The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

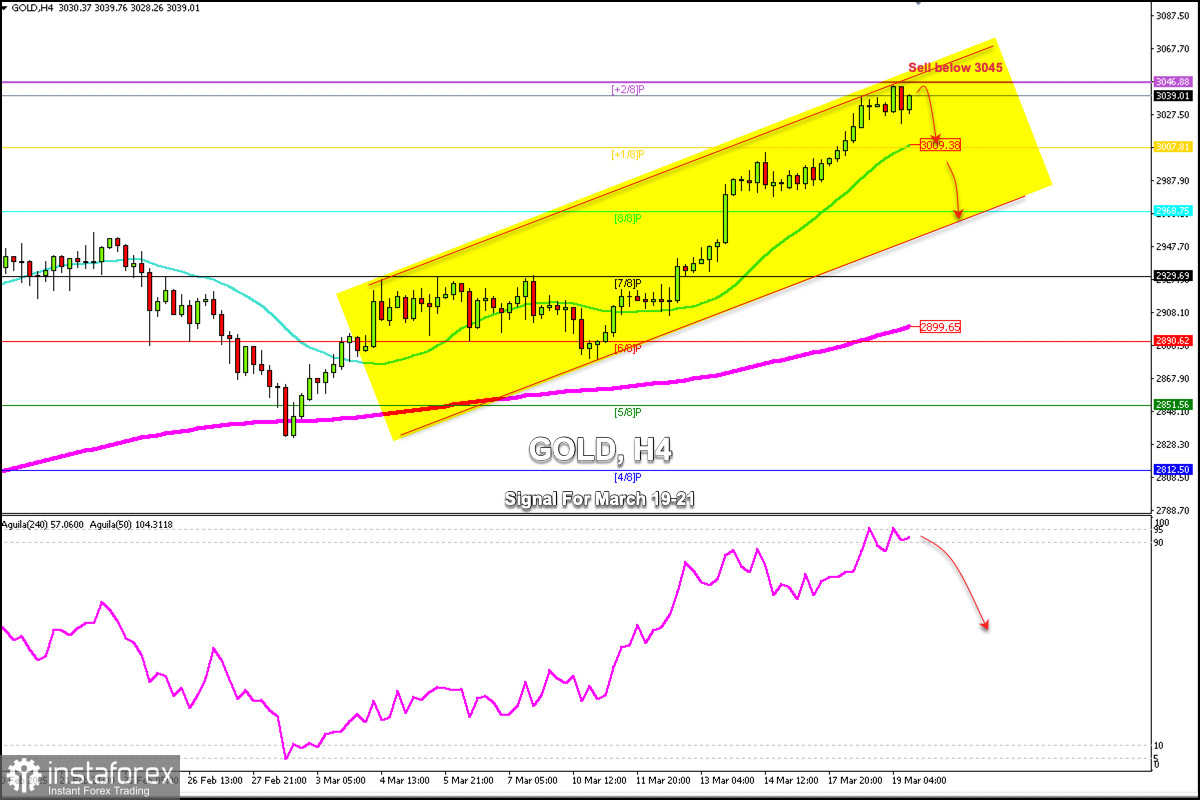

Early in the American session, gold is trading around 3,039, below the +2/8 Murray level and reaching overbought levels, as it could technically be preparing for a sharp decline.

During the European session, gold reached a new all-time high around $3,045.29, and has since seen a technical correction. However, it is showing signs of exhaustion. It is likely that after consolidation, a technical correction could occur in the coming days.

The bulls could take profits, which could lead the precious metal to a technical correction.

In the US, the Federal Reserve will announce its monetary policy decision this afternoon. No change is expected; however, Chairman Powell's speech could influence gold prices in the short term.

A consolidation below $3,045 could set the stage for a technical correction toward the psychological level of $3,000. Therefore, we will look for shorting opportunities in the coming days as long as the price remains below the +2/8 Murray level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

InstaSpot video

analytics

Daily analytical reviews

InstaSpot

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.