The US currency confidently started the week, gaining ground and surpassing the euro. The stability of the dollar, which is carefully overcoming obstacles, is supported by expectations of a soft landing for the US economy.

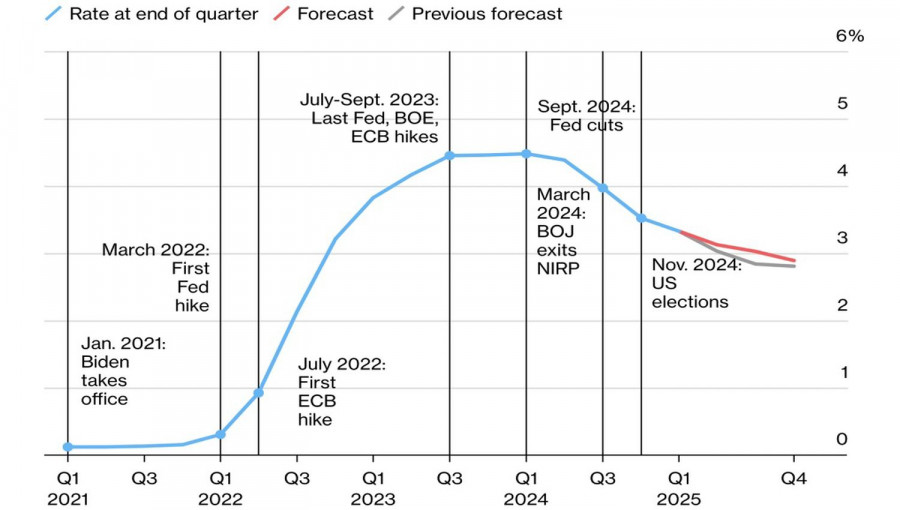

On Monday, October 30, the dollar advanced amid cautious trading. In this regard, the greenback is ready to regain momentum after its decline last Friday, October 27, which followed the release of data on the Core PCE Price Index. This key inflation indicator, which the Federal Reserve relies on, hit its lowest level in the last 2.5 years.

According to reports from the US Bureau of Economic Analysis, in September, the Core PCE Price Index, excluding food and energy prices, increased by 0.3% compared to the previous month. The released economic data was in line with forecasts.

On a yearly basis, the Core PCE Price Index rose by 3.7%. Analysts noted that in September, the annual growth rates of this indicator hit their lowest level since May 2021. This contributed to a brief decline in the US dollar, which then recouped most of its losses.

However, the greenback's drop did not help the euro rise. Current macroeconomic data on PMI, inflation figures in the eurozone, and the European Central Bank's rate decision were not favorable for the EUR. Moreover, the ECB kept interest rates unchanged. The European central bank also noted that, on the one hand, inflation in the eurozone was decreasing, but on the other hand, the European economy remained weak.

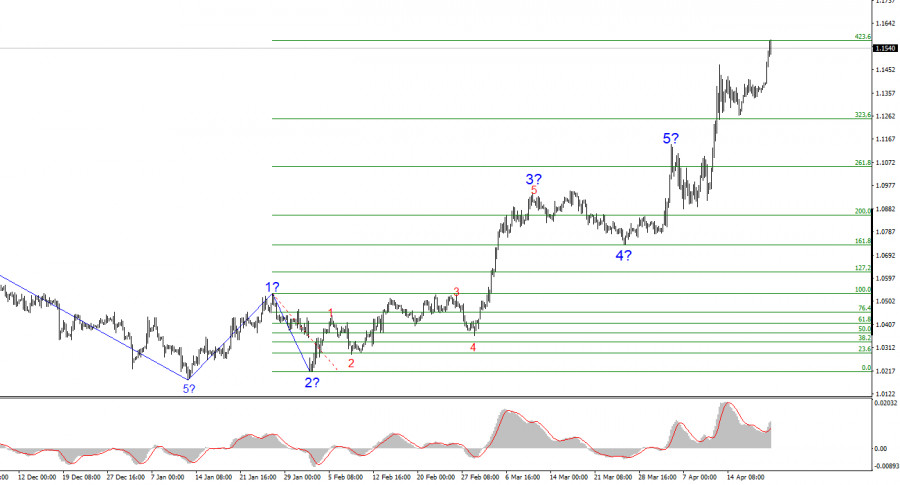

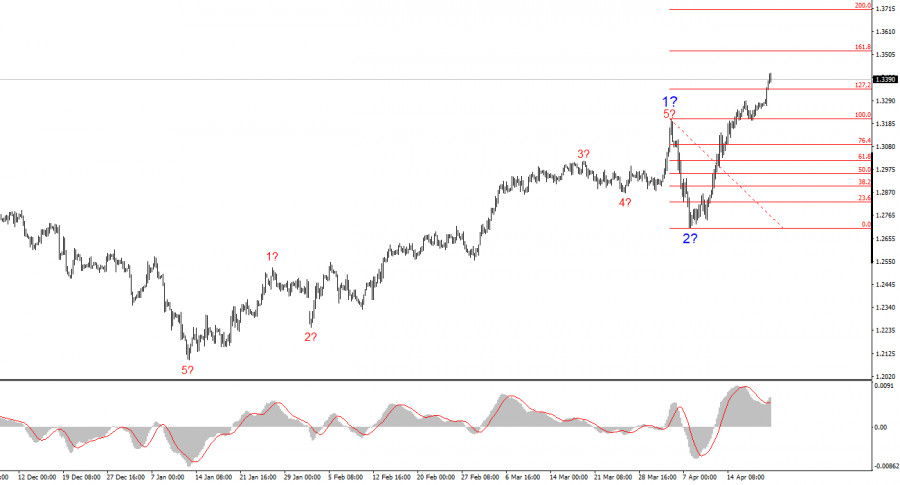

Against this backdrop, the EUR/USD pair sharply dropped to a low of 1.0520, and then it was bought up. Subsequently, the pair stabilized. On Monday, October 30, the EUR/USD pair was trading near 1.0560, attempting to move higher.

At present, the pair returned to a downward trend, but some analysts expect a rise to 1.1000. According to preliminary forecasts, such an increase could be seen by the end of 2023.

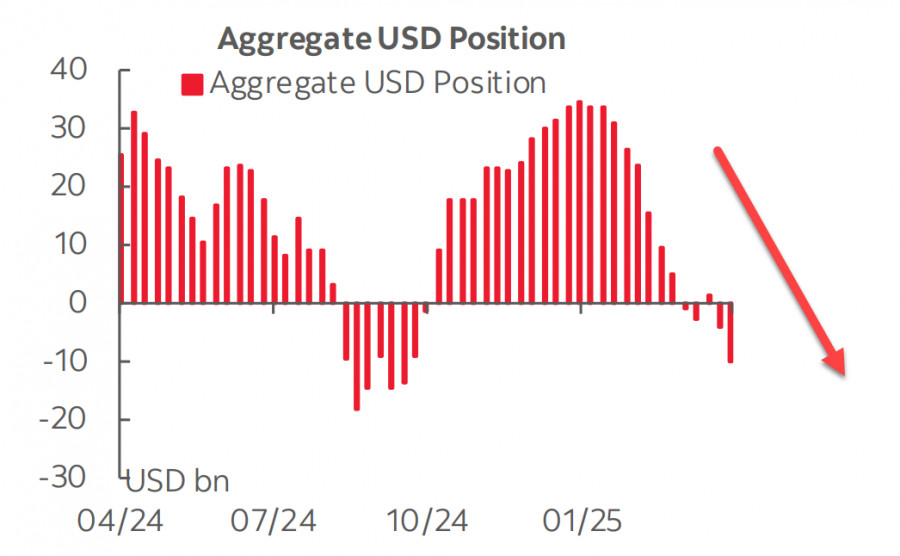

In the short term, many experts anticipate a decline in the US dollar, but this is still uncertain. According to the COT reports on the US Dollar Index (USDX), there is currently an increase in bullish sentiment concerning the American currency. Large funds resumed opening long positions on the USD after a one-week break. Over the past 10 months, net long positions have reached record levels. The continuation of the trend is expected to support the growth of the US currency, according to analysts.

However, hedge funds using long-term strategies are showing bearish sentiment. At the end of the previous week, hedge funds began reducing their net long position on the USD. If large traders join them, the greenback could see a significant decline. Notably, over the past two weeks, the net long position on the USD has seen little change. This indicates some uncertainty in the market. Currently, the market's focus is on the upcoming interest rate decisions from the Federal Reserve and the Bank of England, which will be made in the near future.

According to specialists, in the third quarter of 2023, the American economy was growing at the highest rate in the past two years. The reason for this is the relatively high wages amidst a tight labor market, which led to a sharp increase in consumer spending. This has added confidence that the regulator will keep interest rates high for as long as possible. Such a situation contributes to the further strengthening of the dollar.

The current data has confirmed the resilience of the US economy to the record cycle of Fed rate hikes. Instead of the traditional slowdown, it continues to grow at a high pace. However, the inflation indicators that the Federal Reserve relies on have been moving in opposite directions: the Personal Consumption Expenditures (PCE) Price Index accelerated to 2.9% due to rising energy costs, while the Core PCE slowed down to 2.4% compared to the previous 3.7%.

The decrease in the core inflation rate in the United States at a time of strong economic growth is a positive signal, indicating the possibility of a soft landing. However, if the situation changes, the future of the US economy will hardly be so rosy. Analysts believe that such economic growth rates are unlikely to be sustainable. As a result, in the fourth quarter of 2023 and the first quarter of 2024, the US economy may slacken. This will be influenced by the delayed effect of borrowing cost increases and the resumption of student loan repayments.

Curiously, US GDP data turned out to be better than expected. In the third quarter of this year, this indicator reached 4.9% on a yearly basis, surpassing the forecast of 4.3%. This is a positive factor for the US dollar, which immediately increased.

At present, most concerns are caused by the key interest rate. Some analysts believe it has reached its peak. However, even in such a scenario, strong economic data from the United States is an argument for keeping it at the current level for a longer period.

According to the Fed's officials, for a sustainable slowdown in inflation, the economy should grow at a pace below the trend, and labor market conditions should become less tight. Earlier, Fed Chair Jerome Powell noted that higher-than-expected growth in the US economy or stabilization in the labor market would require further tightening of monetary policy. However, this question remains open, leaving room for maneuver if the situation turns out to be different.