- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 14: The Pound – The Silent Leader

The GBP/USD currency pair continued trading higher on Friday, although the dollar avoided substantial losses this time. Even though one day without a complete dollar collapse may seem significantAuthor: Paolo Greco

03:33 2025-04-14 UTC+2

4

Trading planTrading Recommendations and Analysis for EUR/USD on April 14: The Dollar Continues to Collapse

On Friday, the EUR/USD currency pair continued its ultra-strong rally—something no one was surprised by anymore. U.S. and China reciprocal tariffs continue to rise, while all other news remains irrelevantAuthor: Paolo Greco

03:33 2025-04-14 UTC+2

1

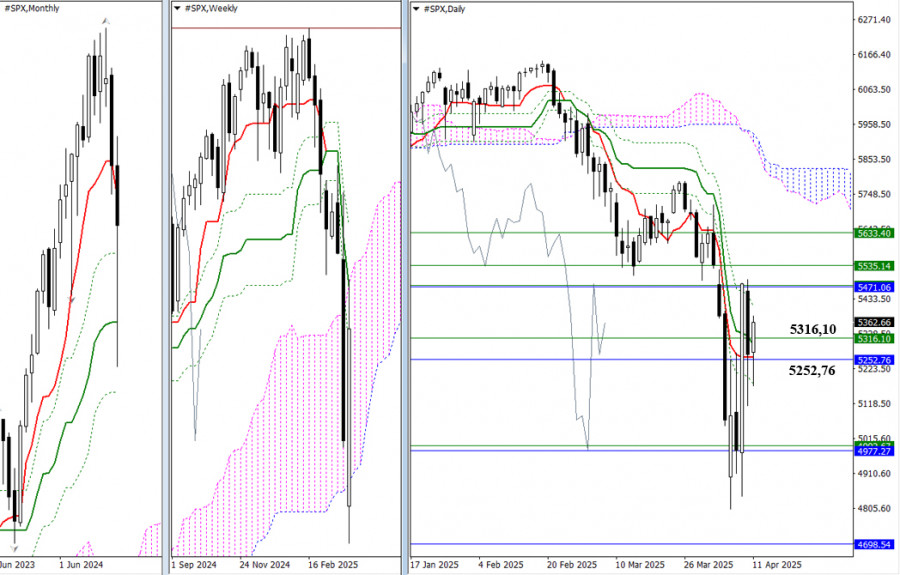

There will be a few significant events in the upcoming week. Of course, reports such as industrial production, retail sales, and new home sales should be noted. At first glanceAuthor: Chin Zhao

00:59 2025-04-14 UTC+2

6

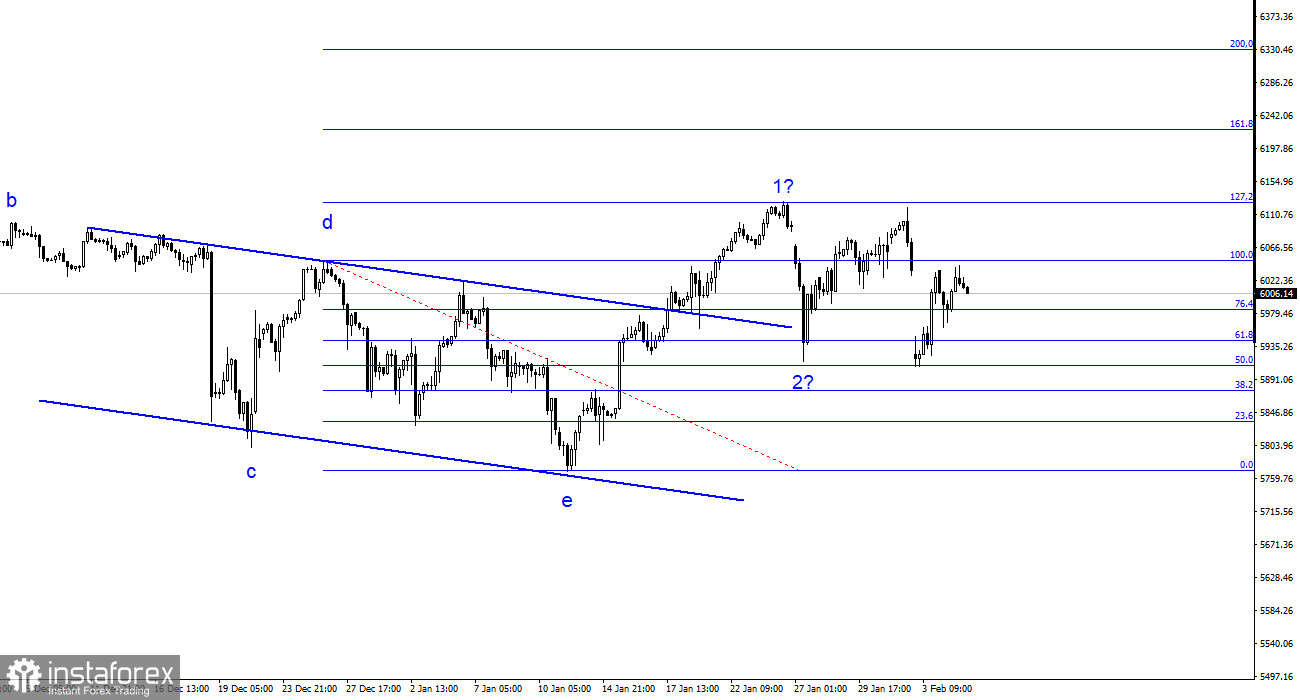

- Last week, even though there was a bearish gap, bullish players were able to reclaim their ground effectively. The market is now approaching the point where it may eliminate

Author: Evangelos Poulakis

00:58 2025-04-14 UTC+2

8

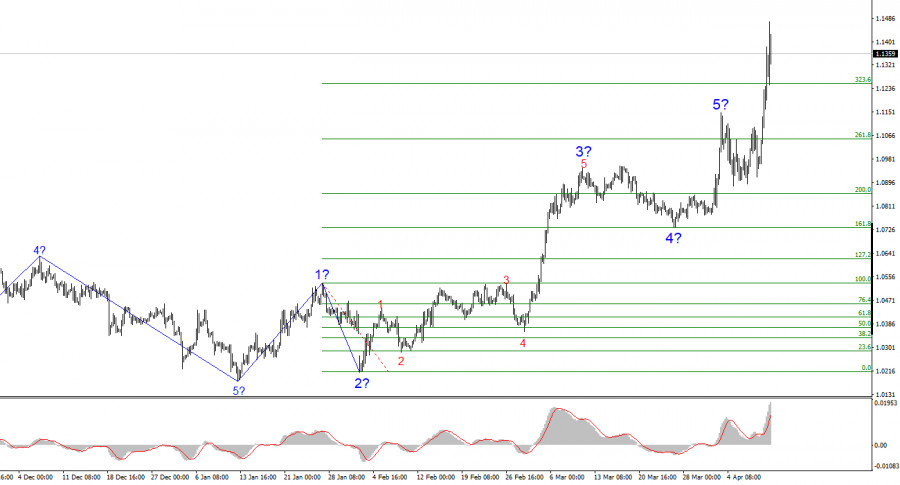

The wave structure on the 4-hour EUR/USD chart has transformed into a bullish one. I believe there's no doubt that this transformation occurred solely due to the United States'Author: Chin Zhao

18:33 2025-04-11 UTC+2

88

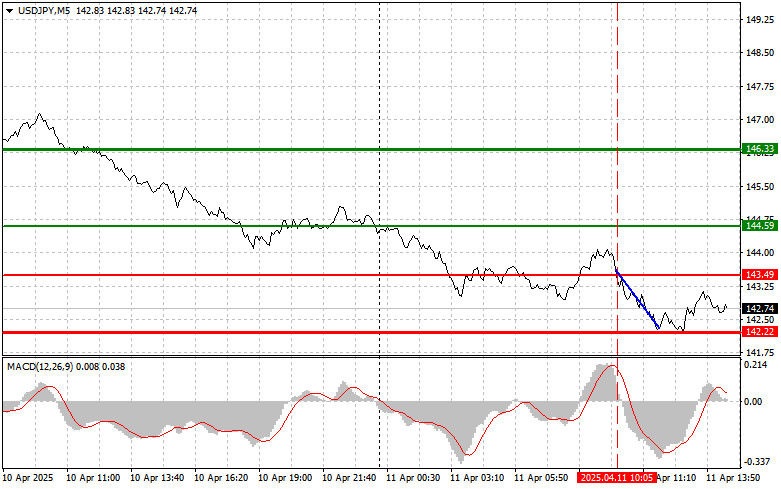

Trade Analysis and Advice for Trading the Japanese Yen The test of the 143.49 price level coincided with the moment the MACD indicator had just started moving downward fromAuthor: Jakub Novak

18:26 2025-04-11 UTC+2

59

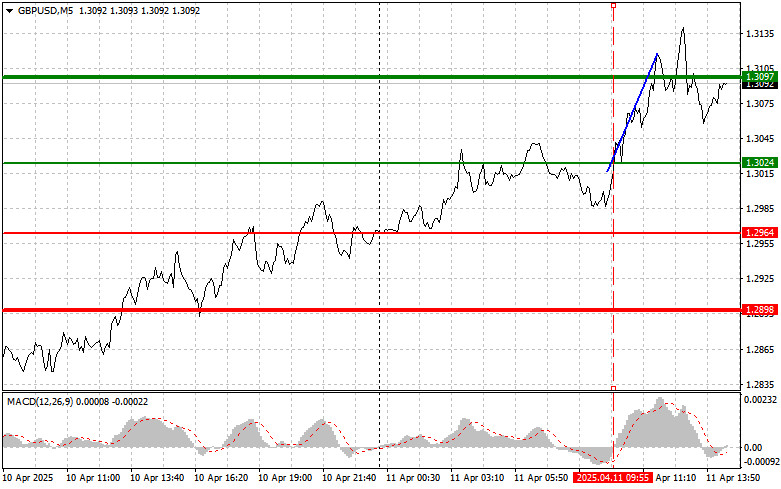

- Trade Breakdown and Tips for Trading the British Pound The test of the 1.3024 price level occurred just as the MACD indicator was beginning to move upward from the zero

Author: Jakub Novak

18:22 2025-04-11 UTC+2

59

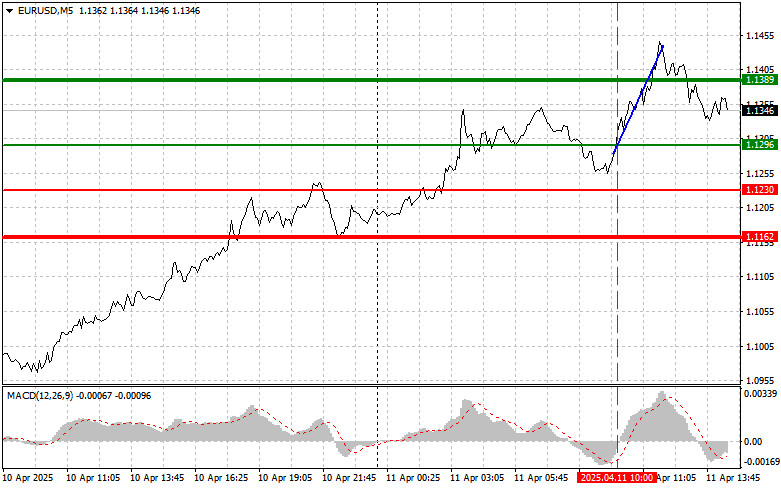

Trade Analysis and Tips for the Euro The test of the 1.1296 price level occurred when the MACD indicator was just starting to move upward from the zero mark, whichAuthor: Jakub Novak

18:20 2025-04-11 UTC+2

58

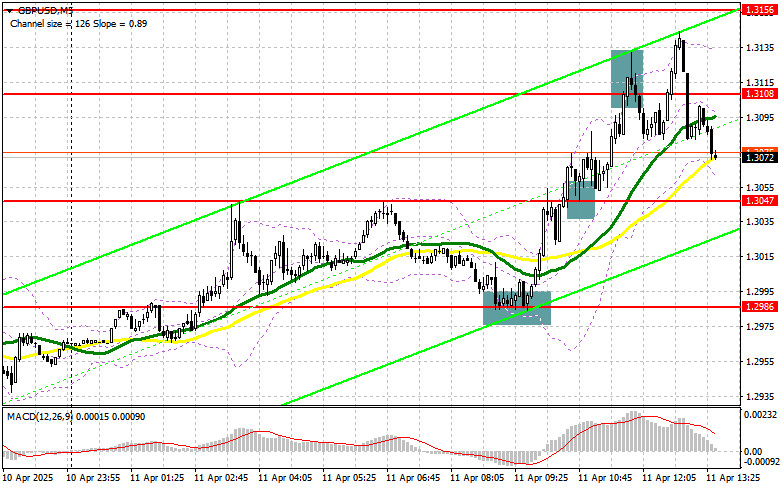

Trading planGBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and breakAuthor: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

54