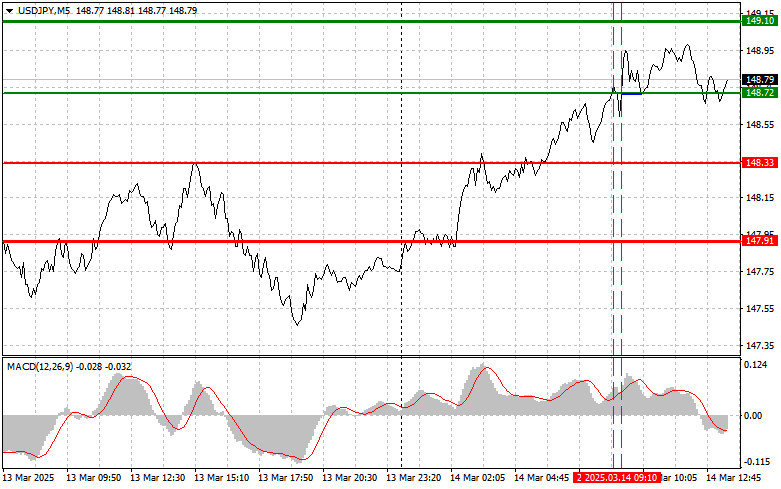

- The 148.72 price test occurred when the MACD indicator had already moved significantly above the zero level, limiting the pair's upward potential. For this reason

Author: Jakub Novak

17:50 2025-03-14 UTC+2

29

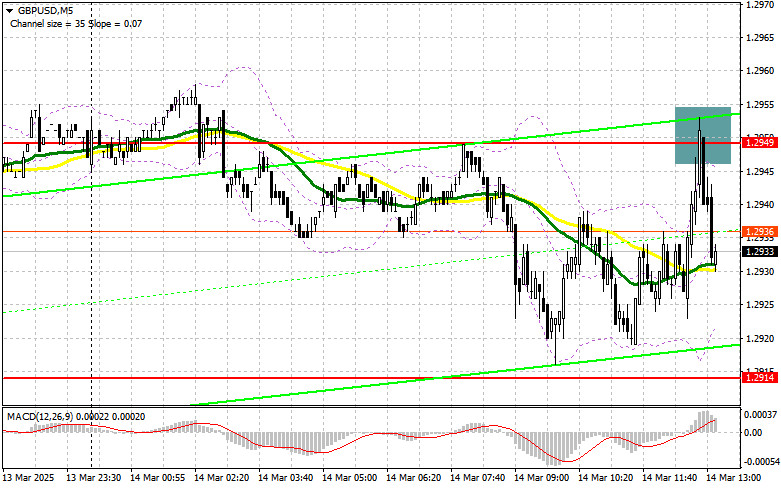

The 1.2934 price test coincided with the MACD indicator beginning its downward movement from the zero level, confirming the validity of the entry point. As a result, the pair declinedAuthor: Jakub Novak

17:02 2025-03-14 UTC+2

37

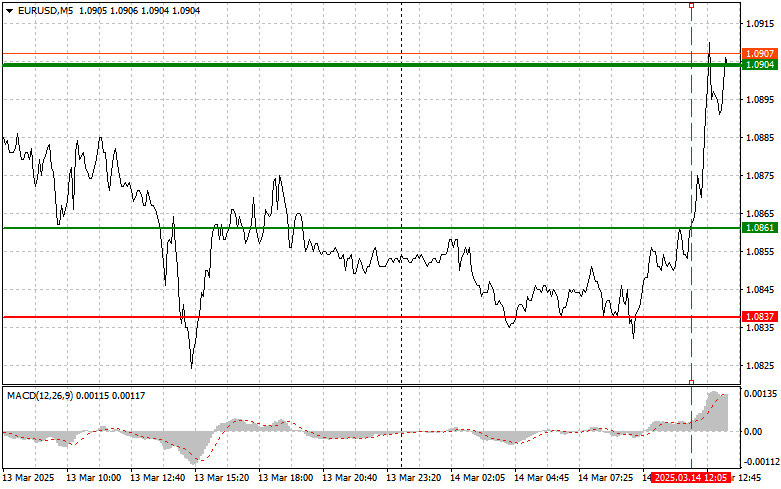

The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero level, limiting the pair's upward potential. For this reasonAuthor: Jakub Novak

16:40 2025-03-14 UTC+2

29

- In my morning forecast, I focused on the 1.2949 level and planned to base my trading decisions on it. Let's examine the 5-minute chart to see what happened. A rise

Author: Miroslaw Bawulski

16:25 2025-03-14 UTC+2

24

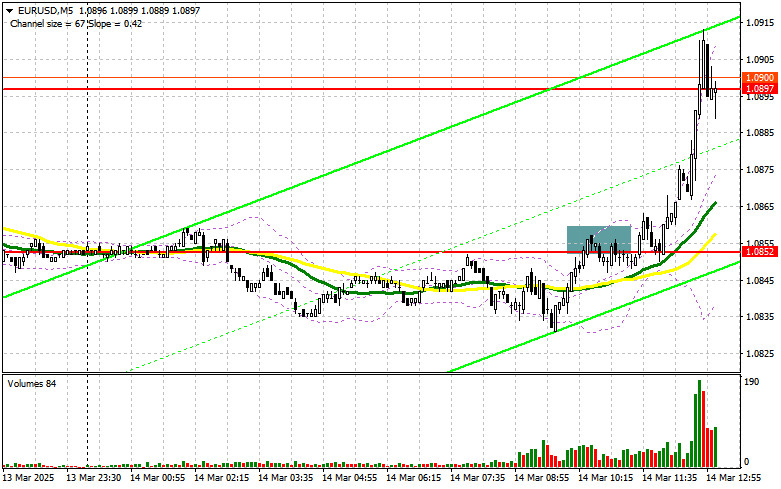

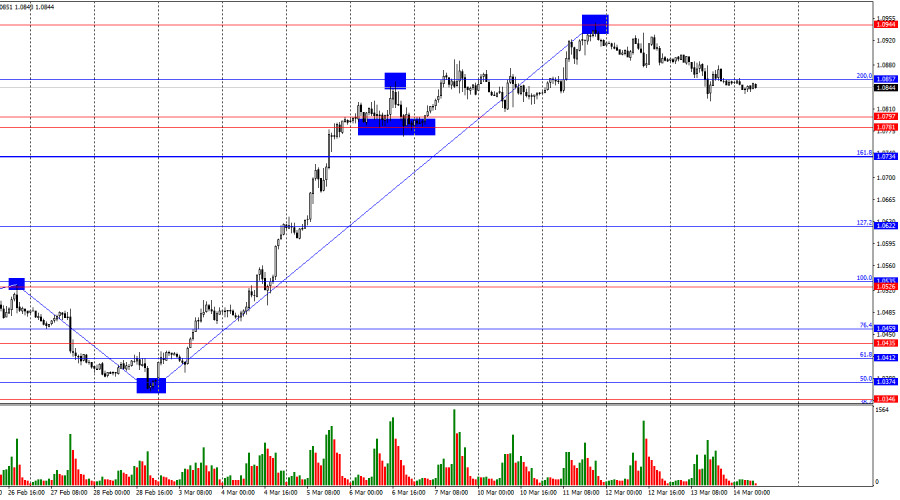

In my morning forecast, I focused on the 1.0852 level and planned to base my trading decisions on it. Let's examine the 5-minute chart to see what happened. A riseAuthor: Miroslaw Bawulski

16:00 2025-03-14 UTC+2

30

On Thursday, the EUR/USD pair continued its decline and consolidated below the 200.0% corrective level at 1.0857. This suggests that the downward movement could extend toward the next support zoneAuthor: Samir Klishi

15:29 2025-03-14 UTC+2

38

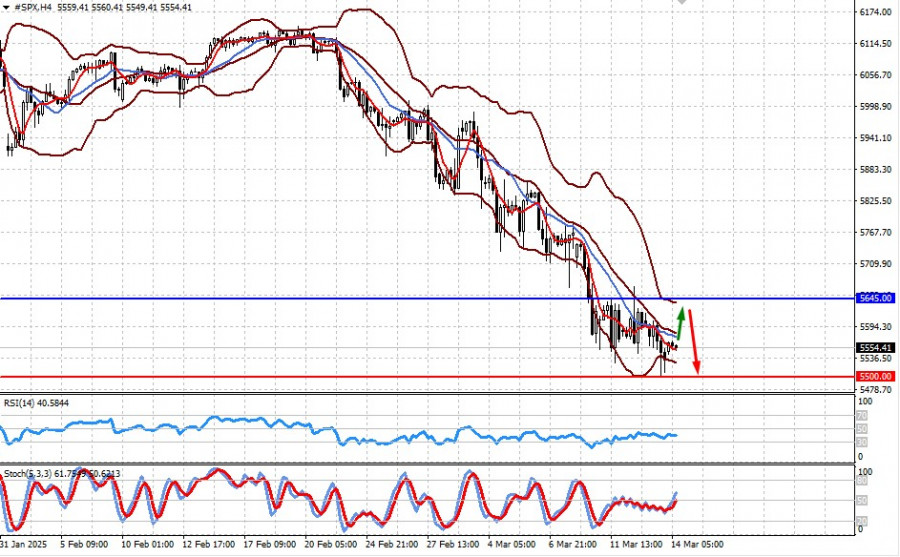

- Fundamental analysis

A New Problem Rises for America – The Debt Ceiling (Expecting #SPX and #NDX to Resume Their Decline After a Likely Short-Term Recovery)

The confrontation between the U.S. and the EU has entered a new phase. The U.S. president is taking a hardline approach toward Europe, effectively following a "tit for tat" strategyAuthor: Pati Gani

15:06 2025-03-14 UTC+2

29

The Japanese yen is losing ground today. Positive news on U.S.-Canada trade negotiations and reports that Democrats have secured enough votes to prevent a U.S. government shutdown are improving globalAuthor: Irina Yanina

14:33 2025-03-14 UTC+2

44