Our team has over 7,000,000 traders!

Every day we work together to improve trading. We get high results and move forward.

Recognition by millions of traders all over the world is the best appreciation of our work! You made your choice and we will do everything it takes to meet your expectations!

We are a great team together!

InstaSpot. Proud to work for you!

Actor, UFC 6 tournament champion and a true hero!

The man who made himself. The man that goes our way.

The secret behind Taktarov's success is constant movement towards the goal.

Reveal all the sides of your talent!

Discover, try, fail - but never stop!

InstaSpot. Your success story starts here!

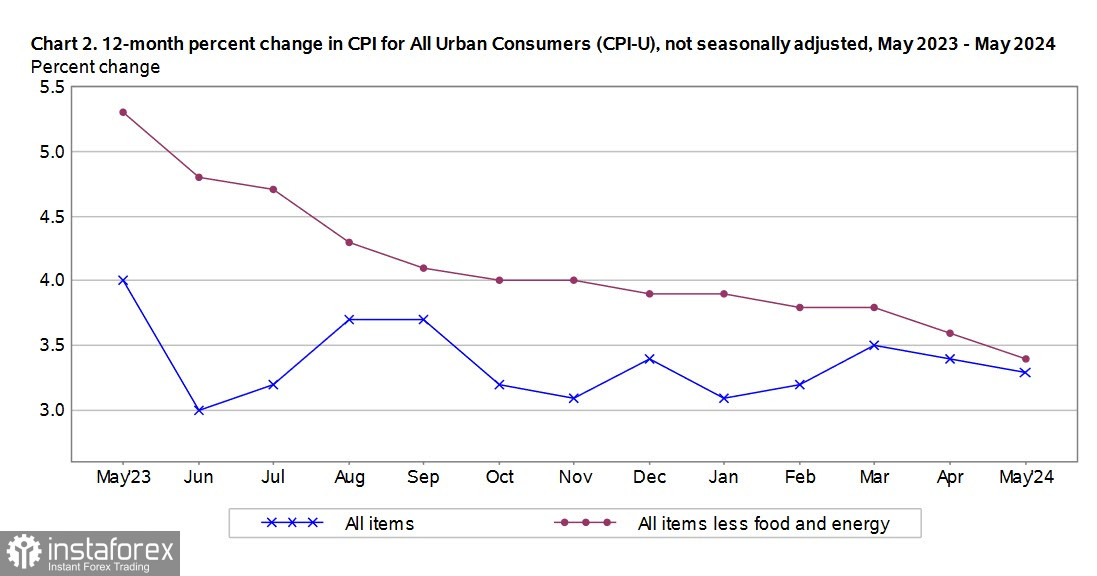

The US Consumer Price Index declined to 3.3% on a yearly basis in May from 3.4% in April, while the core index fell even more sharply from 3.6% to 3.4%. The slowdown in inflation completely offset the effect of the strong labor market. The bond market responded with a sharp decline in yields, and the likelihood of the first Federal Reserve rate cut in September has risen significantly.

The Federal Reserve held its meeting on Wednesday. The interest rate was expected to remain unchanged, but economic forecasts and the rate trajectory were highly likely to be revised. This signals a potential weakness for the US dollar, and we expected volatility to spike following the meeting.

The Bank of Japan will hold its meeting on Friday. A 0.1% rate hike is not expected, but the Bank may announce a program to reduce bond purchases. Such a decision would be the BOJ's first clear step towards quantitative tightening after abandoning the large-scale stimulus program in March and it could be the start to policy normalization. Although the Bank states that it does not target foreign exchange rates, a change in the bond purchase regime or a clear hawkish signal would work in favor of the yen's growth.

Forecasts vary widely. If the BOJ is too cautious, the yen may weaken further and head towards the 160 level, where intervention to prevent further depreciation would likely occur. If the measures are aggressive, bond yields will rise sharply, complicating the government's ability to service its accumulated obligations.

The net short JPY position decreased by $1.75 billion to -$10.6 billion, indicating that positioning remains strongly bearish but a trend reversal is emerging. However, the price is not falling, suggesting that conditions for a bullish bias on the yen have not yet materialized.

USD/JPY is trying to resume its uptrend, which happens whenever the BOJ avoids providing specific details about its future course of actions. Japanese bond yields declined amidst growing uncertainty regarding the BOJ's plans. The substantial yield differential objectively forces the use of the Japanese currency in carry trade transactions, and this will continue until the BOJ decides to proceed with raising its rate.

Nevertheless, we believe that buying USD/JPY is too risky due to the high probability of another currency intervention. Therefore, we adhere to the same strategy – sell on rallies. If the pair rises above 159, the threat of intervention will increase significantly. While the pair remains below this level, local bullish impulses are possible.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

InstaSpot

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.