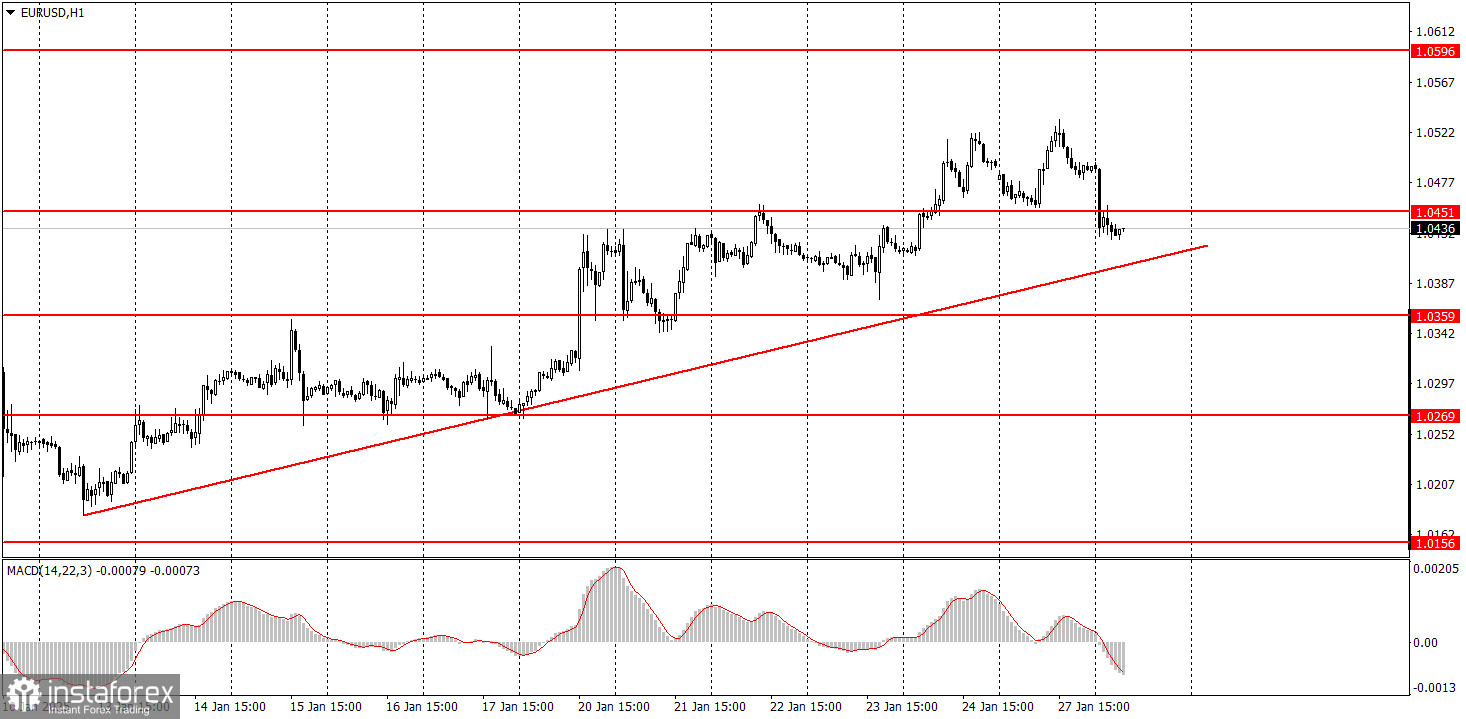

- The euro seems to have given up its attempt to reach the target range of 1.0534 to 1.0575. To confirm this reversal, today's session must close below the 1.0458 level

Author: Laurie Bailey

04:47 2025-02-19 UTC+2

11

The UK employment data for December, released yesterday, helped the pound avoid a decline, even though the dollar strengthened by 0.34%. The pound fell by only 0.10%, while the euroAuthor: Laurie Bailey

04:45 2025-02-19 UTC+2

2

Yesterday, the Reserve Bank of Australia reduced the interest rate from 4.35% to 4.10%, and the Australian dollar held steady. However, today's rate cut by the Reserve BankAuthor: Laurie Bailey

04:45 2025-02-19 UTC+2

16

- Trading plan

Trading Recommendations and Analysis for GBP/USD on February 19: The British Pound is Also "On a Break"

On Tuesday, the GBP/USD currency pair mirrored the behavior of its more dominant counterpart. For the second consecutive day, we observed a completely sideways movement. On Monday, the price attemptedAuthor: Paolo Greco

03:57 2025-02-19 UTC+2

6

Trading planTrading Recommendations and Analysis for EUR/USD on February 19: Two Days of Total Flat Movement

On Tuesday, the EUR/USD currency pair displayed little willingness to engage in trading, as intraday volatility remained minimal and there was effectively no significant movement. For the second consecutiveAuthor: Paolo Greco

03:56 2025-02-19 UTC+2

14

Last week, EUR/USD tested the 1.0515 level, marking its second attempt this year to break into the 1.05 range—the first occurred in January when buyers reached 1.0534. Both attempts failedAuthor: Irina Manzenko

00:32 2025-02-19 UTC+2

16

- Technical analysis

Trading Signals for BITCOIN (BTC/USD) for February 18-20, 2025: buy above $ 95,000 (21 SMA - 200 EMA)

On the H1 chart, Bitcoin is trading around $95,000 above the 21 SMA and below the 200 EMA within a bearish trend channel forming since February 14. If Bitcoin breaksAuthor: Dimitrios Zappas

16:26 2025-02-18 UTC+2

42

Technical analysisTrading Signals for GOLD (XAU/USD) for February 18-20, 2025: buy above $2,905 (21 SMA - 6/8 Murray)

Market volatility will remain high over the next few days as a strong technical correction will occur above the psychological level of 2,900. Therefore, we must be alert to thisAuthor: Dimitrios Zappas

16:25 2025-02-18 UTC+2

44

Technical analysisTrading Signals for EUR/USD for February 18-20, 2025: sell below 1.0470 (21 SMA - 5/8 Murray)

We should pay attention to the level of 1.0470. Once the price settles below, the outlook will continue to be negative and could be seen as a signal to sellAuthor: Dimitrios Zappas

16:21 2025-02-18 UTC+2

34