Our team has over 7,000,000 traders!

Every day we work together to improve trading. We get high results and move forward.

Recognition by millions of traders all over the world is the best appreciation of our work! You made your choice and we will do everything it takes to meet your expectations!

We are a great team together!

InstaSpot. Proud to work for you!

Actor, UFC 6 tournament champion and a true hero!

The man who made himself. The man that goes our way.

The secret behind Taktarov's success is constant movement towards the goal.

Reveal all the sides of your talent!

Discover, try, fail - but never stop!

InstaSpot. Your success story starts here!

A significant number of macroeconomic events are scheduled for Thursday, but few are truly important. The main focus will be on the UK GDP data for Q4 and the industrial production report. Given the current state of the British economy, strong results are unlikely. However, even a modest improvement over minimal forecasts could allow the British pound to extend its gains.

In the Eurozone, the industrial production report is set to be published, although expectations for a positive outcome are extremely low. Additionally, Germany will release the second estimate of January's inflation, which is objectively less significant than the initial estimate—and the market largely overlooked the first one.

In the U.S., the weekly jobless claims report and the Producer Price Index (PPI) are due for release. However, both reports currently carry little weight in shaping market expectations.

On Thursday, important events include speeches from Bundesbank President Joachim Nagel and European Central Bank Governing Council member Cipollone. However, the ECB's sentiment is already well understood, leaving little uncertainty about future rate decisions in the Eurozone. For both EUR/USD and GBP/USD, the primary influencing factor remains the ongoing upward correction on the daily timeframe, which has been supporting their recent gains. Nevertheless, this correction is unlikely to lead to significant increases in the value of these currencies.

On Thursday, market movements may be highly unpredictable due to ongoing chaotic sentiment. For the past two days, the euro and pound have risen, but there is a possibility that they could reverse and decline today. Corrections in the market are often complex, featuring frequent pullbacks and internal adjustments. Therefore, traders should exercise caution and avoid expecting consistent, logical trends.

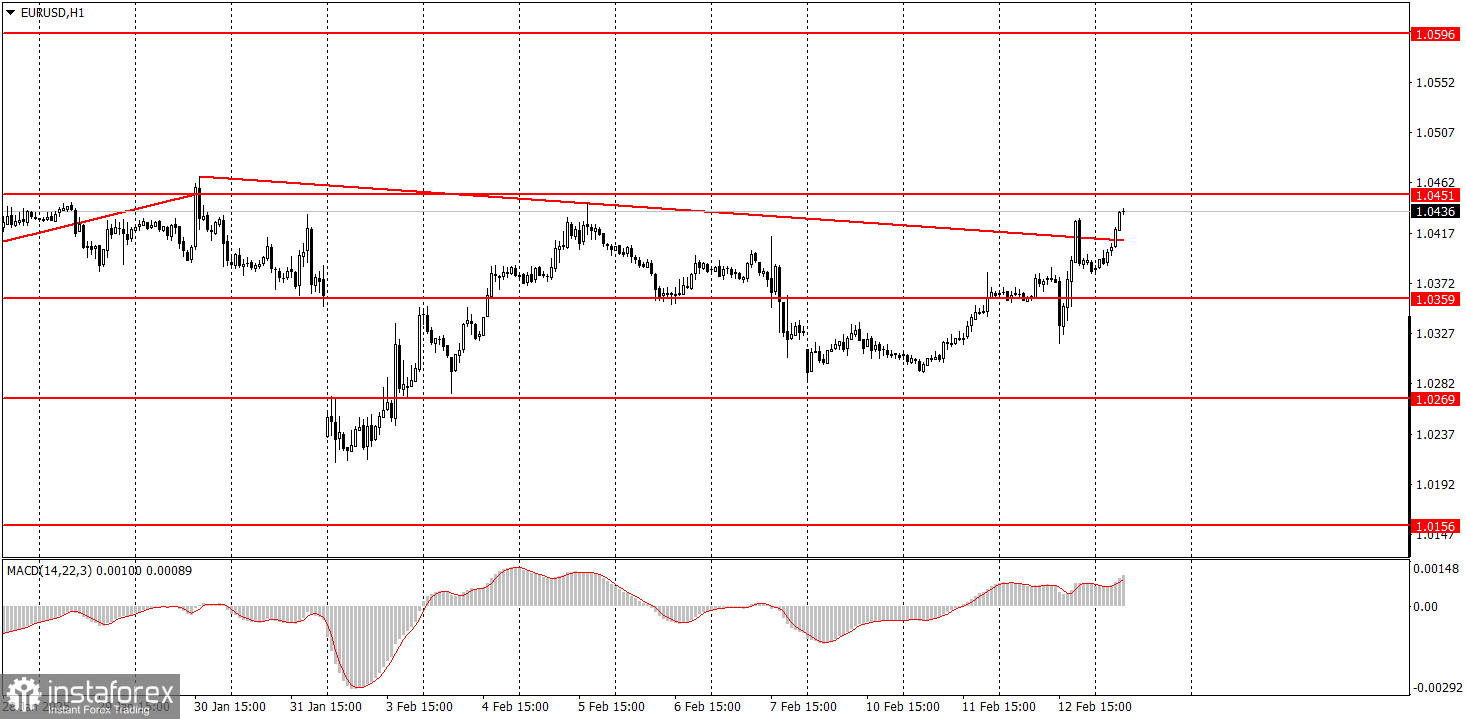

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.