Our team has over 7,000,000 traders!

Every day we work together to improve trading. We get high results and move forward.

Recognition by millions of traders all over the world is the best appreciation of our work! You made your choice and we will do everything it takes to meet your expectations!

We are a great team together!

InstaSpot. Proud to work for you!

Actor, UFC 6 tournament champion and a true hero!

The man who made himself. The man that goes our way.

The secret behind Taktarov's success is constant movement towards the goal.

Reveal all the sides of your talent!

Discover, try, fail - but never stop!

InstaSpot. Your success story starts here!

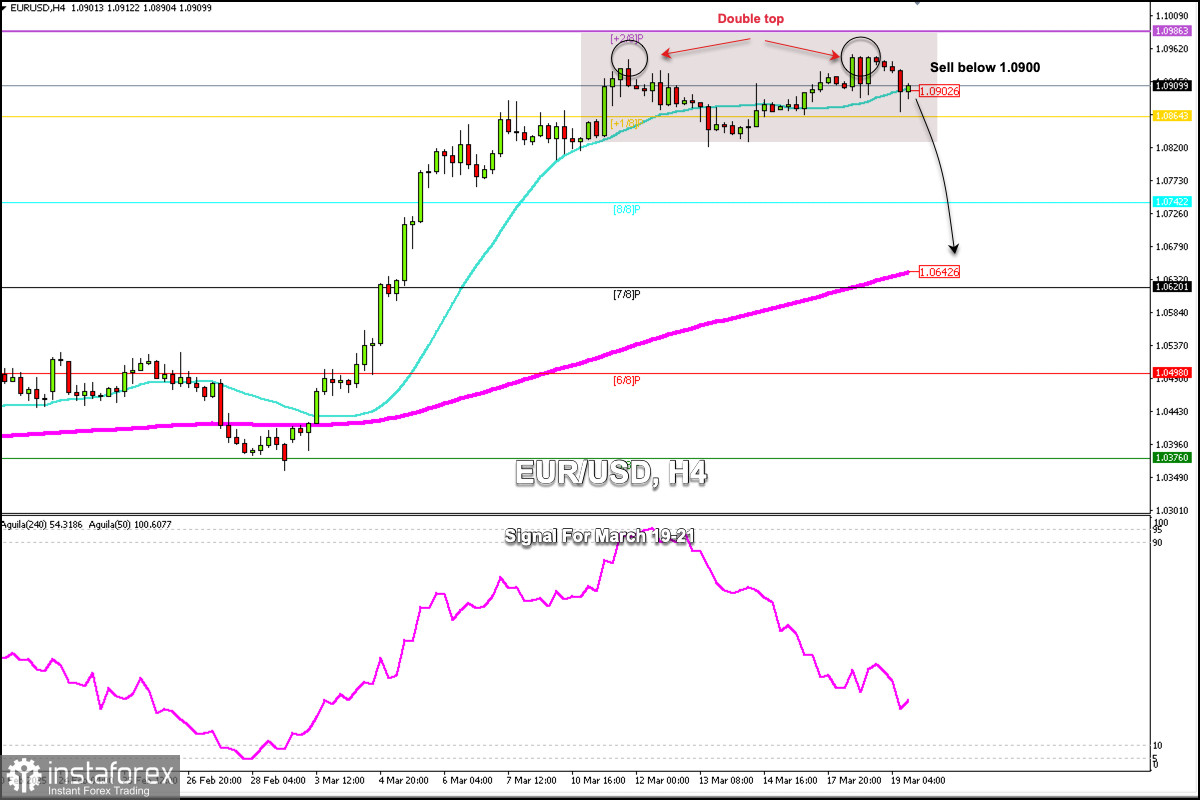

Early in the American session, the euro is trading around 1.0909, undergoing a technical correction after reaching the 1.0954 level. The H4 chart shows that the euro is showing signs of exhaustion.

On the chart, we can see the formation of a double top pattern, which indicates that a short-term technical correction could occur toward the 1.0642 area, where the 200 EMA is located and acts as dynamic support.

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.

On the other hand, the Federal Reserve will announce its policy decision in the United States. This could give the euro a bullish boost, but it could be momentary, as traders expect a technical correction in the coming days due to overbought conditions.

The eagle indicator is reaching overbought levels, so we expect a technical correction to an important support level at 1.0742. Then, EUR/USD could resume its bullish cycle.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.