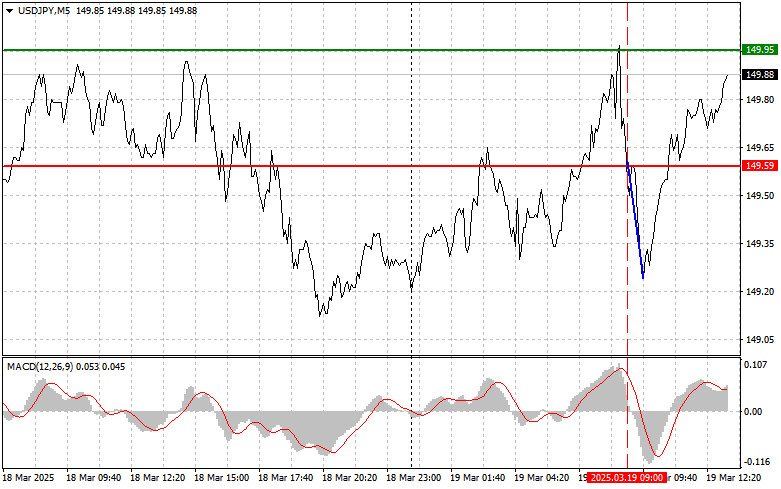

- The test of the 149.59 level coincided with the MACD indicator just starting to move downward from the zero mark, confirming a valid entry point for selling the US dollar

Author: Jakub Novak

19:13 2025-03-19 UTC+2

17

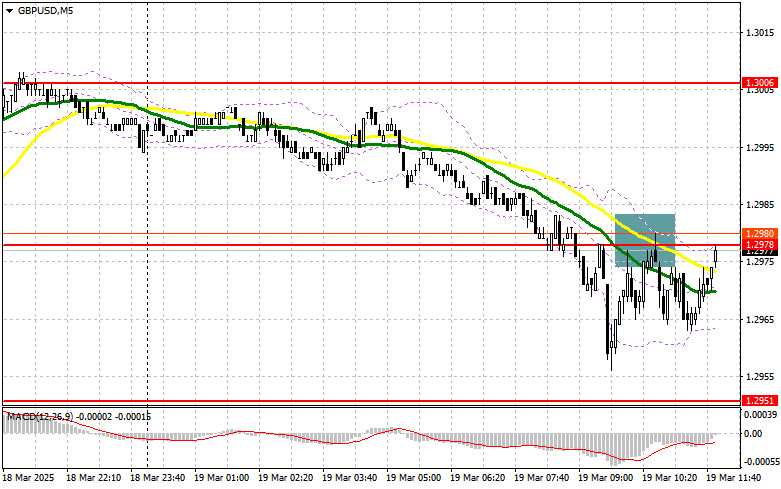

The test of the 1.2975 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reasonAuthor: Jakub Novak

19:07 2025-03-19 UTC+2

38

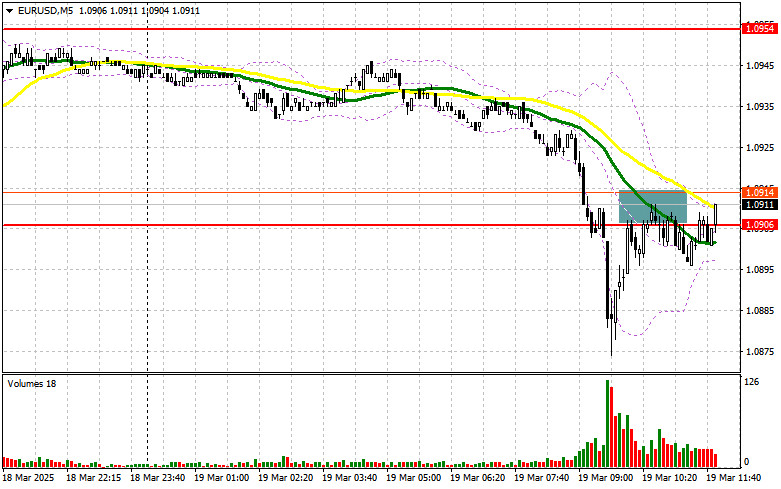

The test of the 1.0920 level coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sellAuthor: Jakub Novak

19:05 2025-03-19 UTC+2

36

- In my morning forecast, I highlighted the 1.2980 level as a key area for making market entry decisions. Let's analyze the 5-minute chart to see what happened. A break

Author: Miroslaw Bawulski

19:02 2025-03-19 UTC+2

11

In my morning forecast, I highlighted the 1.0906 level as a key point for making market entry decisions. Let's examine the 5-minute chart to see what happened. A breakAuthor: Miroslaw Bawulski

18:59 2025-03-19 UTC+2

32

Technical analysisTrading Signals for EUR/USD for March 19-21, 2025: sell below 1.0900 (+2/8 Murray + 21 SMA)

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830Author: Dimitrios Zappas

15:01 2025-03-19 UTC+2

48

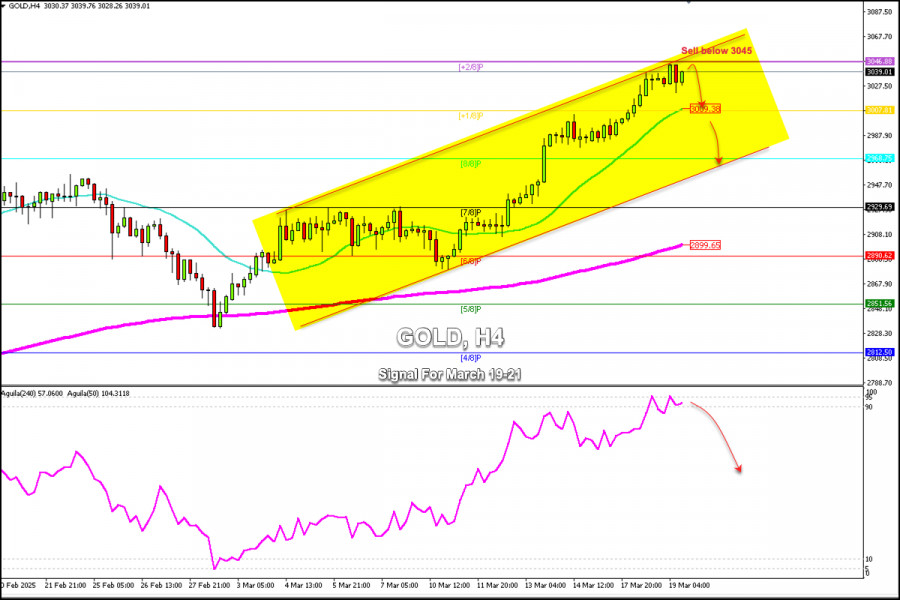

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 19-21, 2025: sell below $3,045 (+2/8 Murray + 21 SMA)

A consolidation below $3,045 could mean a technical correction toward the psychological level of $3,000. Therefore, we will look for shorting opportunities in the coming days as longAuthor: Dimitrios Zappas

15:00 2025-03-19 UTC+2

31

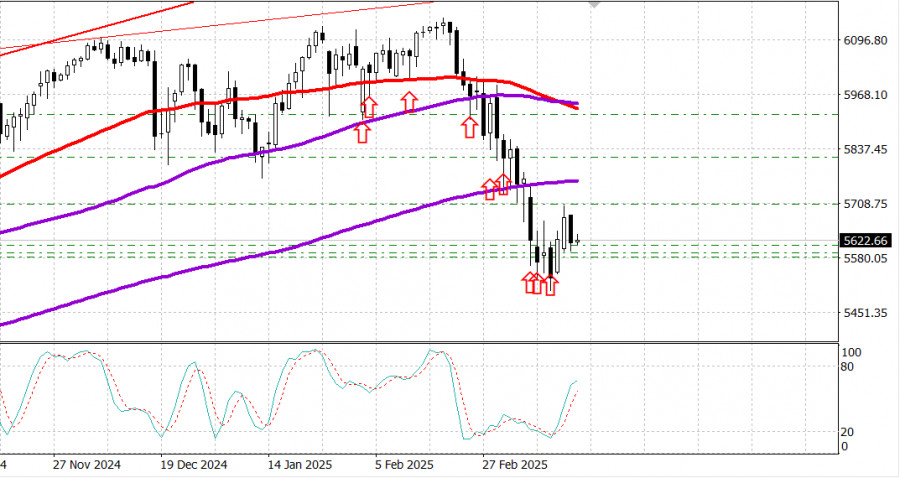

S&P 500 Market overview on March 19 US Market: Pullback. Consolidation. Focus on Fed. Major US indices on Tuesday: Dow -0.6%, NASDAQ -1.7%, S&P 500 -1.1%, S&P 500 5,614, rangeAuthor: Jozef Kovach

11:57 2025-03-19 UTC+2

59

Nvidia, which should have been celebrating the start of its annual developer conference, saw its shares fall instead. Tesla, still reeling from Elon Musk's latest adventures, took a hit fromAuthor: Natalia Andreeva

11:52 2025-03-19 UTC+2

51