The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

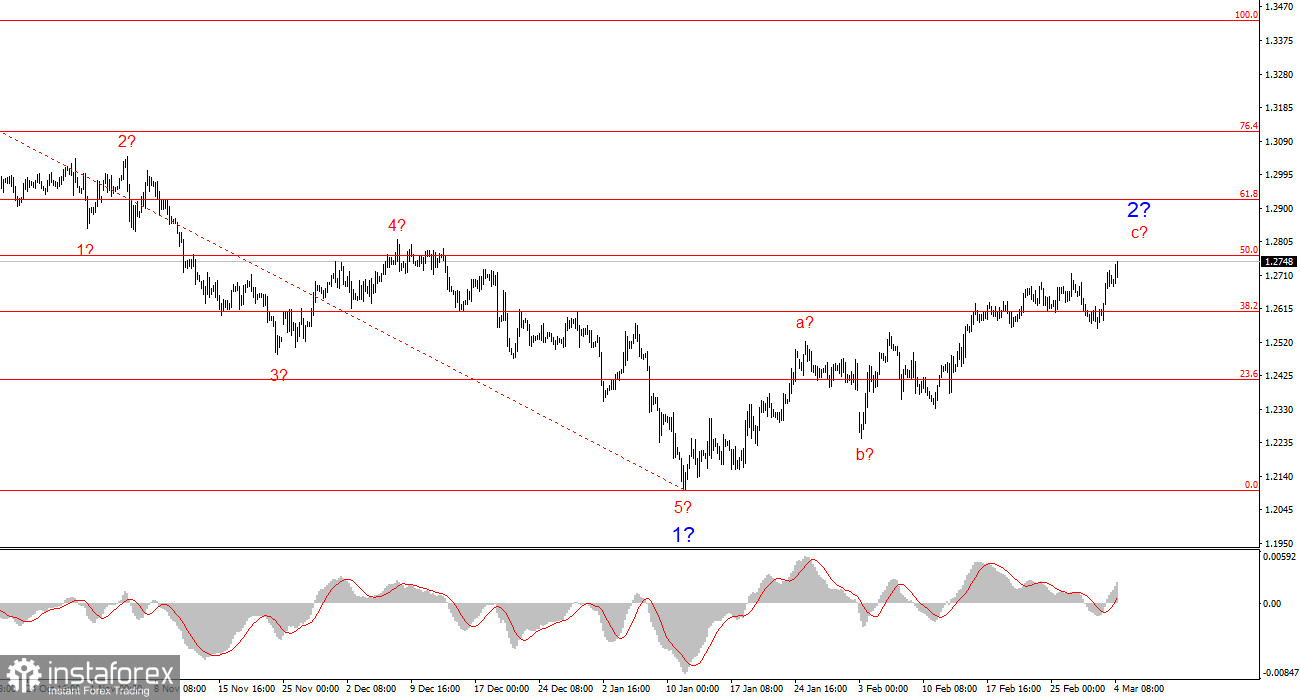

The wave structure of the GBP/USD instrument remains somewhat ambiguous but still comprehensible. At present, there is a high probability of forming a long-term bearish trend segment. Wave 5 has taken a convincing form, which leads me to consider the larger Wave 1 complete. If this assumption is correct, then the pair is currently forming Wave 2, with targets near the 1.26 and 1.28 levels. The first two subwaves within Wave 2 appear to be completed, while the third one could end at any moment.

Demand for the pound continues to grow, largely due to political developments in the U.S., making Trump an unintended ally of sterling. However, in a longer-term perspective, the pound still lacks fundamental drivers for sustained growth. The Bank of England plans four rate cuts in 2025, whereas the Federal Reserve does not expect to cut more than 50 basis points. Additionally, the UK economy consistently disappoints markets, while the resilience of the U.S. economy bolsters confidence in the dollar. These factors should deter traders from forming a prolonged bullish trend in GBP/USD.

The GBP/USD pair surged by 120 basis points on Monday and another 50 on Tuesday. As I mentioned yesterday, this all began last Friday following the scandal at the White House meeting between Trump and Zelensky. However, the market had already closed for the weekend, preventing traders from pricing in the event immediately. On Monday, the market fully reacted to the news, leading to a strong bullish move.

The pound's rally is not driven by optimism about the UK economy. In fact, the pound—much like the euro—is merely a spectator in the current market environment. The demand for GBP and EUR is not increasing—rather, the demand for the U.S. dollar is falling at a rapid pace. Consequently, all major currency movements stem from U.S. developments.

The U.S. headlines have been highly impactful:

As a result, three trade wars are now in full swing. A fourth and fifth conflict against the EU and the UK could be next. If this happens, how will the pound and the euro respond, considering that tariffs pose a greater economic threat to these regions than to the U.S.?

For now, price movements remain aligned with the wave structure. The unsuccessful breakout attempt at 1.2765, corresponding to 50.0% Fibonacci retracement, could signal the completion of Wave 2.

The wave structure of GBP/USD suggests that the bearish trend remains in place, with the first wave of the decline now complete. The current corrective phase (Wave 2) has reached initial targets around 1.26, and further gains toward 1.28 are possible. However, the broader wave analysis still indicates that a long-term bearish trend is developing, which originated last fall.

On the larger wave scale, the pattern has shifted. We can now assume a downward trend structure, as the previous three-wave bullish cycle appears complete. If this assumption holds, then we should expect a corrective Wave 2 or b, followed by an impulsive Wave 3 or c.

Core Principles of My Analysis

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.