- On Thursday, the GBP/USD currency pair also began a slight downward correction. While the pound did not depreciate significantly, explaining why it rose for two weeks is difficult. Of course

Author: Paolo Greco

03:39 2025-03-14 UTC+2

0

The EUR/USD currency pair finally began to decline on Thursday, but once again, this movement was not linked to macroeconomic factors or fundamental events. It wasn't even related to DonaldAuthor: Paolo Greco

03:39 2025-03-14 UTC+2

1

Trading planTrading Recommendations and Analysis for GBP/USD on March 14: The Pound Sterling Isn't Even Trying

The GBP/USD currency pair experienced a slight pullback on Thursday but did not manage to consolidate below the critical line. The Kijun-sen line is situated very close to the currentAuthor: Paolo Greco

03:38 2025-03-14 UTC+2

3

- Trading plan

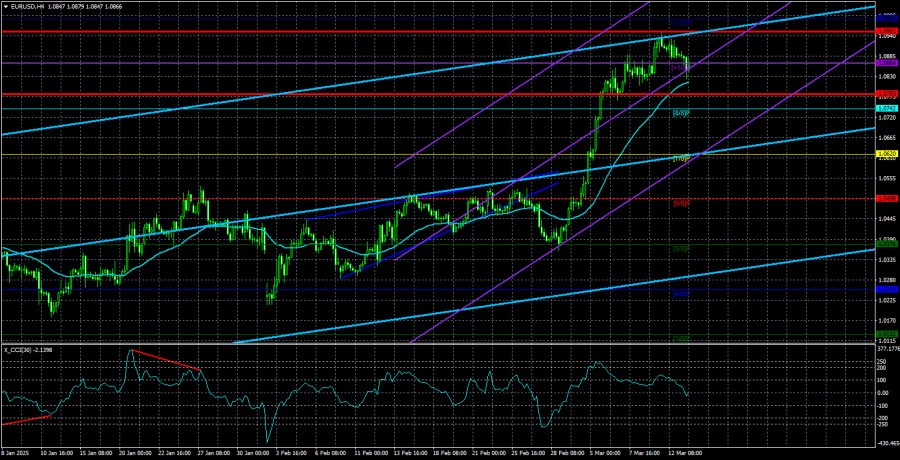

Trading Recommendations and Analysis for EUR/USD on March 14: The Euro Pretends to Correct

The EUR/USD currency pair experienced very weak volatility on Thursday, with only a slight correction. Over the past few weeks, the euro has gained 600 pips, and this entire upwardAuthor: Paolo Greco

03:38 2025-03-14 UTC+2

3

On Thursday, the EUR/USD pair reached a three-day low of 1.0823 but did not break into the 1.07 range, as the downward momentum gradually faded. The EUR/USD pair is currentlyAuthor: Irina Manzenko

00:55 2025-03-14 UTC+2

9

The Green Party responded to Friedrich Merz's call for a coalition between the CDU and the Social Democrats, aimed at abolishing the fiscal brake, with a strong rebuttal: "We don'tAuthor: Marek Petkovich

00:45 2025-03-14 UTC+2

8

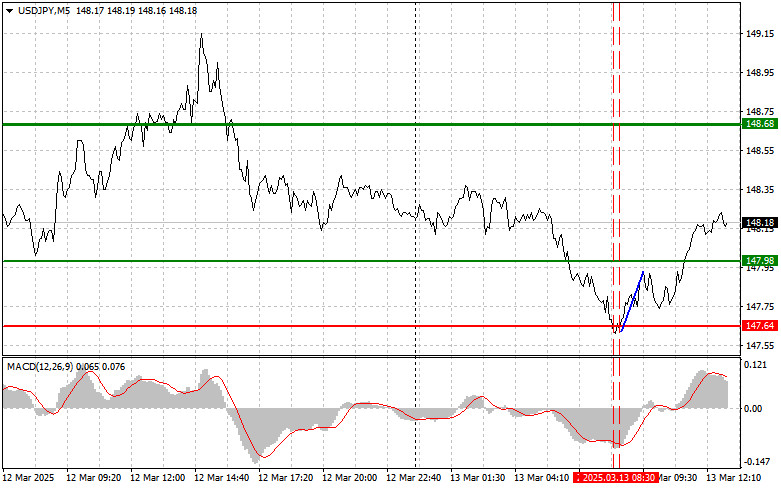

- The price test at 147.64 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential. For this reason

Author: Jakub Novak

19:38 2025-03-13 UTC+2

8

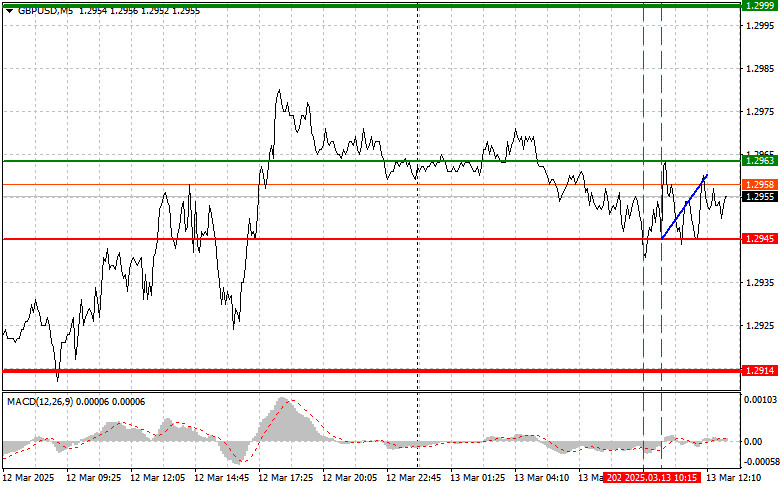

The price test at 1.2945 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential. For this reasonAuthor: Jakub Novak

19:35 2025-03-13 UTC+2

9

The price test at 1.0875 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential in such a bullish marketAuthor: Jakub Novak

19:31 2025-03-13 UTC+2

10