivot points closely for directional cues and remain aware of global economic updates that may influence market sentiment.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.

#instaforex #analysis #sebastianseliga