- Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

6

The wave of optimism that swept through US stock markets following Donald Trump's re-election turned out to be short-lived. Euphoria quickly gave way to a deep correction amid escalating tradeAuthor: Anna Zotova

14:55 2025-03-24 UTC+2

3

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the priceAuthor: Stefan Doll

14:24 2025-03-24 UTC+2

36

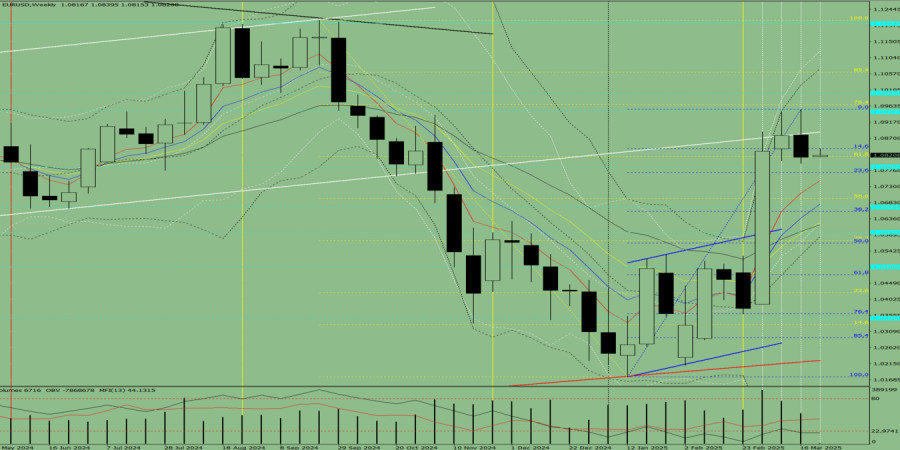

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815

Author: Stefan Doll

14:22 2025-03-24 UTC+2

5

At the start of the week, following the release of a weaker Japanese PMI, the yen came under pressure. This, combined with news of narrower and less aggressive retaliatory tariffsAuthor: Irina Yanina

14:20 2025-03-24 UTC+2

3

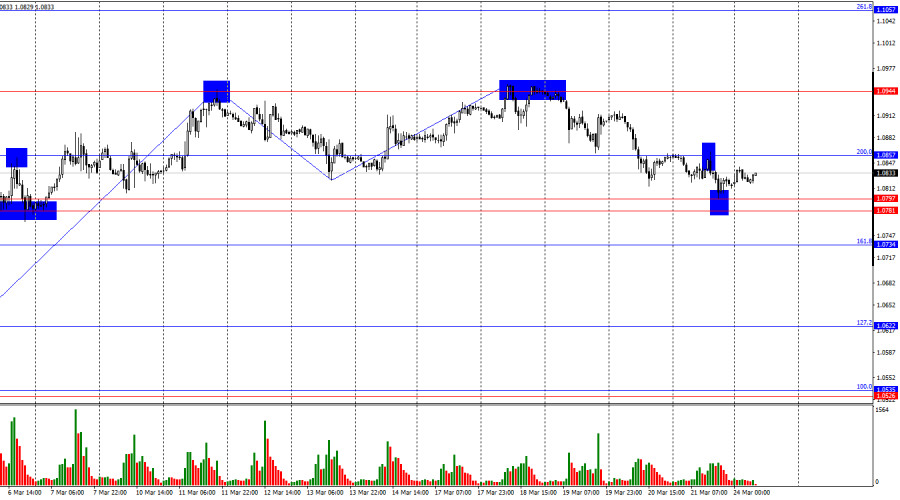

On Friday, the EUR/USD pair rebounded from the 200.0% correction level at 1.0857 and fell to the support zone of 1.0781–1.0797. A rebound from this zone worked in favorAuthor: Samir Klishi

13:55 2025-03-24 UTC+2

9

- The Dow Jones Transportation Average has dropped more than 17% from its November peak. Meanwhile, European equities are climbing ahead of upcoming business activity surveys. Next week brings key reports

Author:

13:39 2025-03-24 UTC+2

1

In the world of finance, every day is a battle for market dominance. Just as traders celebrate rising prices, the tides can turn in an instant. On Friday, naturalAuthor: Natalia Andreeva

13:39 2025-03-24 UTC+2

2

Bitcoin and Ethereum are back in recovery mode after traders took a pause over the weekend. While the latest movement hints at a return of bullish sentiment, it is stillAuthor: Jakub Novak

13:27 2025-03-24 UTC+2

4