- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, which confirms that in the near future Gold has the potential to strengthen even though because the StochasticAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

2

Technical analysisTechnical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Tuesday March 18, 2025

If we look at the 4-hour chart, the EUR/JPY cross currency pair appears to be moving harmoniously in the Bullish Pitchfork channel, which indicates that the bias of EUR/JPYAuthor: Arief Makmur

09:01 2025-03-18 UTC+2

2

Bitcoin and Ethereum buyers attempted to achieve more significant growth, and for a moment, the bullish market might gain hope for a return. However, they could not hold the achievedAuthor: Miroslaw Bawulski

09:00 2025-03-18 UTC+2

2

- Forecast

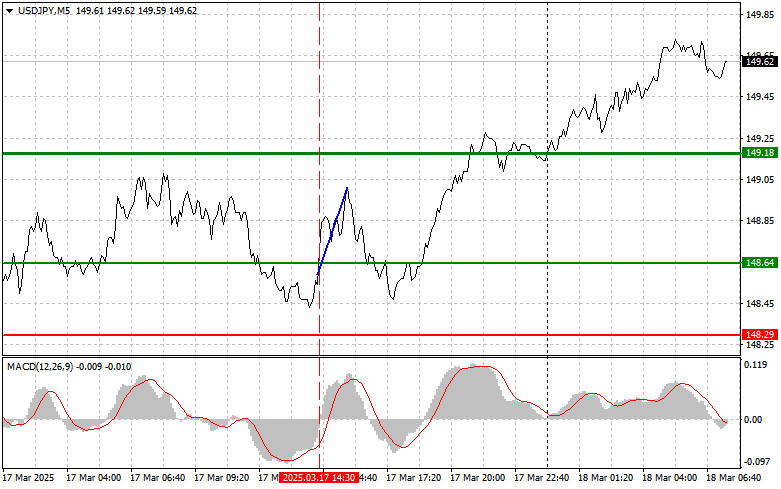

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 148.64 came when the MACD indicator started moving upward from the zero mark, confirming the correct entry point to buy the dollar. As a resultAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

4

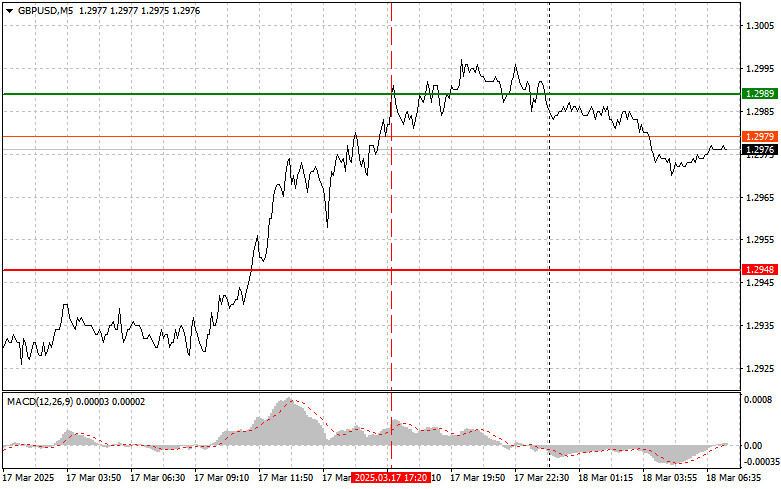

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 1.2989 came when the MACD indicator had already moved significantly from the zero mark, limiting the pair's upward potential. For this reasonAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

1

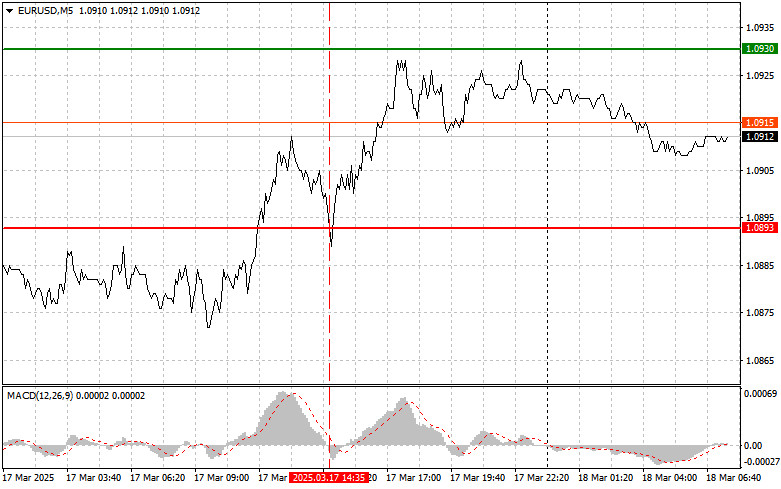

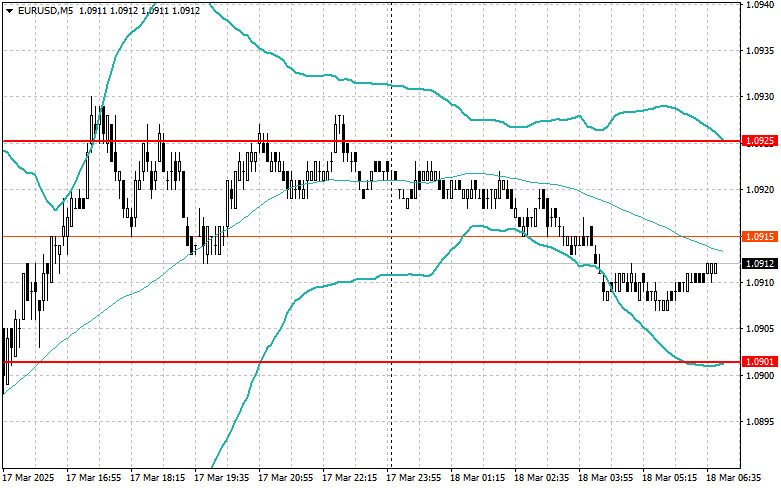

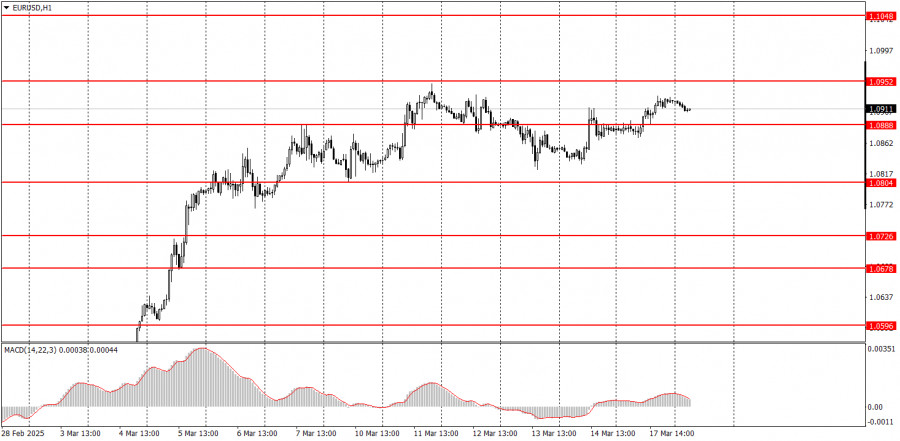

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 1.0893 occurred when the MACD indicator began moving down from the zero mark, confirming a valid entry point for selling the euro. However, losses were recordedAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

2

- The global market is currently struggling to find balance in key currency pairs and stock instruments. This is particularly challenging given the recent decline of the euro and the weakness

Author: Larisa Kolesnikova

08:52 2025-03-18 UTC+2

1

The euro and the pound continue to rise despite all the desperate attempts by sellers of risk assets to achieve at least some reasonable correction at the beginningAuthor: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

6

Fundamental analysisWhat to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significant. For example, the Eurozone and Germany will publish ZEW economic sentiment indices, whichAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

6