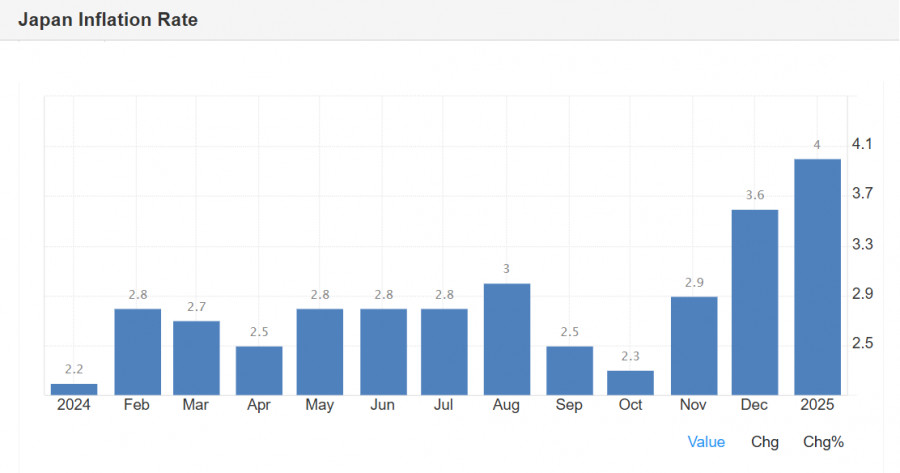

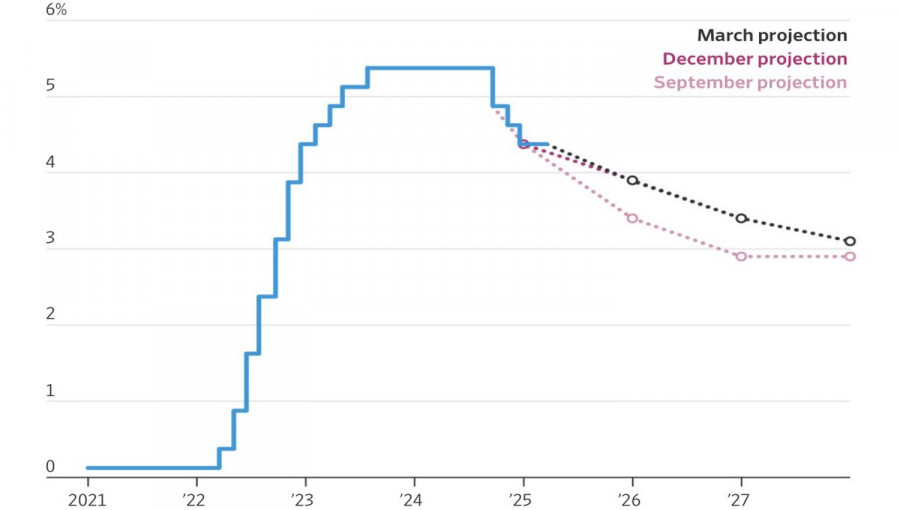

- The Bank of Japan (BoJ) kept interest rates unchanged on Wednesday, and the market reacted neutrally, as this outcome was widely expected. BoJ Governor Kazuo Ueda stated that the risk

Author: Kuvat Raharjo

00:46 2025-03-21 UTC+2

12

Markets shoot first and ask questions later. Upon hearing Jerome Powell's assurance that the Federal Reserve had everything under control and that there would be no recession, U.S. stock indicesAuthor: Marek Petkovich

00:45 2025-03-21 UTC+2

10

The wave structure on the 4-hour chart for EUR/USD is at risk of transforming into a more complex formation. A new downtrend structure started forming on September 25, which tookAuthor: Chin Zhao

19:37 2025-03-20 UTC+2

29

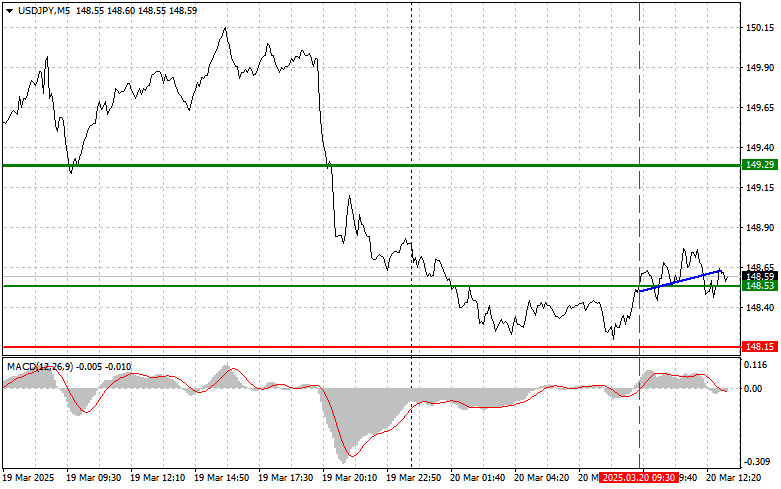

- Trade Analysis and Recommendations for the Japanese Yen The 148.53 price test occurred when the MACD indicator was just starting to move upward from the zero mark, confirming a correct

Author: Jakub Novak

19:34 2025-03-20 UTC+2

62

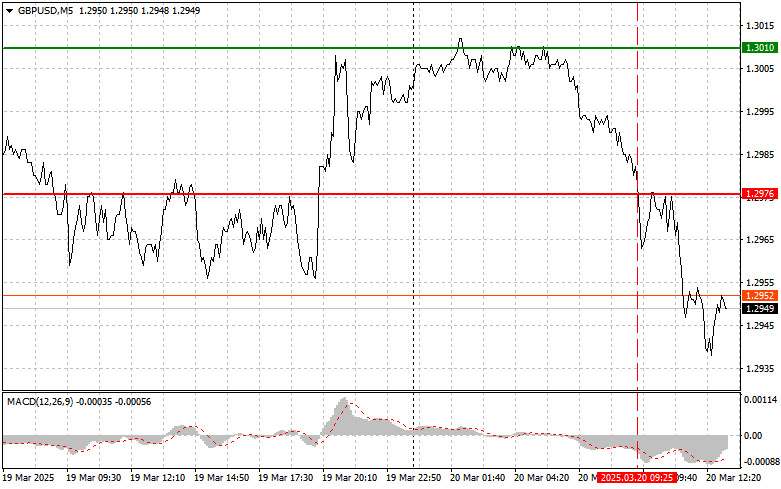

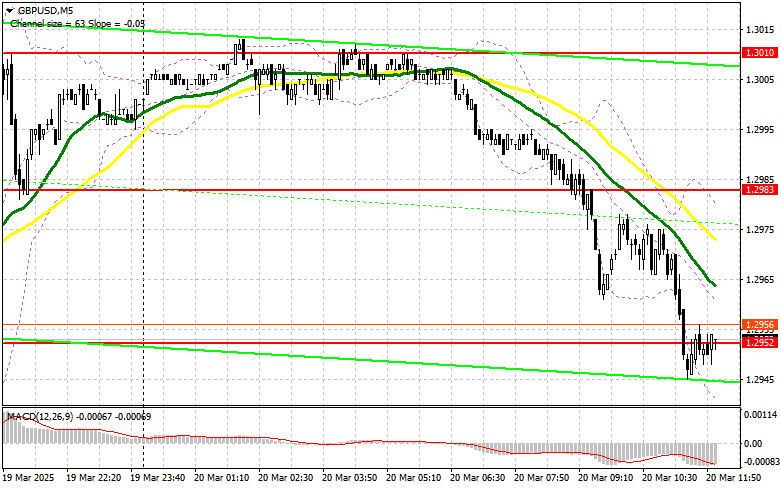

Trade Analysis and Recommendations for the British Pound The 1.2976 price test occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potentialAuthor: Jakub Novak

19:32 2025-03-20 UTC+2

57

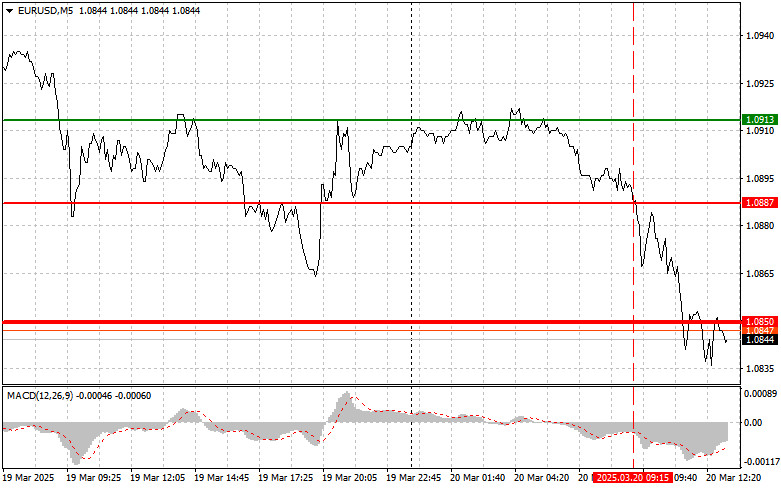

Trade Analysis and Recommendations for the Euro The 1.0887 price test coincided with a moment when the MACD indicator had already moved significantly below the zero mark, which limitedAuthor: Jakub Novak

19:29 2025-03-20 UTC+2

50

- In my morning forecast, I focused on the 1.2983 level and planned to make trading decisions based on it. Looking at the 5-minute chart, we can analyze what happened

Author: Miroslaw Bawulski

19:25 2025-03-20 UTC+2

22

In my morning forecast, I focused on the 1.0888 level and planned to use it as a decision point for entering the market. Let's look at the 5-minute chartAuthor: Miroslaw Bawulski

19:19 2025-03-20 UTC+2

48

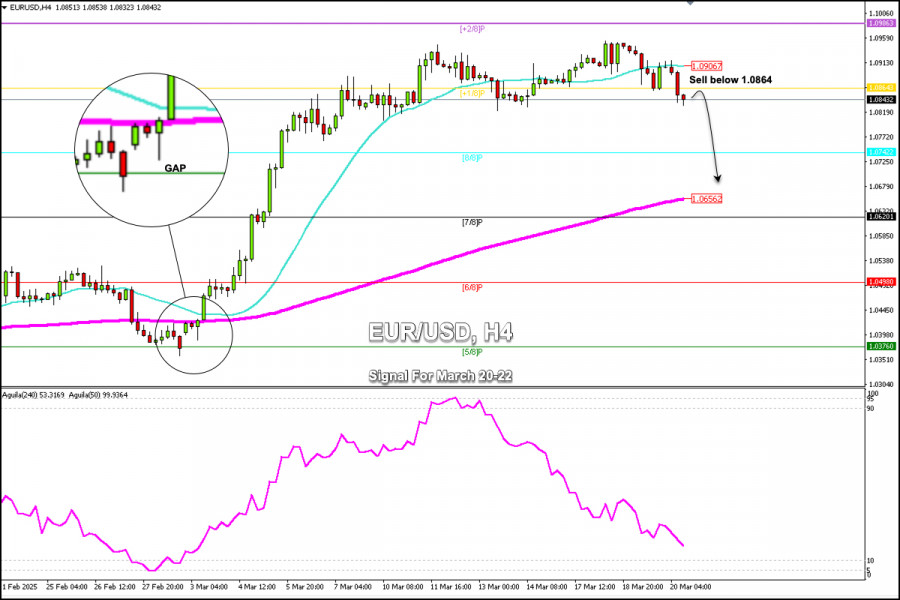

Technical analysisTrading Signals for EUR/USD for March 20-22, 2025: sell below 1.0864 (+1/8 Murray - 21 SMA)

At the same time, fears about economic growth in the Eurozone are also playing a role against the euro, as this could force the ECB to further reduce interest ratesAuthor: Dimitrios Zappas

17:43 2025-03-20 UTC+2

25