Currency analysts come up with grim forecasts for the US dollar. They predict now and then that the greenback is doomed to a deep decline and even collapse in the long term. At the same time, a lot of analysts are confident that the US dollar will remain afloat. In any situation, the dollar knows how to meet the challenge, turning temporary setbacks to its advantage. The European currency is learning this skill from the greenback, with its prospects being relatively good, but unstable.

Since the beginning of this year, the American currency has strengthened its position. In the fall of 2022, the situation was much worse: the dollar had significantly weakened and this decline continued into early 2023. Against this backdrop, market participants feared that the king dollar would meet its end. Indeed, in the context of the Fed's cycle of high interest rates, the USD's share in the reserves of global central banks shrank significantly.

However, by the end of the summer of 2023, the situation went back on track, and the greenback recouped a significant portion of its losses in the currency market and in international transactions. In the forex market, the dollar asserted its strength throughout almost the entire summer. This trend continued in early autumn. In the first half of September, the US dollar index (DXY) logged steady growth for five consecutive weeks.

Analysts believe that the greenback's confident rally was facilitated by the hawkish policy moves of the Federal Reserve. Remarkably, last Wednesday, September 20th, the regulator kept the key rate unchanged in the range of 5.25%–5.50%, but signaled another rate hike by 0.25% by the end of 2023.

The current position of the Federal Reserve diverged from the ECB's decision on the key interest rate. Last week, the European regulator raised interest rates by 0.25%. Most analysts considered the ECB's tightening cycle softer than the Fed's one. Against this backdrop, they forecasted a possible strengthening of the euro.

According to currency strategists at Natixis, the potential strengthening of the European currency is aided by rising inflation in the eurozone, which is expected to remain higher than in the US. Economists at Natixis tried to predict the consequences of maintaining lower inflation in the US compared to the eurozone and concluded that such a situation will serve as a kind of "fertile soil" for the euro. In addition, the Federal Reserve might venture into faster rate cuts than in the Eurozone which is likely to suffer a reduction in investments.

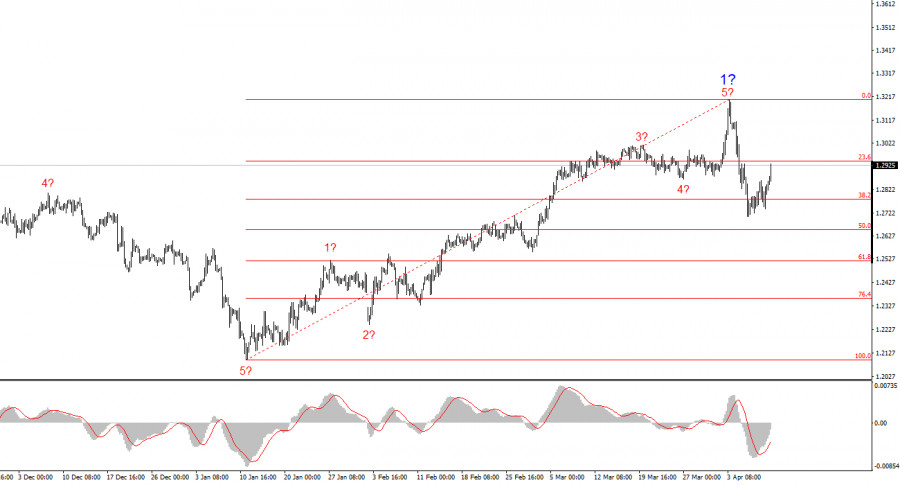

In the current situation, the greenback felt on top and overcame the euro. The new week started on a positive note for the US dollar. On Monday morning, September 25th, the EUR/USD pair was trading near 1.0650, trying to gain momentum.

According to forecasts from Commerzbank, significant changes await the EUR/USD pair in the near future: by the end of the fall, it will rise to 1.1000, and in December – to 1.1400. By spring 2024, the instrument could soar to 1.1500. Moreover, by September of the following year, the EUR/USD pair will return to 1.1400, the bank reckons.

The steady rally of the US dollar index (DXY) has led to the formation of the pattern called Golden cross on the technical chart. According to experts at BofA Global Research, this is one of the most important bullish signals. Experts say that the Golden cross appears when a short-term moving average intersects with a long-term moving average and moves higher. The Golden cross of the dollar index indicates a significant potential for the growth.

Based on the technical chart, the 200-day moving average of DXY at 103.036 is close to overcoming the 50-day moving average at 103.001. In this context, if the instrument climbs above the resistance level of 105.903, this will open the door to the 50% Fibonacci level.

The technical chart has shown that in recent weeks, the dollar index has been in a strong bullish trend. During this period, it retested the Fibonacci correction level of 38.2% and approached a crucial resistance at 105.903, the highest mark since May 8, 2023.

According to COT reports on the US dollar index, a sharp rise in bullish sentiment for the US currency was recorded at the end of last week. Market participants significantly increased their net long positions on the greenback. The net position of large players, who reduced their USD short contracts by 53% over the week, reached its highest in the last eight months. If this trend continues, this will set the stage for the growth of the US currency, analysts believe.

According to economists at Commerzbank, the dollar will win favor with investors in the medium term. It's expected that next year, as the US economy cools down, the Federal Reserve will once again lower the key funds rate. Meanwhile, the ECB is highly likely to maintain its interest rates at the current level, despite easing inflation and grave factors for the European economy. "This means that the ECB's stance is more hawkish than the Federal Reserve's. Maintaining this strategy is favorable for the euro's forex rate, which will gradually strengthen," Commerzbank concludes.

However, in the long-term prospects, the strengthening of the European currency is an open question. Economists believe that in the future, it will be more challenging for the European regulator to tame inflation than for the Federal Reserve. As a result, the euro "will suffer from an elevated inflation risk", while the dollar will take advantage of the situation and strengthen its position once again.