- Fundamental analysis

GBP/USD Pair Overview – April 7. The British Pound Delivered a Major Surprise on Friday

The GBP/USD currency pair rose 280 pips between Wednesday and Thursday, only to crash by 340 on Friday. These kinds of "flights" have become a regular occurrence lately. WhileAuthor: Paolo Greco

03:23 2025-04-07 UTC+2

0

The EUR/USD currency pair lost over 300 pips on Wednesday and Thursday, but Friday brought a strong recovery. No one would have been surprised if the dollar had continued fallingAuthor: Paolo Greco

03:23 2025-04-07 UTC+2

4

Trading planTrading Recommendations and Analysis for GBP/USD on April 7: The Pound Collapsed Like a House of Cards

The GBP/USD currency pair fell by "only" 200 pips on Friday, which was hardly expected. Yes, the number of NonFarm Payrolls exceeded forecasts, and Jerome Powell once again reaffirmedAuthor: Paolo Greco

03:23 2025-04-07 UTC+2

6

- Trading plan

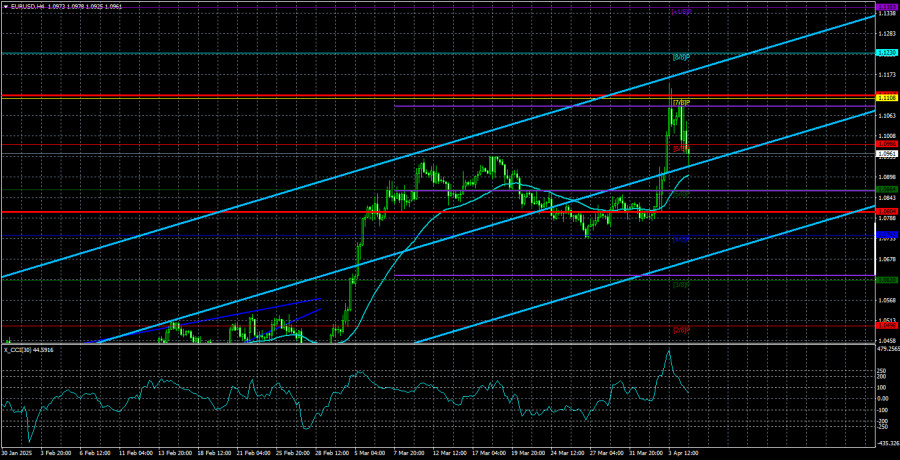

Trading Recommendations and Analysis for EUR/USD on April 7: Nothing Is Improving for the Dollar

The EUR/USD currency pair began a sharp pullback on Friday after a strong rally on Wednesday evening and Thursday. There are different ways to interpret this decline, but we wantAuthor: Paolo Greco

03:23 2025-04-07 UTC+2

6

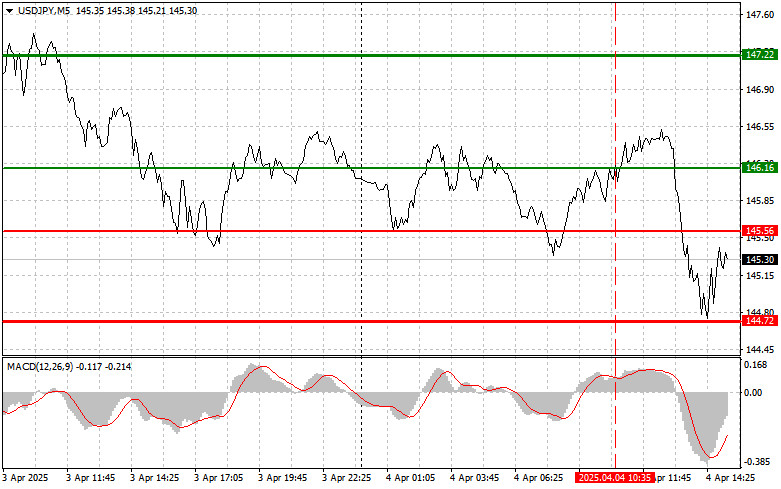

The price test of 146.16 occurred at a moment when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential within a bearishAuthor: Jakub Novak

20:08 2025-04-04 UTC+2

127

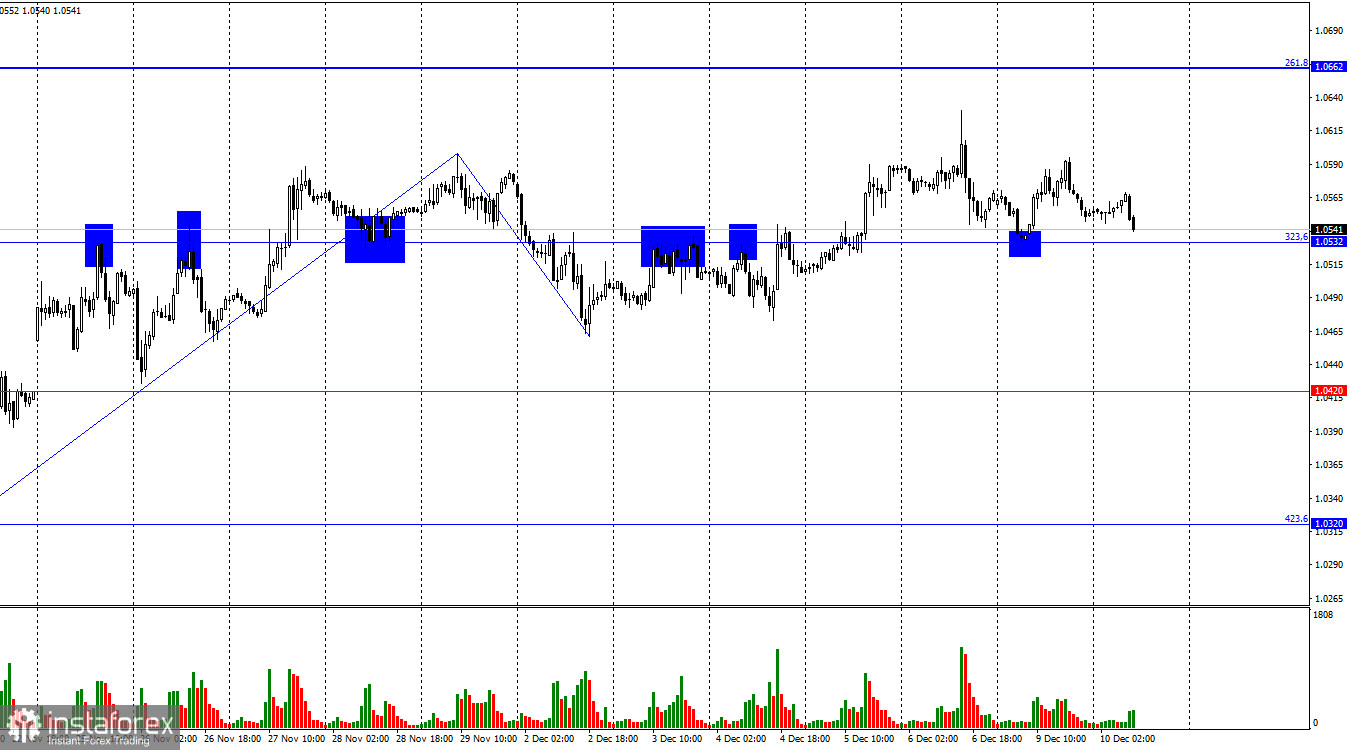

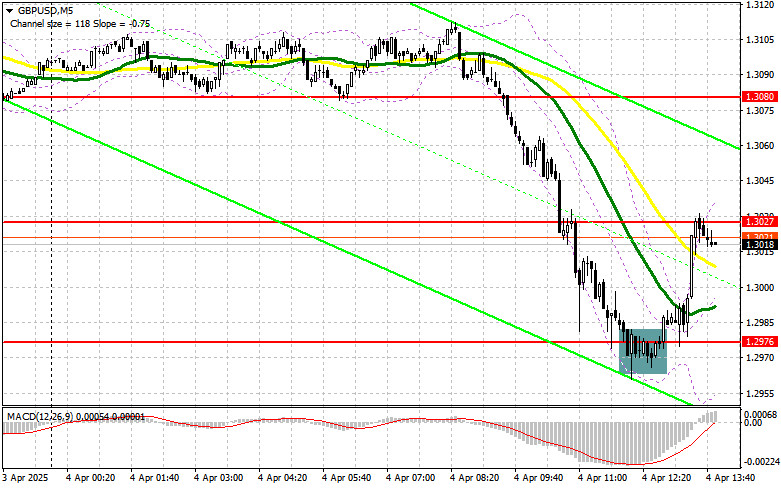

The price test of 1.3077 occurred at a time when the MACD indicator had already moved significantly below the zero line, which limited the pair's further downward potential. Following recentAuthor: Jakub Novak

20:03 2025-04-04 UTC+2

112

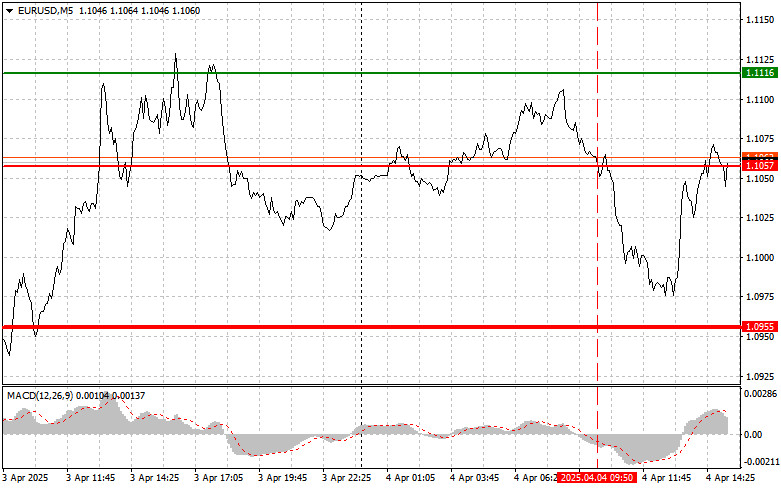

- The price test of 1.1050 occurred at a time when the MACD indicator had already moved significantly below the zero line, limiting the pair's downward potential. For this reason

Author: Jakub Novak

20:00 2025-04-04 UTC+2

102

In my morning forecast, I highlighted the level of 1.2976 and planned to base market entry decisions around it. Let's look at the 5-minute chart to see what happenedAuthor: Miroslaw Bawulski

19:55 2025-04-04 UTC+2

101

In my morning forecast, I highlighted the 1.0994 level and planned to base my market entry decisions on it. Let's look at the 5-minute chart and break down what happenedAuthor: Miroslaw Bawulski

19:52 2025-04-04 UTC+2

123