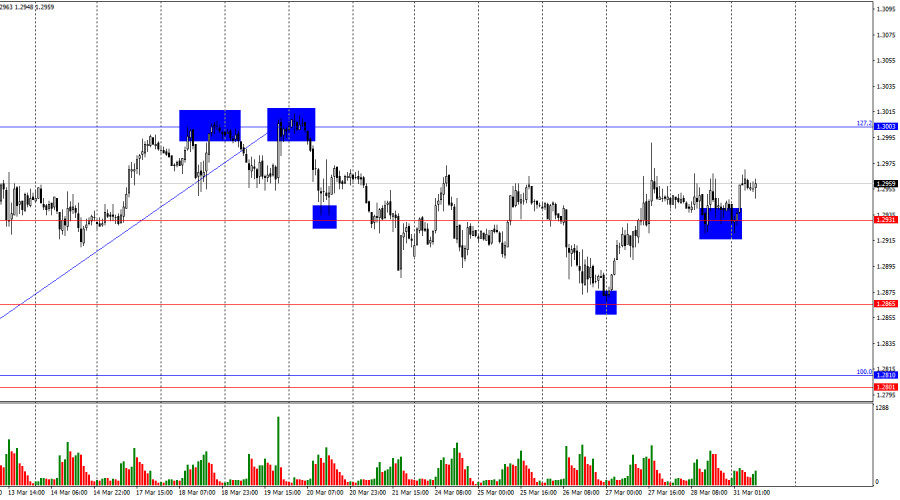

Analysis of Trades and Trading Tips for the British Pound

The price test at 1.2595 occurred when the MACD indicator had already risen significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound. After the pair's decline in the second half of the day, there was another price test at 1.2571. However, this also happened when the MACD had moved significantly downward from the zero mark, which restricted the pair's downside potential. The only viable option was to wait for Scenario #2 to buy, which materialized shortly thereafter. The price test at 1.2571, while the MACD was in the oversold zone, triggered a buy entry that resulted in a 25-pip gain for the pound.

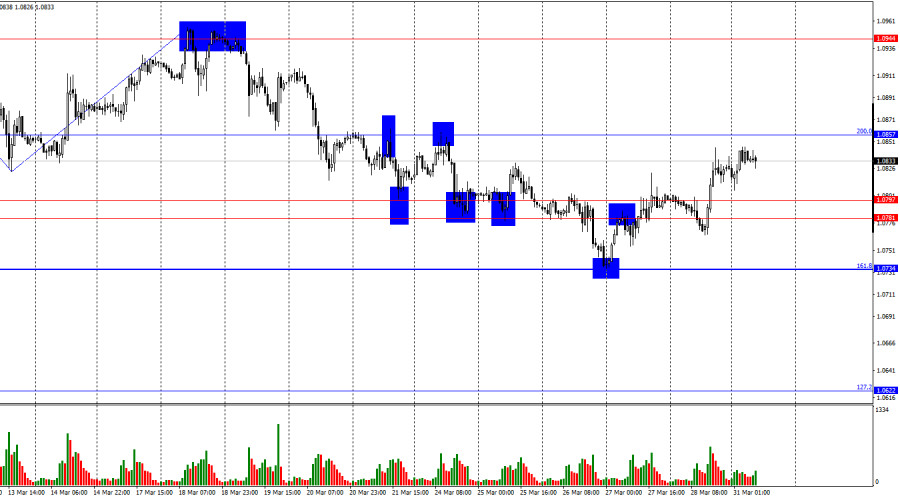

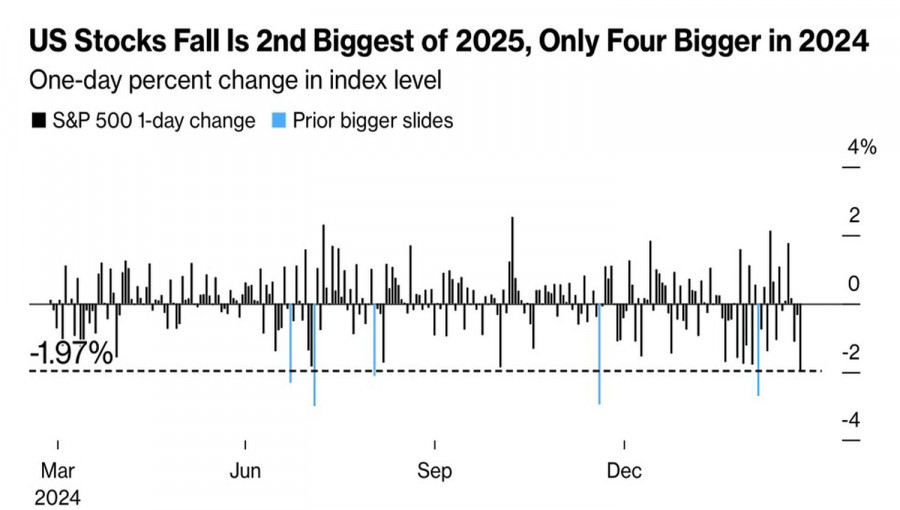

Yesterday, the pound attempted to rise following mixed inflation data from the UK, which prompted further considerations for the Bank of England. However, it failed to break through the weekly high, leading to active profit-taking by speculative traders. In the second half of the day, GBP/USD faced increased selling pressure, breaking through the sideways channel and creating significant conditions for a deeper downward correction. The sterling remains under pressure amid growing concerns about economic instability, which could strengthen the bearish outlook and raise concerns about the currency's future trajectory.

Today, in the first half of the day, we expect data on the CBI Industrial Orders Balance from the Confederation of British Industry (CBI). This figure serves as an indicator of the health of the UK manufacturing sector, reflecting the difference between the percentage of companies reporting an increase in orders and those reporting a decline. A positive value indicates order growth, while a negative value suggests a decrease. The CBI publishes the order balance monthly, providing valuable insights into current trends and prospects for UK manufacturers. Analyzing this data helps assess the impact of various factors on manufacturing activity, such as domestic and external demand, exchange rates, and government policies.

As for the intraday strategy, I will mainly rely on implementing Scenarios #1 and #2 today.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the price reaches 1.2601 (green line on the chart) with a target of 1.2623. At 1.2623, I plan to exit the trade and sell the pound in the opposite direction, expecting a 30-35 pip retracement from the entry point. A bullish move is only likely after strong economic data. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I will buy the pound today if the price tests 1.2585 twice while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and likely trigger a reversal to the upside. The expected upside targets are 1.2601 and 1.2623.

Sell Signal

Scenario #1: I plan to sell the pound after breaking 1.2585 (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be 1.2561, where I plan to exit short positions and immediately buy in the opposite direction, expecting a 20-25 pip retracement. Important! Before entering a sell trade, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I will also sell the pound today if the price tests 1.2601 twice while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and likely trigger a reversal downward. The expected downside targets are 1.2585 and 1.2561.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.The thin red line represents the entry price where the trading instrument can be sold.The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.