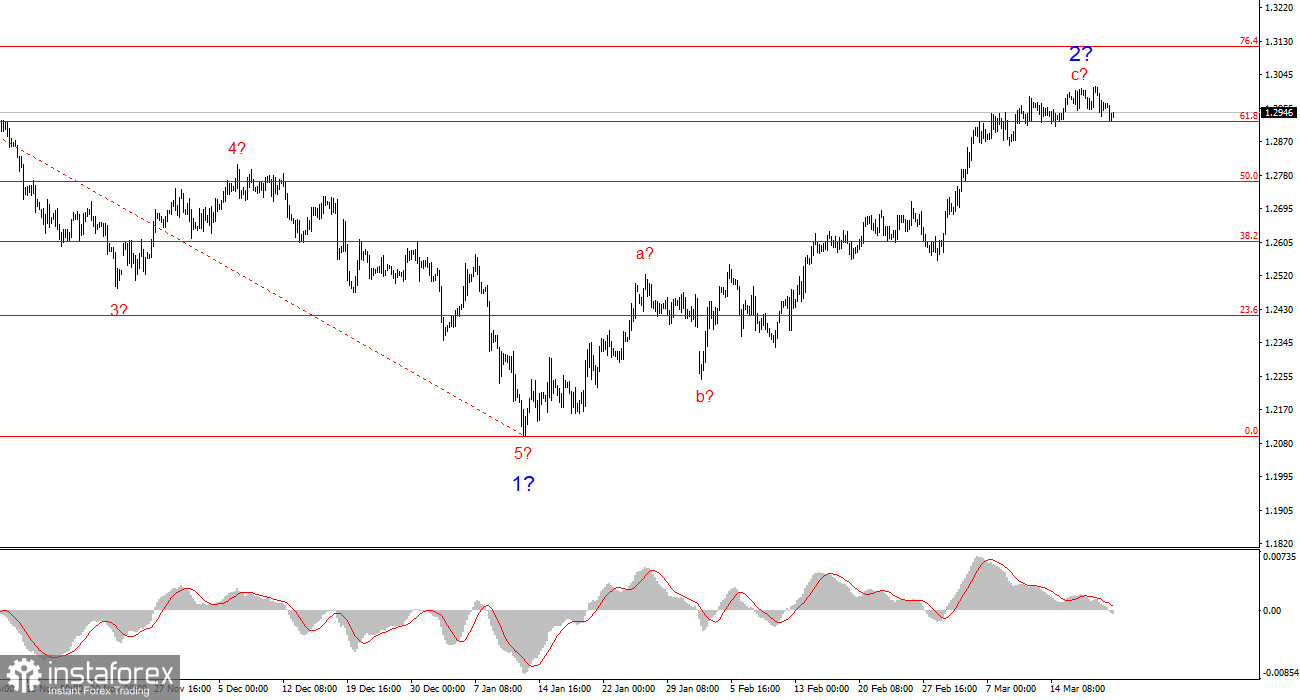

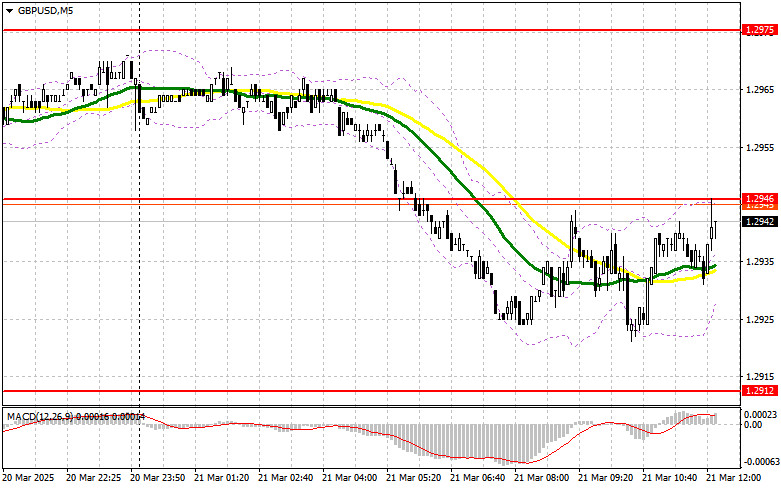

- The wave structure for GBP/USD remains somewhat ambiguous, but overall manageable. At present, there's still a high probability of a long-term downward trend developing. Wave 5 has taken

Author: Chin Zhao

19:42 2025-03-21 UTC+2

127

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respondAuthor: Chin Zhao

19:39 2025-03-21 UTC+2

107

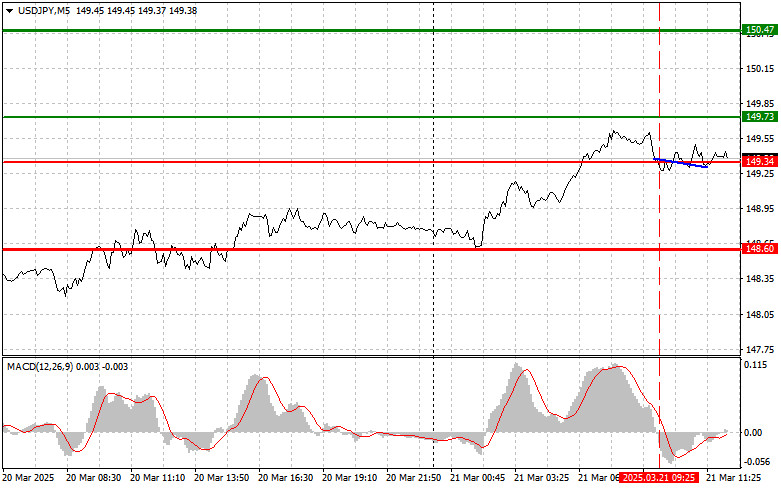

Trade Review and Tips for Trading the Japanese Yen The test of the 149.34 level occurred when the MACD indicator had just started moving downward from the zero line, confirmingAuthor: Jakub Novak

19:30 2025-03-21 UTC+2

103

- Trade Review and Tips for Trading the British Pound No tests of the key levels I indicated occurred in the first half of the day. The reason was low market

Author: Jakub Novak

19:17 2025-03-21 UTC+2

93

Trade Review and Tips for Trading the Euro There were no tests of the key levels I identified earlier today. The reason was low market volatility due to the absenceAuthor: Jakub Novak

19:09 2025-03-21 UTC+2

96

In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that point. Let's take a look at the 5-minute chart to see whatAuthor: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

86

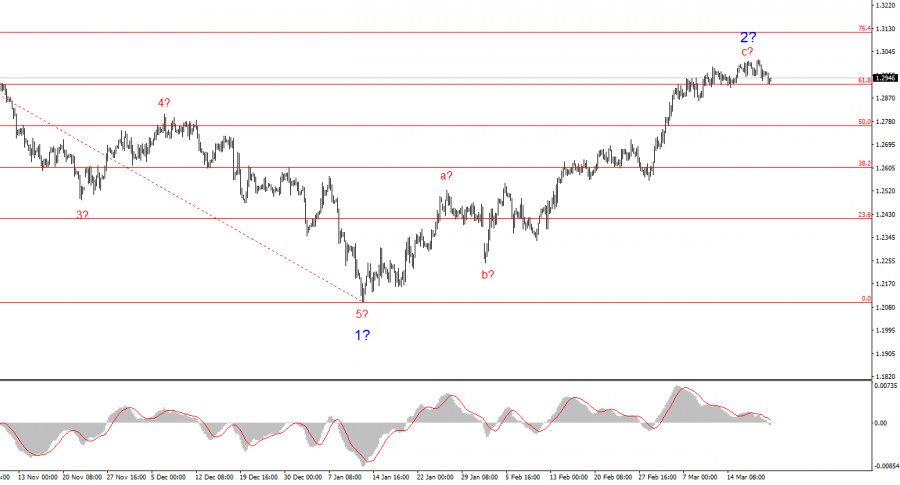

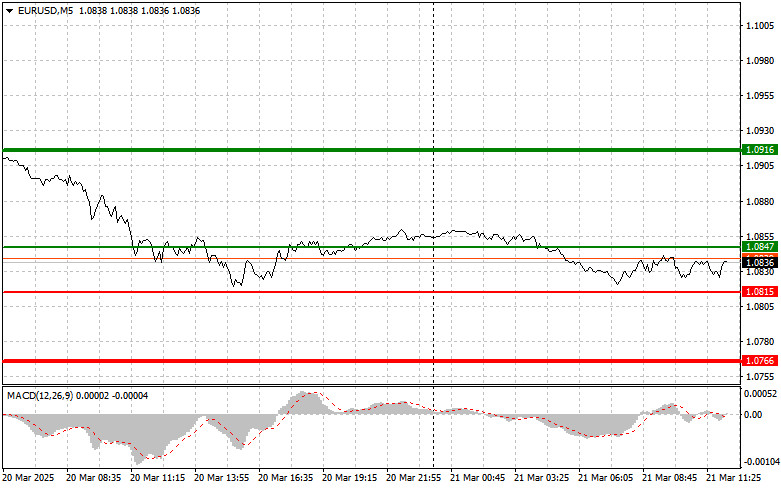

- In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it. Let's take a look at the 5-minute chart and see what happened

Author: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

88

US stock market in limbo despite positive economic data such as unexpected growth in existing home sales On Thursday, US benchmark stock indices closed in the red: the Dow JonesAuthor: Natalia Andreeva

15:48 2025-03-21 UTC+2

104

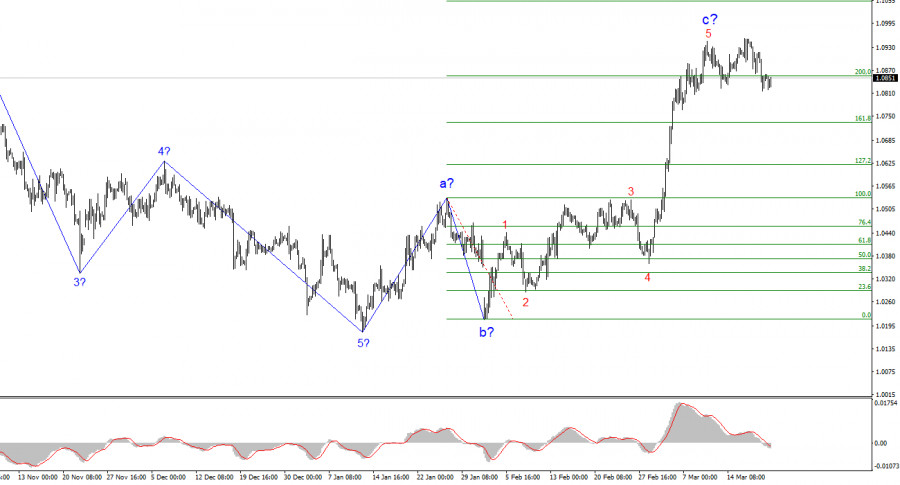

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument leftAuthor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

122