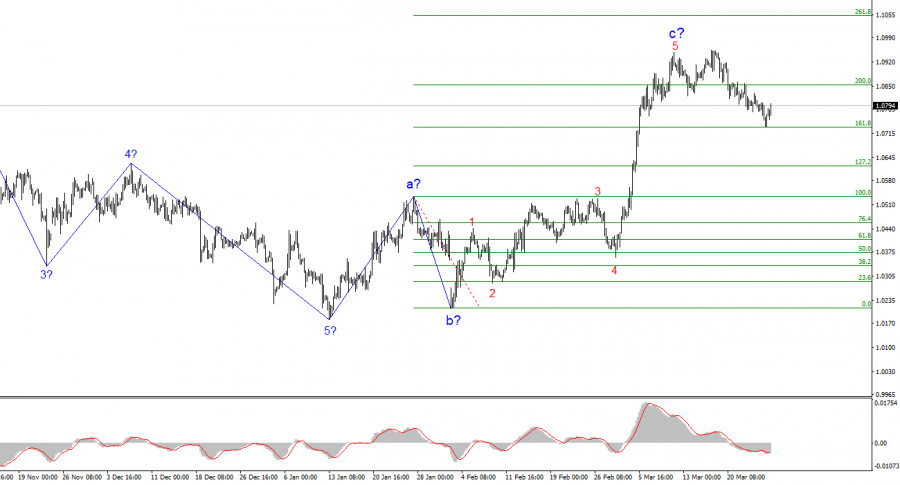

- The wave structure on the 4-hour chart for EUR/USD threatens to evolve into a more complex formation. A new downward structure began forming on September 25, taking the shape

Author: Chin Zhao

20:10 2025-03-28 UTC+2

0

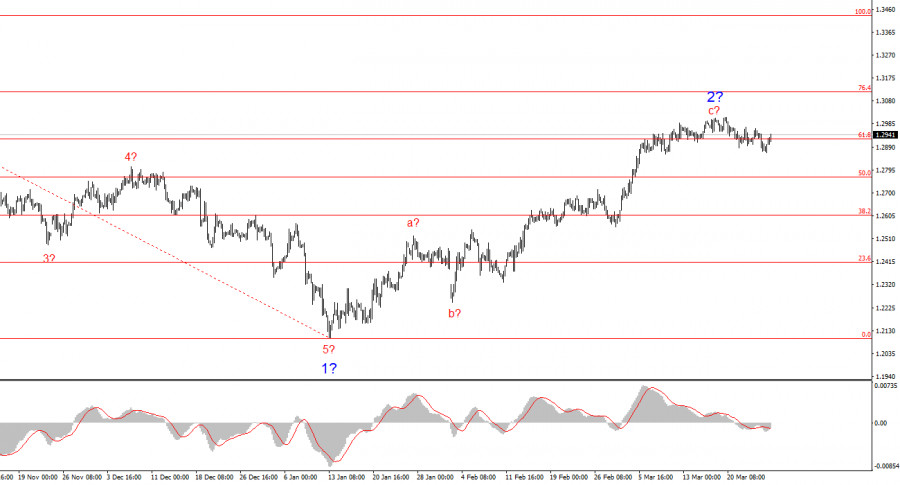

The wave structure of the GBP/USD instrument remains somewhat ambiguous, but overall digestible. At this stage, there is a strong likelihood that a long-term downward trend segment is forming. WaveAuthor: Chin Zhao

20:07 2025-03-28 UTC+2

0

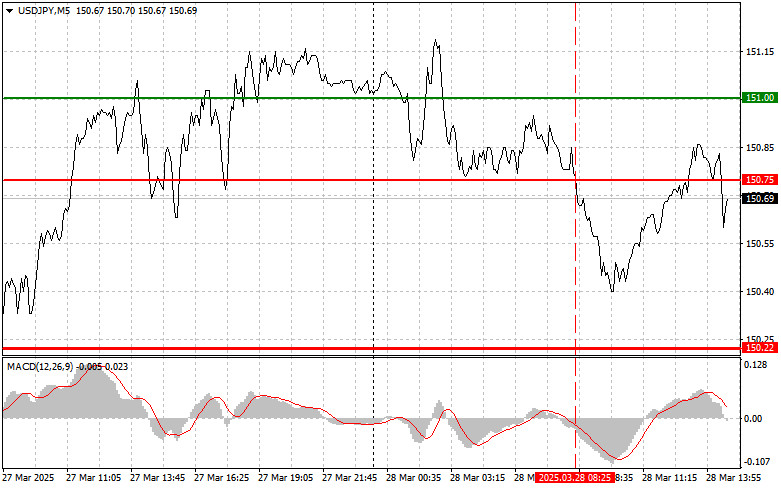

Trade Analysis and Tips for Trading the Japanese Yen The test of the 150.75 level occurred when the MACD indicator had already moved significantly below the zero line, which limitedAuthor: Jakub Novak

20:04 2025-03-28 UTC+2

0

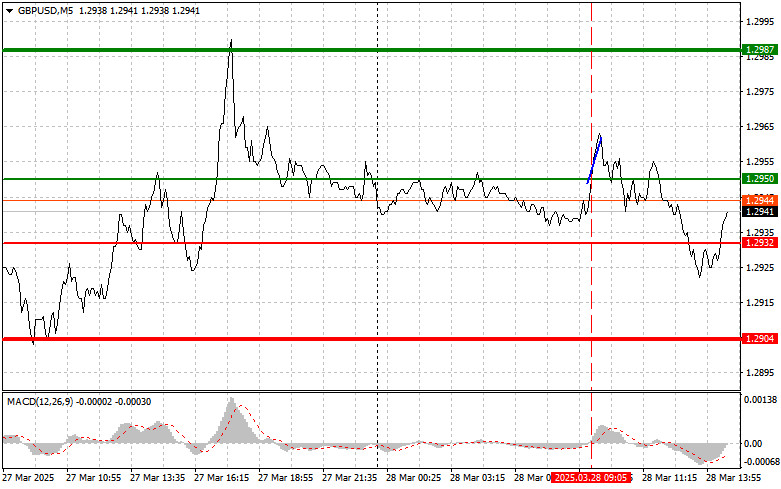

- Trade Analysis and Tips for the British Pound The test of the 1.2950 level occurred just as the MACD indicator began to rise from the zero line, confirming a valid

Author: Jakub Novak

20:00 2025-03-28 UTC+2

0

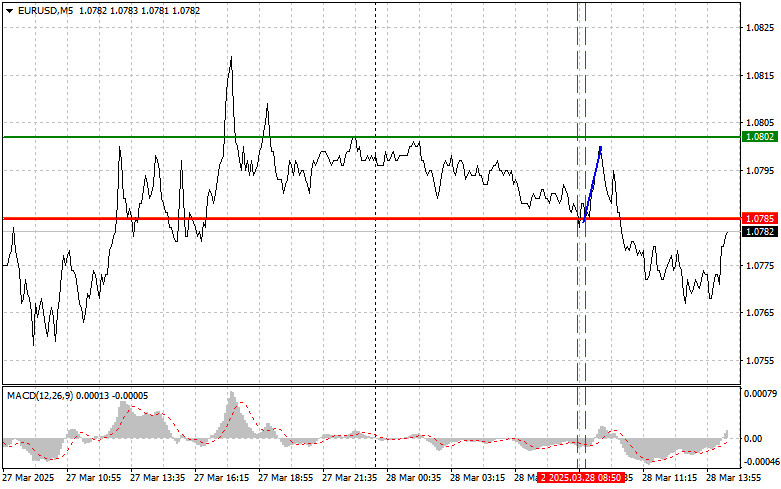

Trade Analysis and Tips for the Euro The price test at 1.0785 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downwardAuthor: Jakub Novak

19:57 2025-03-28 UTC+2

0

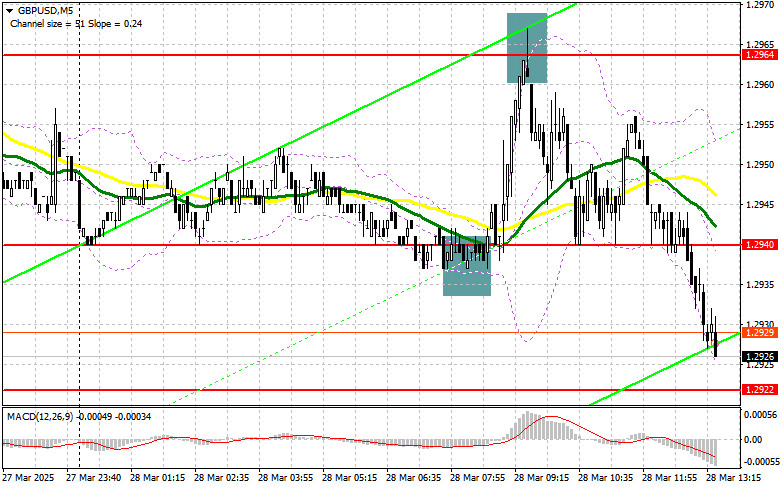

In my morning forecast, I focused on the level of 1.2964 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and break downAuthor: Miroslaw Bawulski

19:54 2025-03-28 UTC+2

0

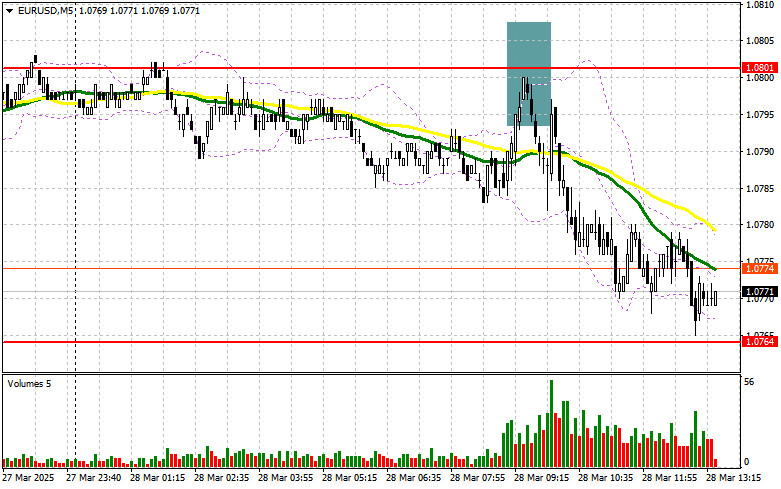

- In my morning forecast, I highlighted the level of 1.0801 and planned to base my market entries on it. Let's look at the 5-minute chart to see what happened

Author: Miroslaw Bawulski

19:52 2025-03-28 UTC+2

0

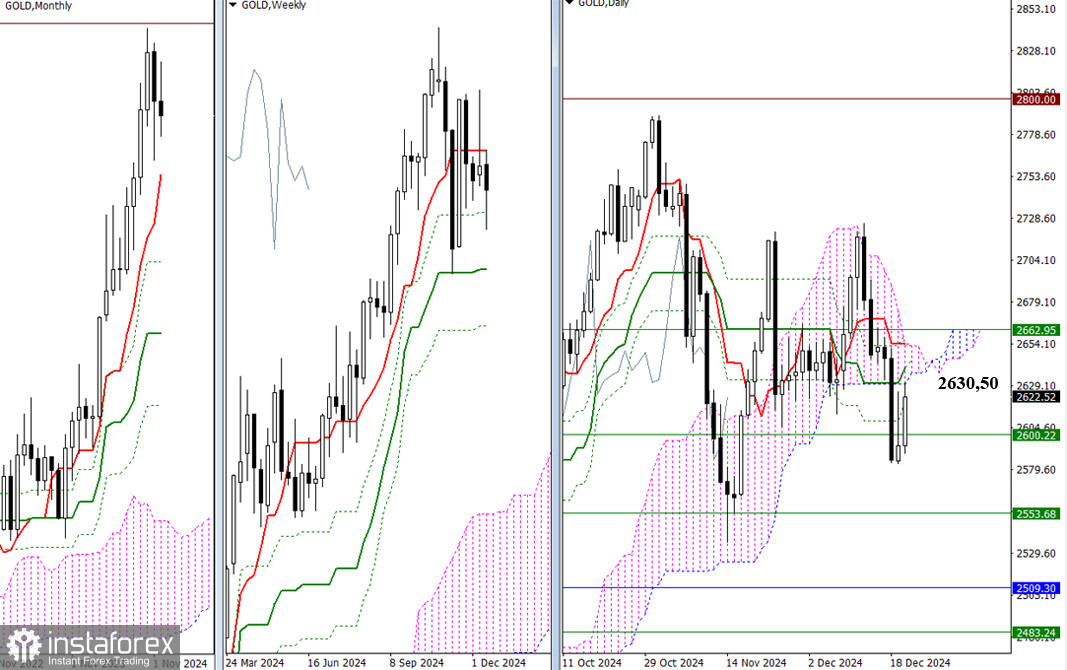

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming daysAuthor: Dimitrios Zappas

15:12 2025-03-28 UTC+2

12

Technical analysisTrading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

Early in the American session, the euro is trading around 1.0771, below the 21SMA, and within the downtrend channel forming since March 14. The bias is bearish. Yesterday, EUR/USD attemptedAuthor: Dimitrios Zappas

15:09 2025-03-28 UTC+2

4