- Trading plan

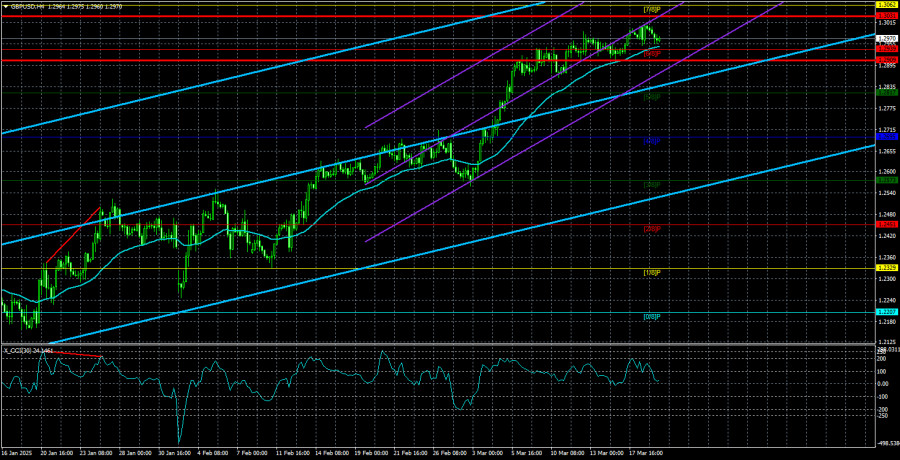

Trading Recommendations and Analysis for GBP/USD on March 20: Bank of England Meeting Ahead

The GBP/USD currency pair continued to trade within the same range on Wednesday. Despite the Fed meeting, Jerome Powell's speech, and the updated dot-plot, the market saw no significant movementsAuthor: Paolo Greco

06:55 2025-03-20 UTC+2

0

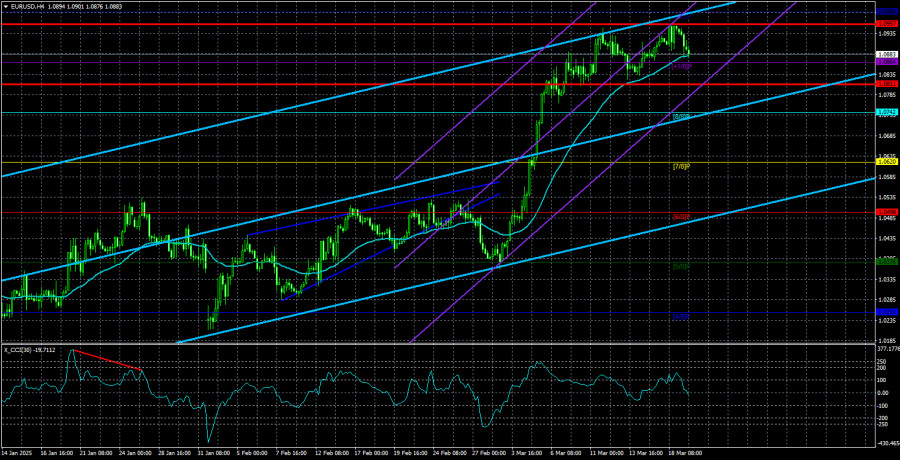

The EUR/USD currency pair traded on Wednesday the same way it had for the last two weeks. The Fed meeting had virtually no impact on market sentiment, although thereAuthor: Paolo Greco

06:54 2025-03-20 UTC+2

3

Yesterday, the pound sterling closed at the opening level, targeting 1.3001. This allowed the price to start today with a quiet upward movement above this level. The Marlin oscillator successfullyAuthor: Laurie Bailey

04:37 2025-03-20 UTC+2

18

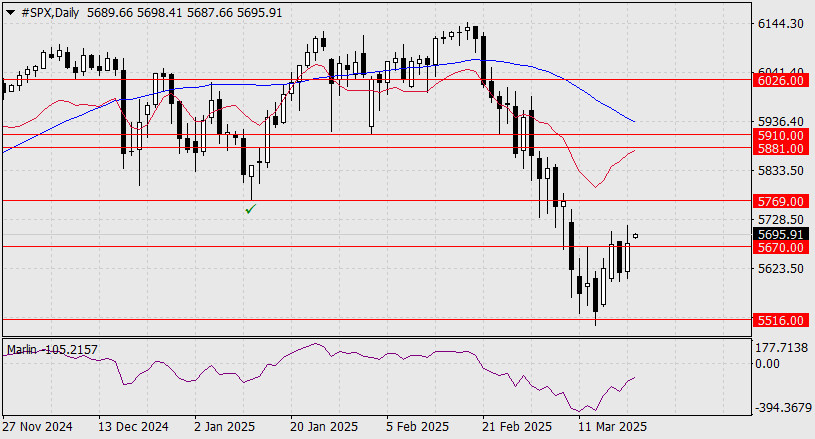

- The Federal Reserve meeting has concluded, and our expectation that economic risks would be highlighted was correct. Both the accompanying statement and Powell's speech emphasized these concerns. The central bank

Author: Laurie Bailey

04:37 2025-03-20 UTC+2

27

Yesterday's Bank of Japan and Federal Reserve meetings were uneventful, but they did not provide any reasons for the yen to weaken against the dollar. Instead, the yen's strengthening trendAuthor: Laurie Bailey

04:37 2025-03-20 UTC+2

20

The S&P 500 experienced a positive trading session yesterday and has started today on a strong note. However, the entire rally since March 14 still appears to be a correctionAuthor: Laurie Bailey

04:37 2025-03-20 UTC+2

10

- Fundamental analysis

GBP/USD Pair Overview – March 20: Bank of England Vote May Cool Bullish Sentiment

The GBP/USD currency pair traded very calmly on Wednesday, considering the evening movements. As a reminder, we are not analyzing the results of the Federal Reserve meetingAuthor: Paolo Greco

03:18 2025-03-20 UTC+2

23

On Wednesday, the EUR/USD currency pair experienced a slight pullback but failed to consolidate below the moving average line. As per tradition, we will not analyze the outcomeAuthor: Paolo Greco

03:18 2025-03-20 UTC+2

21

Fundamental analysisEUR/JPY: Mixed Outcomes of the Bank of Japan's March Meeting and Germany's "Debt Brake" Reform

The Bank of Japan has concluded its March policy meeting, delivering the most anticipated baseline scenario—keeping all monetary policy parameters unchanged. Market participants closely followed the statements of BOJ GovernorAuthor: Irina Manzenko

00:43 2025-03-20 UTC+2

18