The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

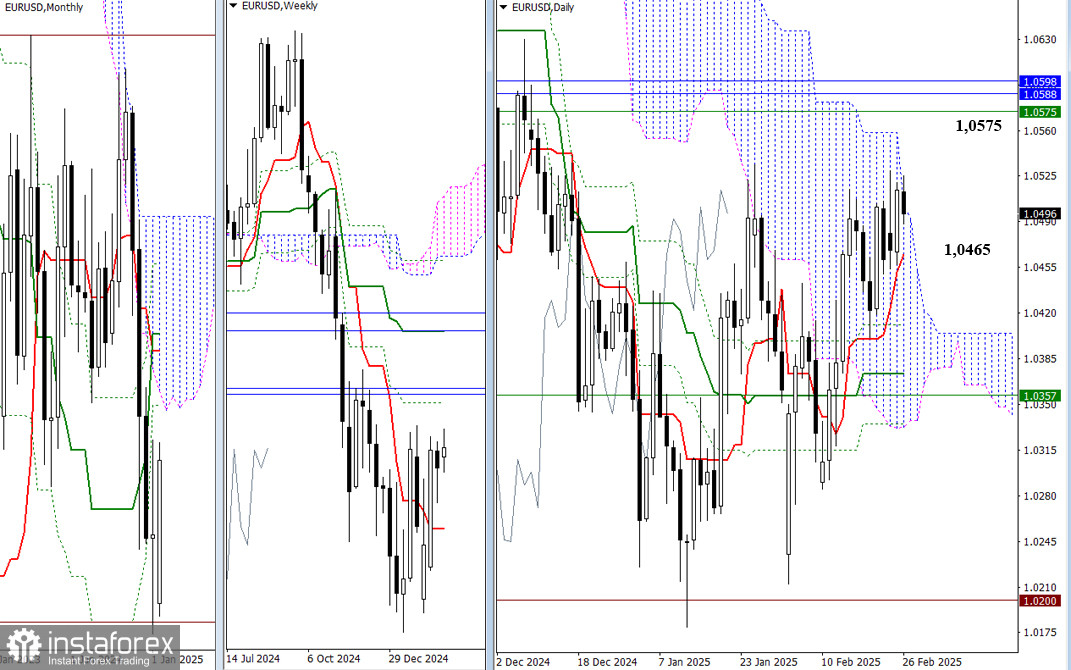

At the start of the workweek, bullish players strive to achieve new results but clearly lack strength. Today, the daily cloud boundary has shifted, attempting to move out of the bulls' way, clearing a path toward the cluster of resistances from the highest timeframes in the 1.0575 – 1.0598 range. If the bulls fail to hold their gains and continue the upward movement, their opponents will regain their positions, with the nearest support being the daily short-term trend at 1.0465.

The pair is in a corrective zone on the lower timeframes, but the overall advantage remains on the bulls' side. A few hours ago, they began testing the strength of the daily central Pivot level support at 1.0497, with the next challenge being the weekly long-term trend at 1.0473. A breakout of these key levels would shift the balance of power in favor of strengthening bearish sentiment. Additional intraday movement targets include supports at 1.0434 – 1.0411 and resistances at 1.0537 – 1.0560 – 1.0600, based on classic Pivot levels.

***

Currently, the daily timeframe is forming a consolidation. The market is struggling against the pull and influence of several strong Ichimoku levels, which have converged around 1.2650 – 1.2609. To shift the sentiment, the pound must exit this zone and consolidate above or below it. If the bears take control, they can slide down through the daily cloud, starting from 1.2553 (the upper cloud boundary today). Conversely, the bulls will aim for the resistance zone with a lower boundary around 1.2765.

In the lower timeframes, the bulls maintain an advantage, but it is evident that they are struggling, repeatedly relying on key-level support. Today's key levels are 1.2648 (the daily central Pivot level) and 1.2634 (the weekly long-term trend). The prevailing condition is uncertainty. A breakout from this indecisive range and the development of a directional movement will shift focus to other targets on the lower timeframes. For the bears, these targets will be the classic Pivot level supports at 1.2620 – 1.2577 – 1.2549, while for the bulls, they will be the resistances at 1.2691 – 1.2719 – 1.2762.

***

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

InstaSpot

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.