- US stock market in limbo despite positive economic data such as unexpected growth in existing home sales On Thursday, US benchmark stock indices closed in the red: the Dow Jones

Author: Natalia Andreeva

15:48 2025-03-21 UTC+2

33

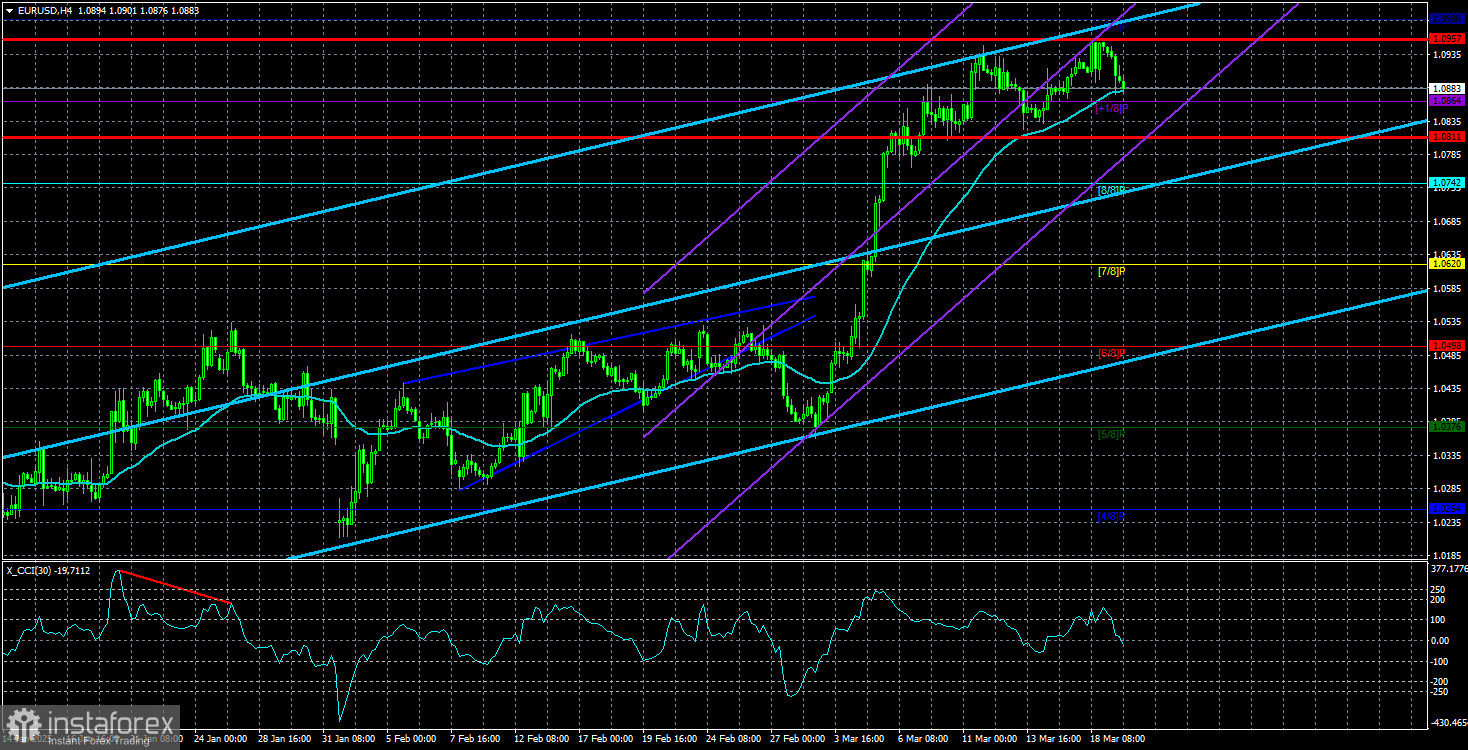

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument leftAuthor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

47

Some analysts believe that the Federal Reserve's current monetary policy—particularly its decision to hold interest rates steady and slow down quantitative tightening (QT)—could provide meaningful support for Bitcoin. AccordingAuthor: Larisa Kolesnikova

14:11 2025-03-21 UTC+2

4

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychologicalAuthor: Dimitrios Zappas

14:04 2025-03-21 UTC+2

37

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuthor: Sebastian Seliga

13:15 2025-03-21 UTC+2

21

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuthor: Sebastian Seliga

13:14 2025-03-21 UTC+2

16

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty

Author: Irina Yanina

12:07 2025-03-21 UTC+2

53

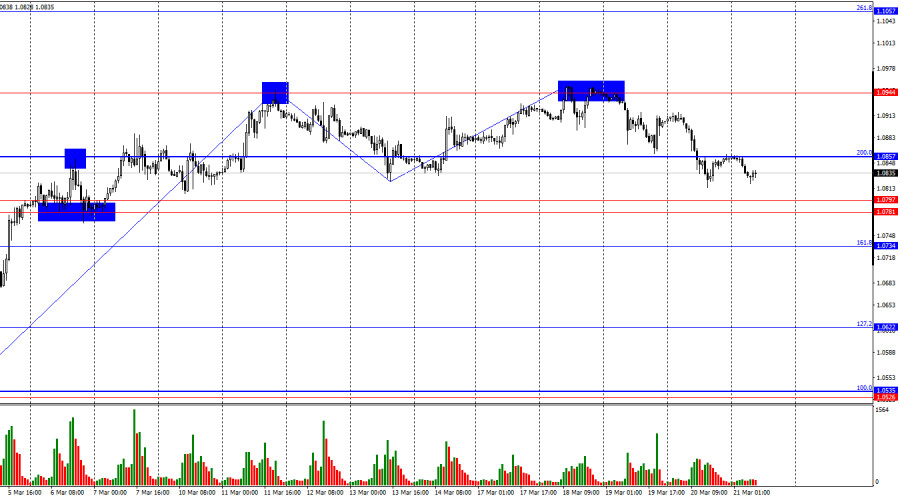

On Thursday, the EUR/USD pair continued its decline and closed below the 200.0% Fibonacci retracement level at 1.0857. This suggests that the downward move may continue toward the support zoneAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

50

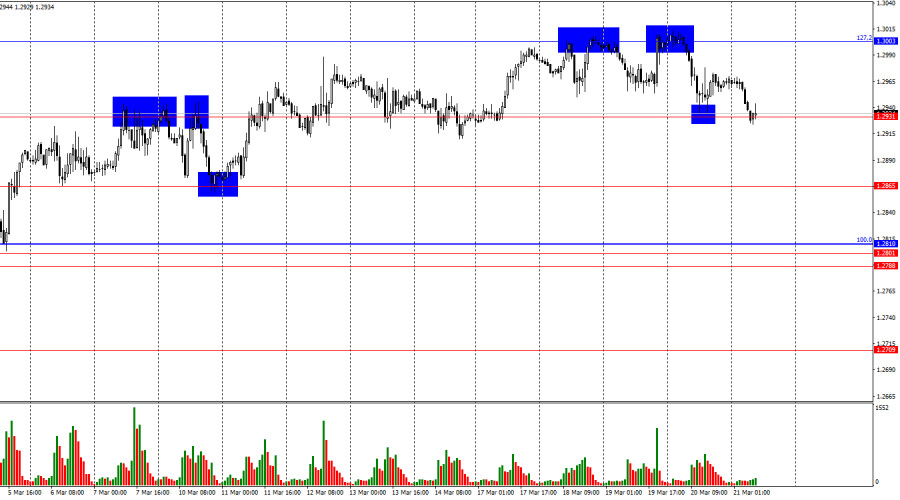

On the hourly chart, the GBP/USD pair on Thursday dropped to the 1.2931 level, rebounded from it, saw a slight rise, and returned to 1.2931 again on Friday morningAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

46