US Stock Market in the Red: Futures Lose Ground

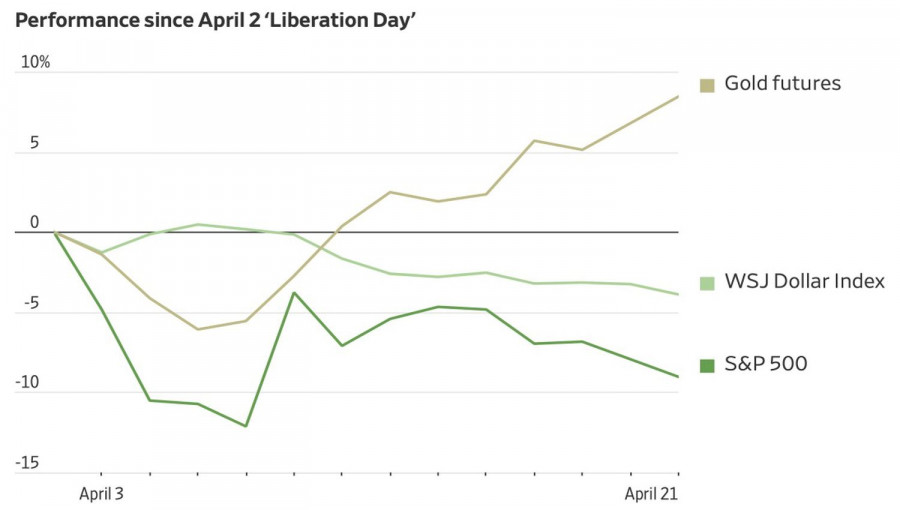

Futures on key U.S. stock indices have fallen sharply. S&P 500 E-mini contracts fell 218 points, or minus 4.27%, leaving the index at 4892.25. The other major indices showed similar signs, with Dow E-mini futures down 1,524 points, or 3.96%, and Nasdaq 100 E-minis down 804 points, or 4.58%.

European Banking Sector Under Pressure: Bear Market Is Around the Corner

Shares in Europe's largest banks continue to plummet. The region's banking sector index (SX7P) fell 4.8% on Monday, and is now down more than 20% from its last peak. This means the sector is on the verge of officially entering a bear market.

Third Day of Sell-Offs: Investors Flee Risk

Market pessimism has been growing for the third day in a row, prompted by new aggressive tariff measures from the Donald Trump administration, which have sparked fears of a potential full-scale trade war and an impending global recession.

Taking into account losses from previous sessions, the overall decline in the banking index since the collapse began exceeded 18% on Monday alone.

European banks are suffering: minus 9-10% in a day

Among the hardest hit are banks in Germany and France. Shares of Commerzbank and Deutsche Bank have fallen by 9-10%. French giants Credit Agricole, Societe Generale and BNP Paribas have also suffered similar losses.

The UK and Asia are also in the zone of turbulence

British financial institutions have not escaped the fall either. Barclays quotes have fallen by 9%, and HSBC shares have lost about 5% of their value. The pressure is also felt in the Asian region: the Japanese banking index has fallen by a staggering 17%, signaling a large-scale outflow of investors from the banking sector.

Asian markets are under attack: investors are betting on the worst

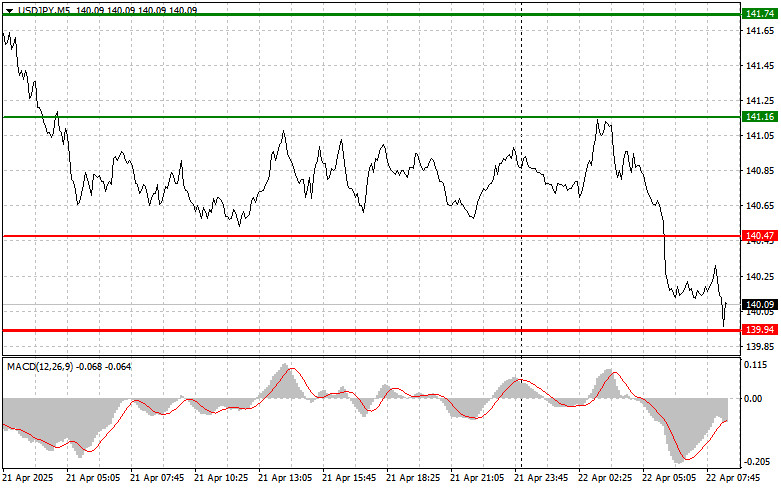

At the start of the week, Asian stock markets showed a sharp decline. The reason is the tough rhetoric of US President Donald Trump, who has shown no willingness to back down from his aggressive tariff policy. Amid the growing threat of a recession, market participants have begun to actively bet on the fact that the Federal Reserve will be forced to begin a cycle of interest rate cuts as early as May.

Futures signal: the Fed may cut five times

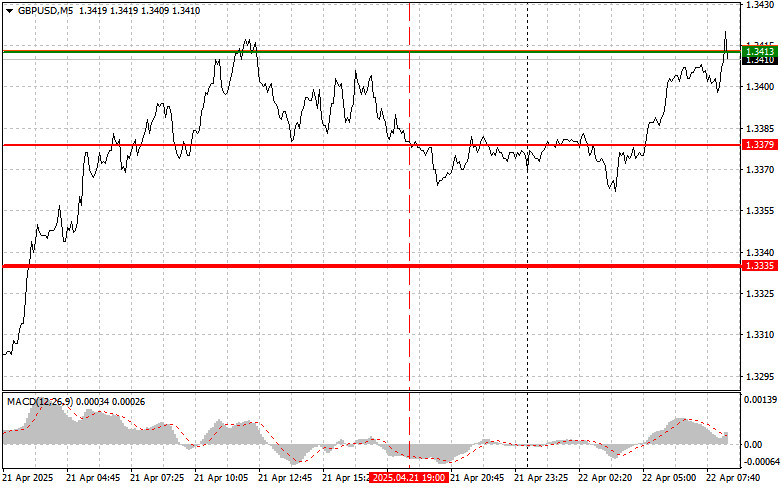

Derivatives markets have reacted immediately to the new wave of uncertainty: current expectations already include almost five quarterly rate cuts within a year. This has caused a sharp drop in the yield of US Treasury bonds and put pressure on the dollar, which is usually considered a "safe haven" for investors.

Trump's tough rhetoric is increasing panic

The situation was provoked by a comment Trump made in a conversation with reporters. The president made it clear that investors must "swallow the pill," since there will be no concessions to China until the US receives a solution to the problem of trade imbalance. In response, China signaled that it was prepared to retaliate — and markets immediately responded with an alarming fall.

Betting on shock therapy: the calculus may not pay off

Investors and analysts were confident that such a powerful collapse in market capitalization and the threat of a systemic blow to the economy would force the White House to reconsider its course. However, for now, the US administration is only tightening its stance.

"The scale and potential disruption of the current trade strategy could be a turning point leading to a recession, both in the US and in the global economy," said Bruce Kasman, chief economist at JPMorgan.

JPMorgan forecast: the Fed will cut rates at every meeting

According to Kasman, the Federal Reserve will be forced to intervene: "We still expect the first rate cut in June. But now, given the new risks, we see the likelihood that the FOMC will ease policy at every meeting until January next year." By that time, he predicted, the target upper limit of the rate could fall to 3%.

Markets hit: Fall continues amid panic

Stock futures have plunged into the red again, adding to the wave of losses that swept global markets last week. S&P 500 contracts fell 3.5%, while Nasdaq posted an even deeper decline of minus 4.4%. Taking into account past losses, that means almost $6 trillion in market capitalization has already evaporated.

Europe not far behind: Red on all screens

Volatility has also engulfed European markets. EUROSTOXX 50 futures lost 4.4%, Britain's FTSE fell 2.1%, and Germany's DAX fell 4.2%. All of these indicators point to one thing: investors see no horizon in the current turbulence and are exiting risky assets en masse.

Asia: Biggest One-Day Drop Since 2008 Crisis

Asian stock markets are in turmoil. Japan's Nikkei plunged 6.6%, hitting levels not seen since late 2023. South Korea's Nikkei lost 5%, while the MSCI Asia-Pacific composite index fell 7.8%, its biggest one-day decline since the global financial crisis in 2008.

China, Taiwan, India Under Fire from Sell-Offs

China's largest blue-chip companies also succumbed, with the CSI300 index falling 6.3% as markets waited to see if Beijing would impose emergency support measures. Taiwan returned to trading after a two-day break with a near-10% plunge. The situation was so dire that regulators were forced to impose restrictions on short selling.

In India, the Nifty 50 index also succumbed, falling 4%, confirming that no market in the region was spared the pressure.

Oil prices are back in the red as global demand declines frighten

Amid growing fears for the global economy, commodity markets have not been left out. Brent crude fell $1.35 to $64.23 per barrel. American WTI lost $1.39 to settle at $60.60. Investors are taking note: demand could shrink sharply if economic activity continues to wane.