- Over the past day and this morning, the euro has reached the target range of 1.1385–1.1420, corresponding to the highs of June 2019 and 2020. The signal line

Author: Laurie Bailey

05:03 2025-04-11 UTC+2

9

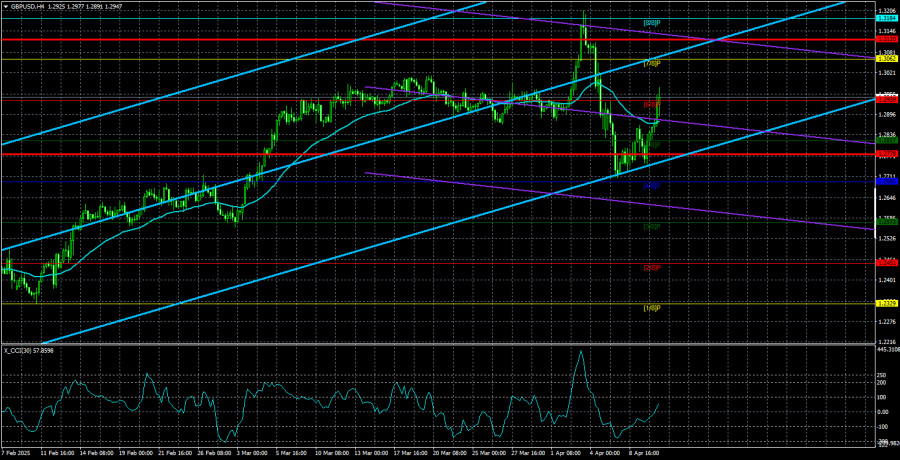

The British pound has reached the target level of 1.3001. The signal line of the Marlin oscillator is breaking through the zero line into bullish territory, opening the way towardAuthor: Laurie Bailey

05:03 2025-04-11 UTC+2

8

Yesterday, the USD/JPY pair decisively broke through the wide support range of 145.08/91 and reached the target level of 143.45 during today's Pacific session. The Marlin oscillator has only recentlyAuthor: Laurie Bailey

05:03 2025-04-11 UTC+2

7

- The GBP/USD currency pair also traded higher on Thursday. As a reminder, macroeconomic and traditional fundamental factors currently have little to no influence on currency movements. The only thing that

Author: Paolo Greco

03:28 2025-04-11 UTC+2

6

The EUR/USD currency pair declined sharply overnight on Wednesday but showed some recovery during the day. On Thursday, there was further growth—this series of fluctuations can only be describedAuthor: Paolo Greco

03:28 2025-04-11 UTC+2

7

Fundamental analysisTrading Recommendations and Analysis for GBP/USD on April 11: The Dollar Takes a Double Hit

The GBP/USD currency pair also showed strong growth on Thursday, although not as strong as the EUR/USD pair. The pound gained only around 200 pips—which isn't a considerable move underAuthor: Paolo Greco

03:28 2025-04-11 UTC+2

11

- Trading plan

Trading Recommendations and Analysis for EUR/USD on April 11: Trump Raises Tariffs on China Again

The EUR/USD currency pair showed ultra-strong growth on Thursday—a move that, by now, probably surprised no one. Just as we reported that tariffs on China had been raised to 125%Author: Paolo Greco

03:28 2025-04-11 UTC+2

7

The CPI report released on Thursday showed weaker-than-expected inflation. The market responded accordingly: the U.S. dollar came under renewed pressure (the U.S. Dollar Index fell into the 100.00 range)Author: Irina Manzenko

00:47 2025-04-11 UTC+2

9

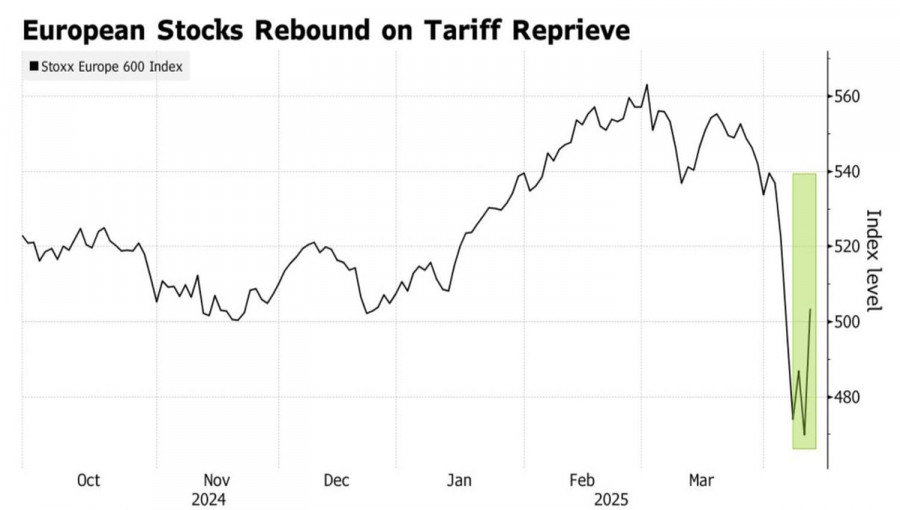

A rally in European stock indices, slowing U.S. inflation, and the fact that the average U.S. tariff has not changed significantly despite the 90-day deferral all contributed to the riseAuthor: Marek Petkovich

00:47 2025-04-11 UTC+2

8