Our team has over 7,000,000 traders!

Every day we work together to improve trading. We get high results and move forward.

Recognition by millions of traders all over the world is the best appreciation of our work! You made your choice and we will do everything it takes to meet your expectations!

We are a great team together!

InstaSpot. Proud to work for you!

Actor, UFC 6 tournament champion and a true hero!

The man who made himself. The man that goes our way.

The secret behind Taktarov's success is constant movement towards the goal.

Reveal all the sides of your talent!

Discover, try, fail - but never stop!

InstaSpot. Your success story starts here!

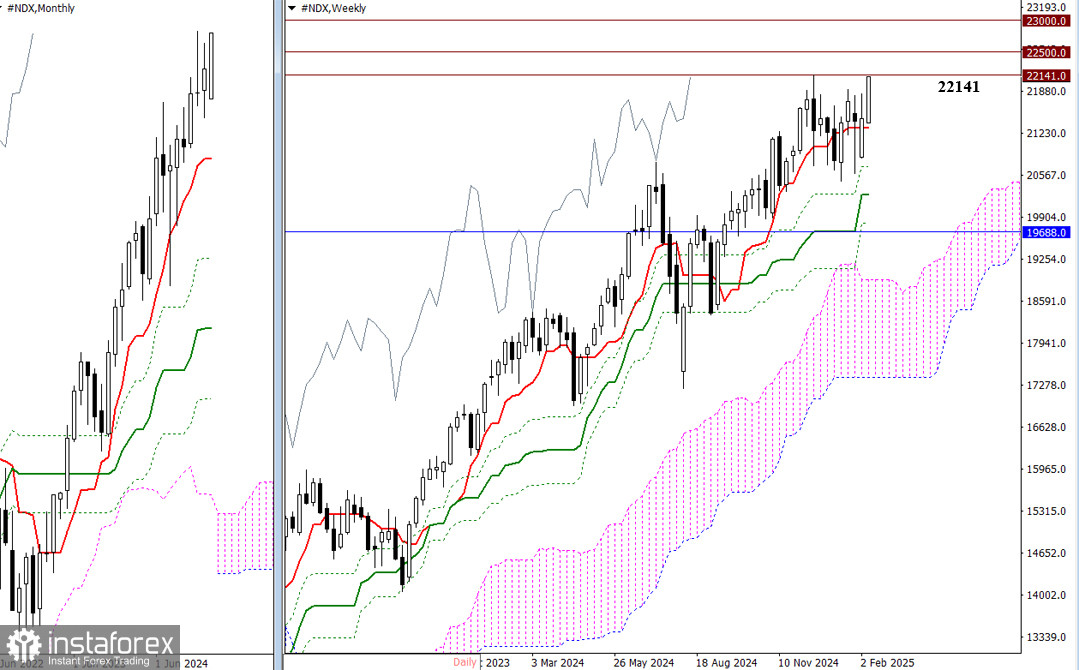

The past trading week has shown a distinct bullish trend. Buyers are focused on completing the downward correction and restoring the uptrend, as they have nearly reached the 2024 high of 22,141. If this positive sentiment continues, the index may move toward new highs, with key psychological levels at 22,500 and 23,000 gaining attention. A successful test and breakthrough of these levels could lead to the establishment of new all-time highs. Additionally, the weekly short-term trend at 21,309 has acted as a crucial point of attraction, helping to maintain consolidation in recent months.

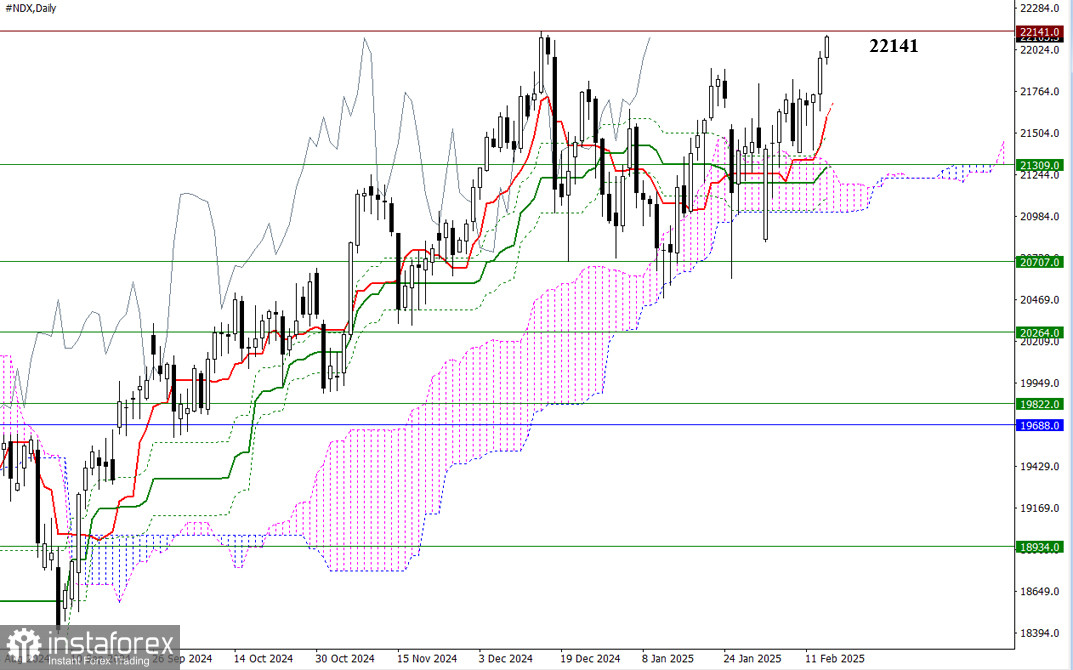

On the daily timeframe, it is evident that despite several attempts by bears to gain control through significant downward gaps, the market spent the past week trying to exit the correction and consolidation phase in order to restore the uptrend. The final objective is to break above the recent high of 22,141 and consolidate above this level. If buyers fail to accomplish this, the market may retreat to the range of 21,704 to 21,014, where all Ichimoku daily levels are clustered and supported by the weekly short-term trend at 21,309. In such a scenario, sellers could push further down toward additional weekly support levels at 20,707 to 20,264 and beyond.

On lower timeframes, buyers currently hold the advantage. Classic pivot resistance levels serve as reference points for continued upward movement. However, a break and reversal of the weekly long-term trend at 21,747.9 would shift the balance in favor of sellers. If this occurs, the pivot support levels will become crucial targets for intraday declines. Updated pivot levels for trading decisions will be available at the market open.

***

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.