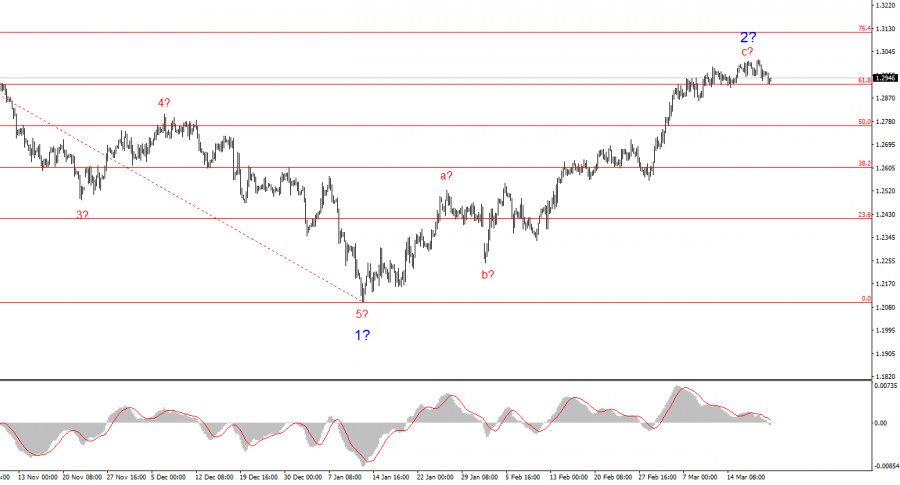

Analysis of Trades and Trading Tips for the Euro

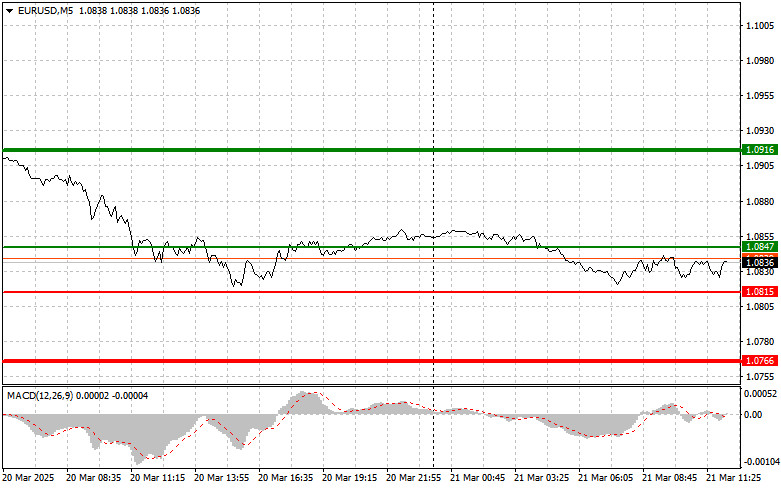

The price test at 1.0911 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.0911, with the MACD in the overbought zone, led to the execution of Scenario No. 2 for selling, resulting in a decline of more than 30 pips.

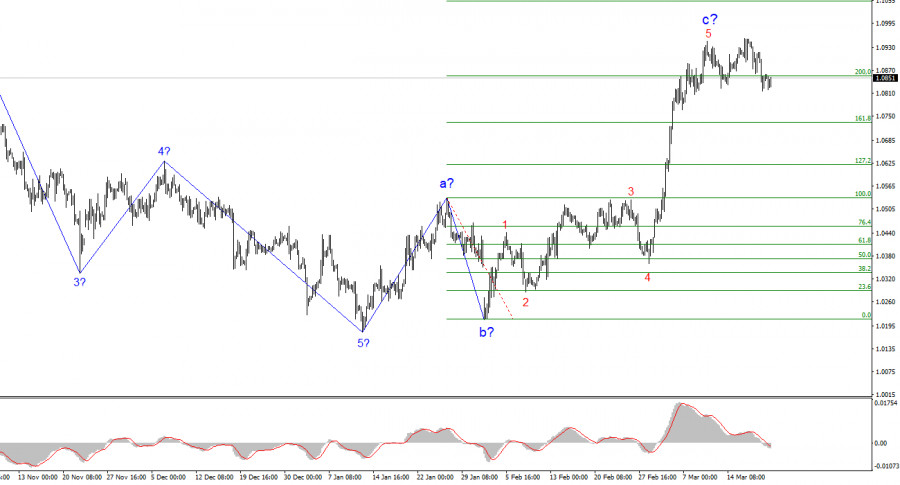

Amid growing concerns about a U.S. economic slowdown and persistently high inflation, Federal Reserve officials decided to keep the key interest rate unchanged yesterday. However, this decision did not support the U.S. dollar, as under current conditions, high rates seem to exacerbate the dollar's problems and economic difficulties rather than solve them. The Federal Open Market Committee confirmed that the target range for the key interest rate would remain at 4.25% - 4.5% for the second consecutive meeting. This decision highlights the central bank's complex challenge—balancing the need to contain inflation while preventing further economic slowdown.

Despite this, the euro still has the potential for further growth. However, this scenario will depend on positive data from Germany's Producer Price Index and European Central Bank President Christine Lagarde's hawkish rhetoric. Investors closely analyze Germany's economic indicators, which serve as a key barometer of the eurozone's economic health. Lagarde's statements will also be crucial. If she hints at keeping interest rates unchanged for the foreseeable future, the euro may continue to rise—otherwise, the euro risks facing a downward correction.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario No. 1: Today, I plan to buy the euro when the price reaches around 1.0913, with a target of 1.0952. At 1.0952, I intend to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. The euro's growth in the first half of the day can be expected to continue the upward trend following strong eurozone data. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of 1.0887 while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.0913 and 1.0952 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after it reaches 1.0887, with a target of 1.0850. At this level, I will exit the market and buy in the opposite direction, expecting a movement of 20-25 pips in the reverse direction. Pressure on the pair could return today if Lagarde adopts a dovish stance. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of 1.0913 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A decline toward 1.0887 and 1.0850 can be expected.

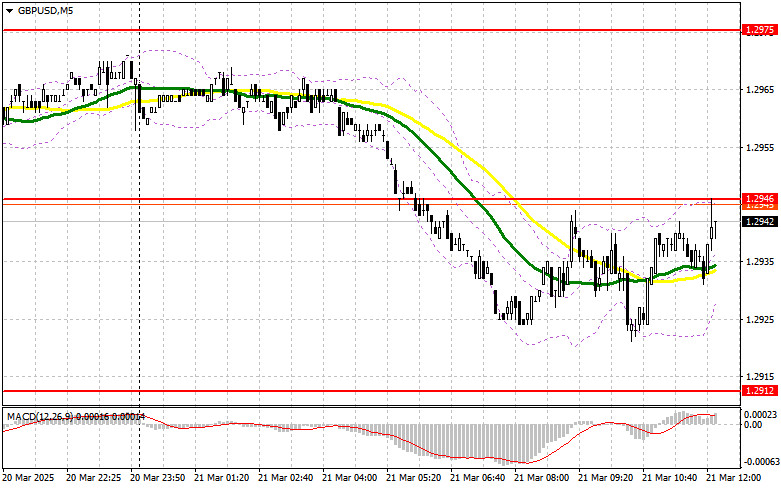

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.