- There will be a few significant events in the upcoming week. Of course, reports such as industrial production, retail sales, and new home sales should be noted. At first glance

Author: Chin Zhao

00:59 2025-04-14 UTC+2

2

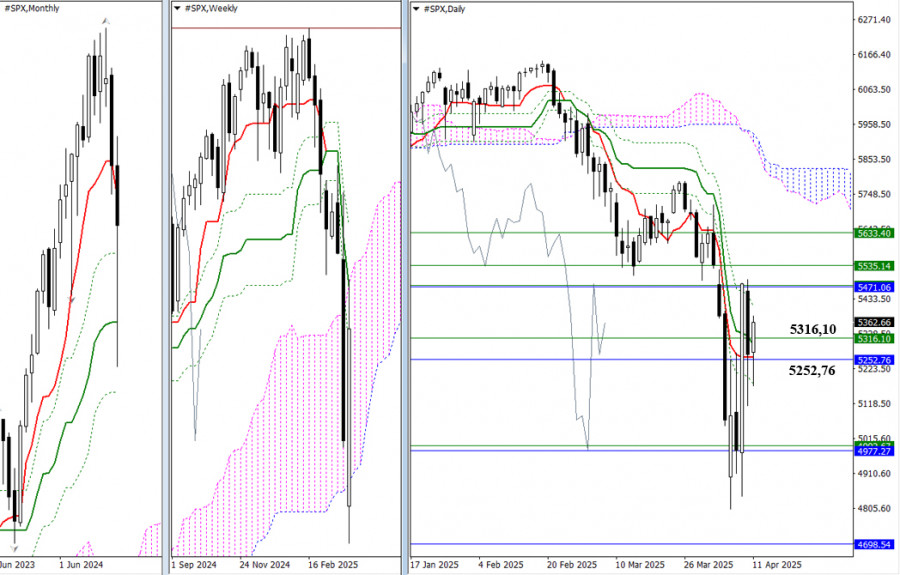

Last week, even though there was a bearish gap, bullish players were able to reclaim their ground effectively. The market is now approaching the point where it may eliminateAuthor: Evangelos Poulakis

00:58 2025-04-14 UTC+2

6

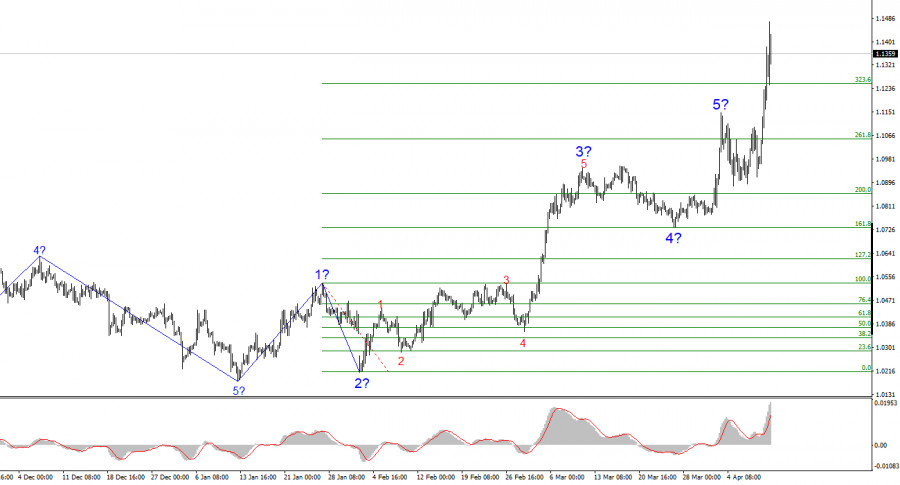

The wave structure on the 4-hour EUR/USD chart has transformed into a bullish one. I believe there's no doubt that this transformation occurred solely due to the United States'Author: Chin Zhao

18:33 2025-04-11 UTC+2

87

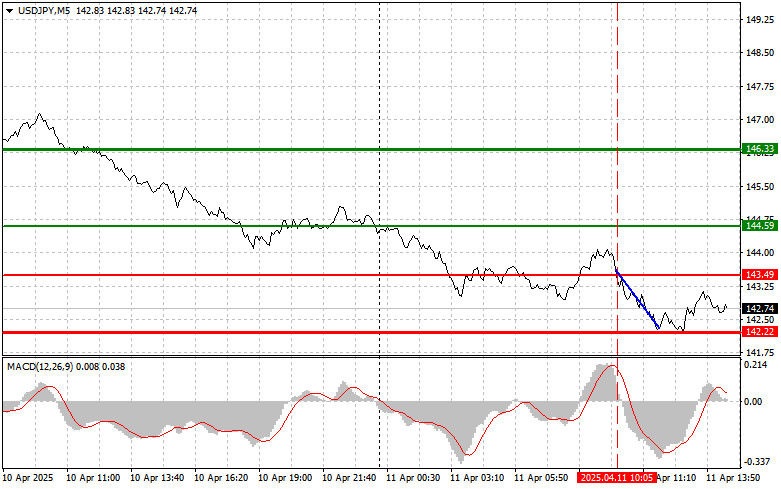

- Trade Analysis and Advice for Trading the Japanese Yen The test of the 143.49 price level coincided with the moment the MACD indicator had just started moving downward from

Author: Jakub Novak

18:26 2025-04-11 UTC+2

59

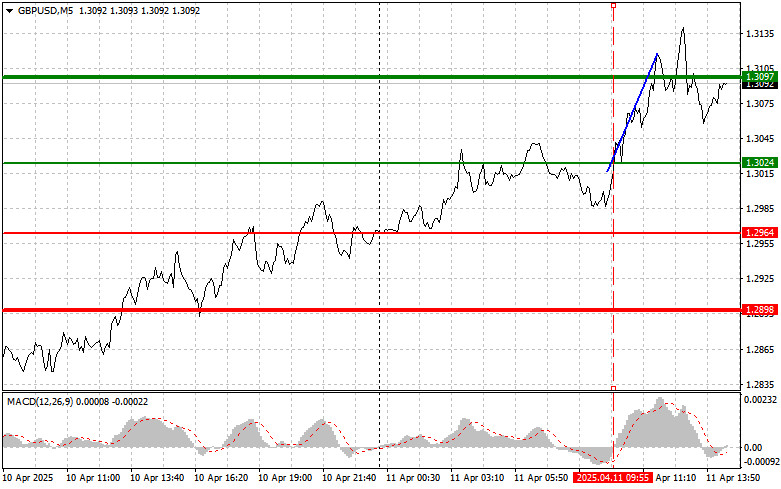

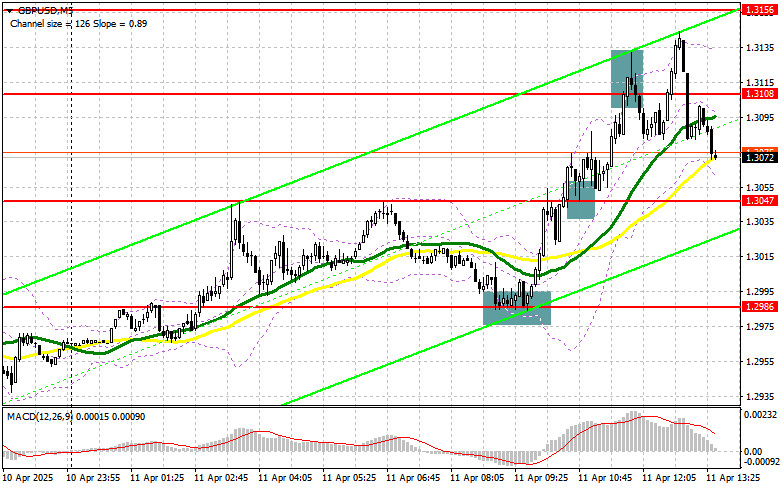

Trade Breakdown and Tips for Trading the British Pound The test of the 1.3024 price level occurred just as the MACD indicator was beginning to move upward from the zeroAuthor: Jakub Novak

18:22 2025-04-11 UTC+2

59

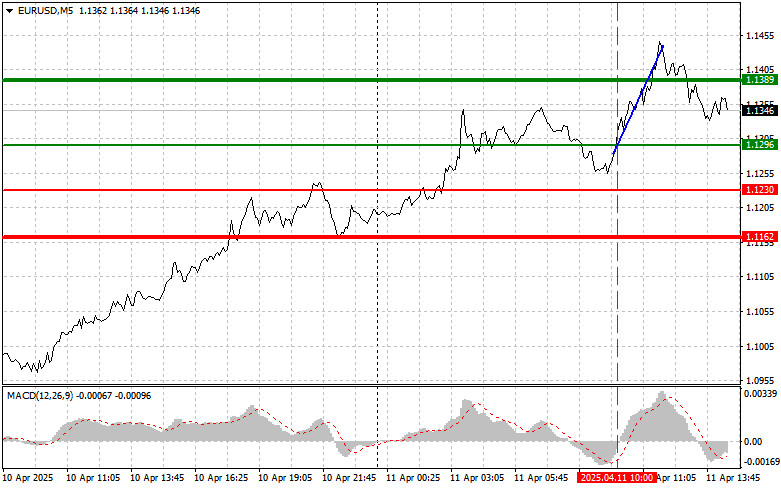

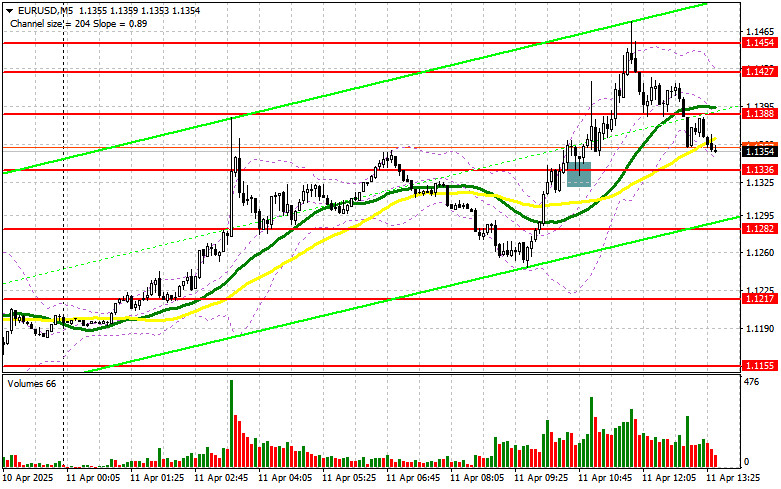

Trade Analysis and Tips for the Euro The test of the 1.1296 price level occurred when the MACD indicator was just starting to move upward from the zero mark, whichAuthor: Jakub Novak

18:20 2025-04-11 UTC+2

58

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and breakAuthor: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

53

Trading planEUR/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I focused on the 1.1336 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyzeAuthor: Miroslaw Bawulski

18:15 2025-04-11 UTC+2

48

Technical analysisTrading Signals for EUR/USD for April 11-15, 2025: sell below 1.1470 (+2/8 Murray - overbought)

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance thatAuthor: Dimitrios Zappas

16:44 2025-04-11 UTC+2

101