The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

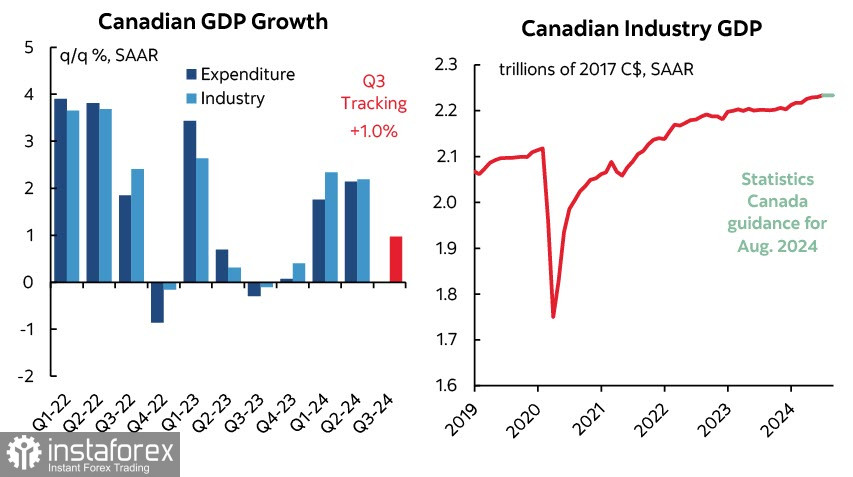

Canada's GDP grew by 0.2% month-on-month in July, exceeding forecasts of 0.1%, despite the risk of a weaker result. The Canadian economy has expanded in six out of the last seven months, showing moderate but steady growth. The downside is that economic growth is happening amid high immigration. When adjusted per capita, it appears rather weak. Preliminary data for August show zero growth, with the annual rate hovering around 1.3% in the third quarter. While this is far from a potential recession, it puts pressure on the Bank of Canada to adjust its monetary policy.

Canada's economic weakness has a positive impact on inflation. The annual CPI dropped to the target level of 2% in August. On the flip side, the unemployment rate climbed to 6.6% in August and continues to rise. BoC Governor Tiff Macklem stated that the central bank wants to spur growth, suggesting that the situation may lead to a 50 basis-point rate cut at the upcoming meeting in October. The three previous rate cuts, totaling 75 basis points, appear insufficient. Needless to say, if the BoC does cut rates by 50 basis points on October 23, it would bury any hopes for the Canadian dollar's strengthening, as Canadian bond yields have already fallen below US bond yields after three rate cuts, and this gap is likely to widen.

However, there is a positive side. Fed Chairman Jerome Powell's speech, in which he stated that markets are overestimating the extent of rate cuts, caused strong market movements but didn't fundamentally change forecasts. So, a 75 basis-point rate cut by the Federal Reserve is still expected by the end of the year, as it was before Powell's comments. This means that the US dollar remains under selling pressure.

The net short position on the CAD decreased by $0.5 billion during the reporting week, to -$4.88 billion. Market sentiment remains bearish, and the Canadian dollar currently has the weakest position against the USD among G10 currencies. It was the only currency that failed to strengthen against the dollar last month. The estimated value is below the long-term average, which sets the stage for a downward move in USD/CAD. However, there is no clear direction in the estimated price.

After a sharp rise in August, the Canadian dollar spent all of September in a sideways range. The bearish momentum is still valid. At the moment, a further bearish move still seems more likely than a rally in USD/CAD. However, the Canadian dollar is struggling to find reasons for strengthening. We expect USD/CAD to eventually begin a movement toward the long-term target of 1.3170, with resistance at the 1.3520/30 zone. A pullback to this level justifies selling, targeting a new low of 1.3419.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.