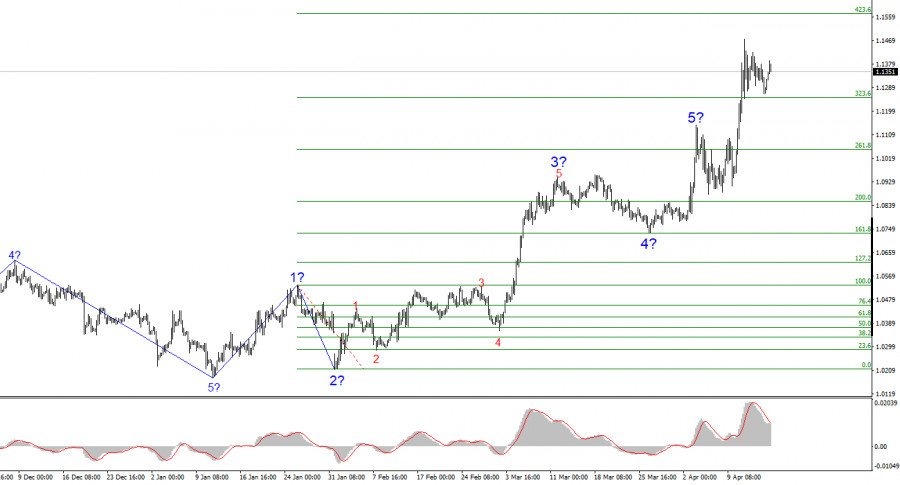

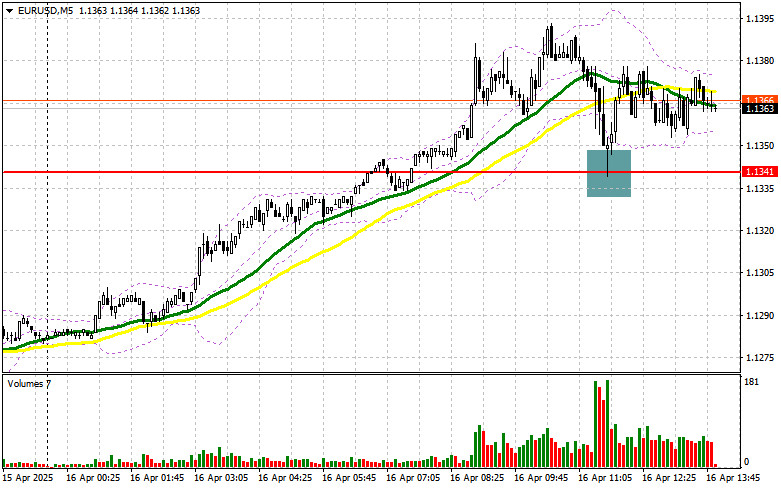

- The wave structure on the 4-hour chart for the EUR/USD pair has shifted into a bullish formation. I think there's little doubt that this transformation was caused solely

Author: Chin Zhao

18:56 2025-04-16 UTC+2

49

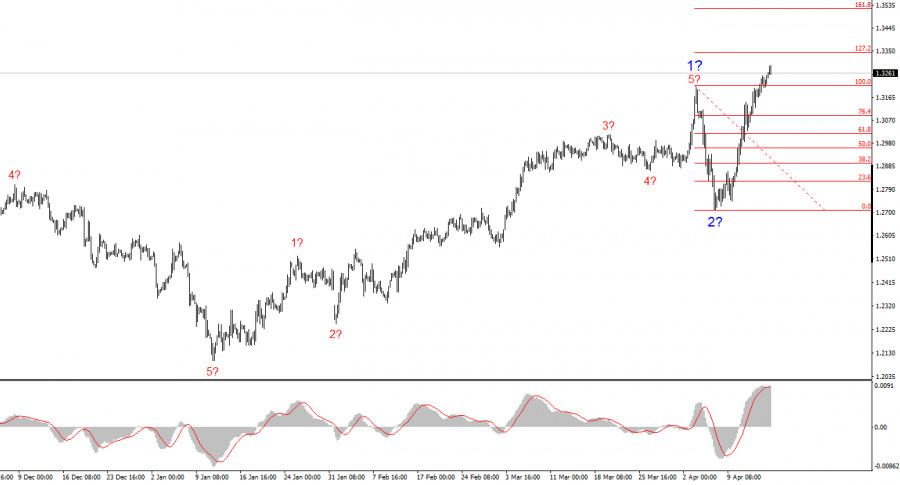

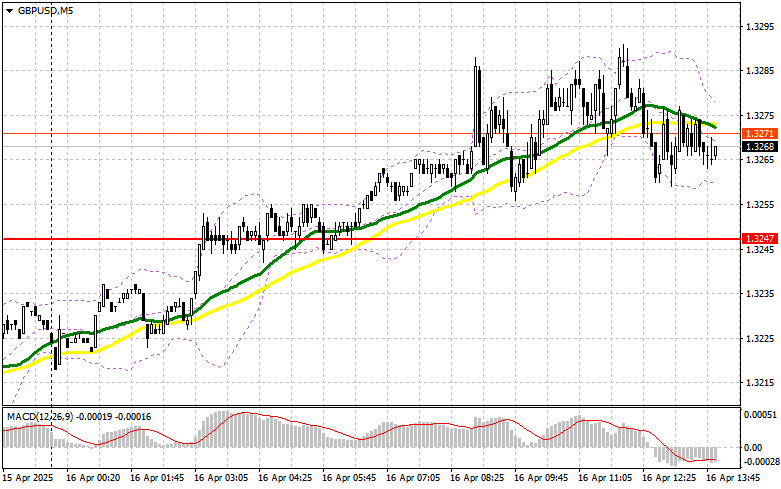

The wave structure of the GBP/USD pair has also transformed into a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to that of EUR/USDAuthor: Chin Zhao

18:53 2025-04-16 UTC+2

22

This week, the European Union and the United States made no significant progress in resolving trade disputes, as officials from President Donald Trump's administration indicated that most of the U.SAuthor: Jakub Novak

18:48 2025-04-16 UTC+2

15

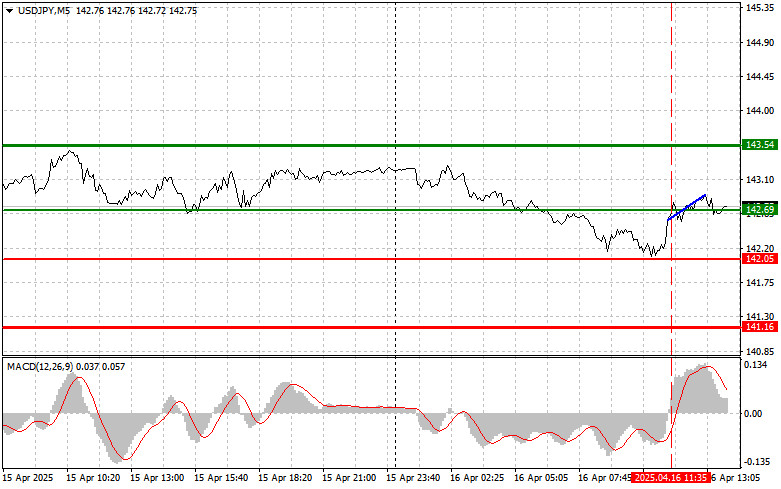

- The price test at 142.69 occurred just as the MACD indicator was beginning to move up from the zero line, confirming a proper entry point for buying the dollar

Author: Jakub Novak

18:46 2025-04-16 UTC+2

20

There were no tests of the levels I outlined in the first half of the day. Even with the release of important inflation data from the UK, reduced market volatilityAuthor: Jakub Novak

18:43 2025-04-16 UTC+2

17

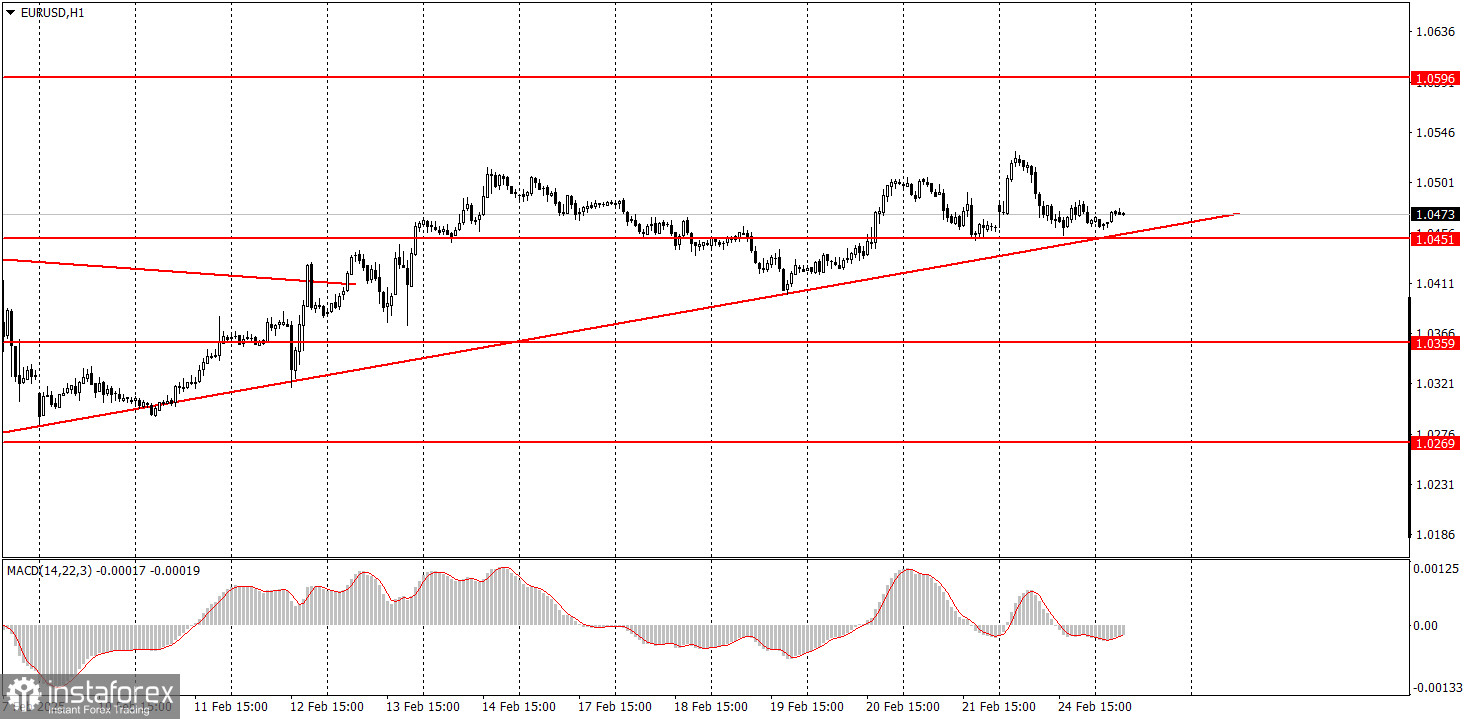

Trade Review and Guidance for Trading the Euro There were no tests of the levels I outlined in the first half of the day. Even with the release of importantAuthor: Jakub Novak

18:36 2025-04-16 UTC+2

12

- Trading plan

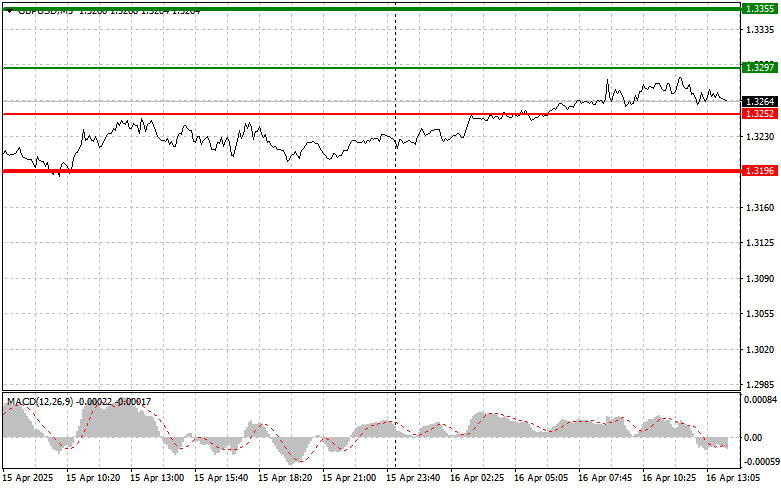

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happenedAuthor: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

22

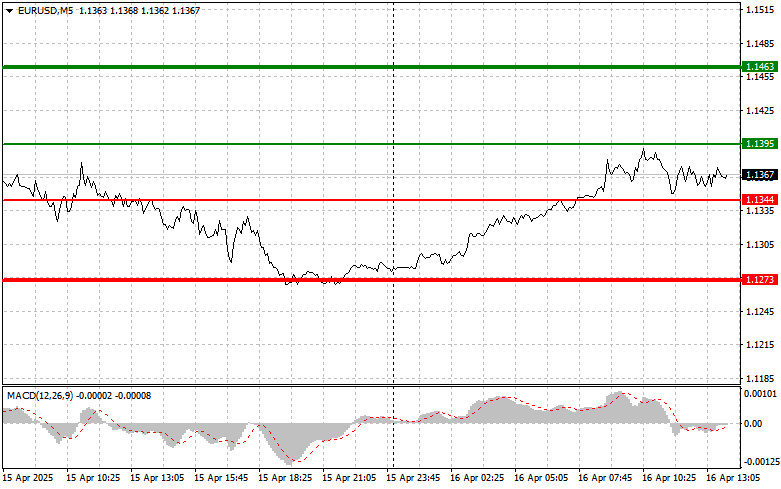

Trading planEUR/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened thereAuthor: Miroslaw Bawulski

18:28 2025-04-16 UTC+2

19

Following the previous regular session, US stock indices closed slightly lower. The S&P 500 slipped by 0.17%, the Nasdaq 100 edged down 0.05%, and the Dow Jones Industrial Average droppedAuthor: Jakub Novak

12:22 2025-04-16 UTC+2

22