The EUR/USD currency pair continued to trade upward on Tuesday. Although the upward movement is weakening, the euro remains strong while the US dollar keeps falling. This is happening despite the complete absence of significant macroeconomic and fundamental events. Donald Trump is not introducing new tariffs, and no significant reports or indicators are being published. Nevertheless, the US dollar continues to decline.

The results of the Federal Reserve meeting will be announced this evening. The key interest rate is 99%, likely to remain unchanged. However, since Donald Trump became president, market expectations regarding Fed monetary policy have become significantly softer. This does not mean that traders now expect a rate cut at every meeting, but whereas they previously anticipated two cuts in 2025, they now expect more.

Frankly, the current market expectations are very similar to those for 2024. Most experts then believed the Fed would lower rates at least six times. There were only three cuts, which was a major discrepancy between expectations and reality. For 2025, the market initially expected two rate cuts, but as inflation rose, expectations turned more hawkish. Later, when concerns grew about inflation and a slowdown in the US economy, expectations became more dovish. However, market expectations alone are not the reason for the dollar's decline. They may be used as an excuse to continue selling off the dollar repeatedly, but they are not the root cause.

We are talking about minimal changes in expectations. Initially, the market anticipated two cuts, then one, and now three. These are relatively minor shifts. Everyone understands that, given the current level of inflation, the Fed is unlikely to lower rates even once every two meetings. However, the threat of a US economic slowdown or even a recession could force the Fed to adopt a more dovish stance than before. This would be a fresh reason for the market to continue selling the US dollar, which is already falling almost daily.

Therefore, today, the market will closely analyze Jerome Powell's rhetoric. Any concerns about economic growth or changes in the accompanying statement will be scrutinized. If something does not sit well with the market, the dollar will continue its decline.

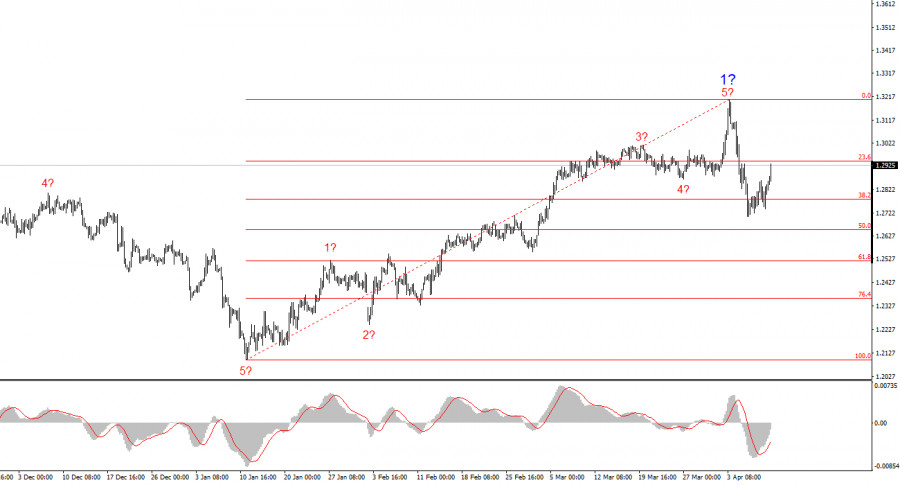

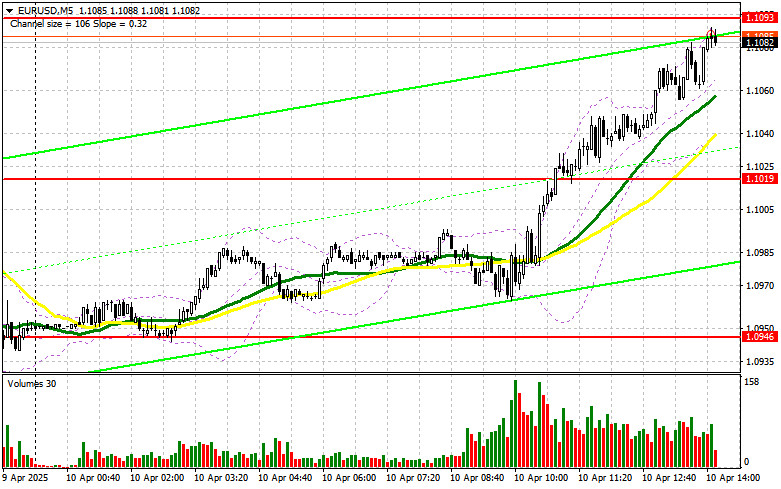

From a technical perspective, nothing is changing in the four-hour timeframe. The euro remains on an uptrend, which is entirely disconnected from the actual state of the European economy. The market continues to react to the "Trump factor," pushing the dollar further into decline. It is challenging to predict how long this trend will last. However, traders must understand that this situation does not indicate that the dollar is fundamentally weak or that the US economy is on the verge of recession. It merely reflects the "Trump factor," overshadowing all other factors.

![Exchange Rates 19.03.2025 analysis]()

The average volatility of the EUR/USD currency pair over the past five trading days as of March 19 is 68 pips, which is classified as "moderate." We expect the pair to move between the levels of 1.0868 and 1.1004 on Wednesday. The long-term regression channel has turned upward, but the long-term downtrend remains in place, as seen on higher timeframes. The CCI indicator has entered the oversold area, signaling a new wave of an upward correction that barely resembles a correction.

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

Trading Recommendations:

The EUR/USD pair has exited its sideways channel and continues to rise. In recent months, we have consistently stated that we expect the euro to decline in the medium term, and at this point, nothing has changed. Aside from Donald Trump, the dollar still has no fundamental reasons for a medium-term decline. Short positions remain far more attractive, with targets at 1.0315 and 1.0254. However, predicting when this seemingly illogical growth will end is extremely difficult. If you trade purely based on technical analysis, long positions can be considered if the price is above the moving average, with targets at 1.0986 and 1.1004.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.