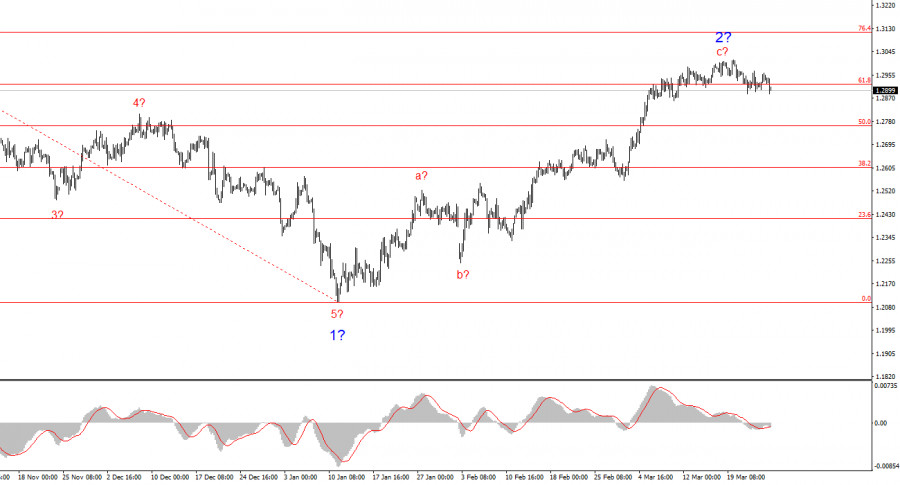

- The wave pattern for GBP/USD remains somewhat ambiguous but overall workable. There is still a high probability of a long-term bearish trend forming. Wave 5 has taken a clear shape

Author: Chin Zhao

18:37 2025-03-26 UTC+2

41

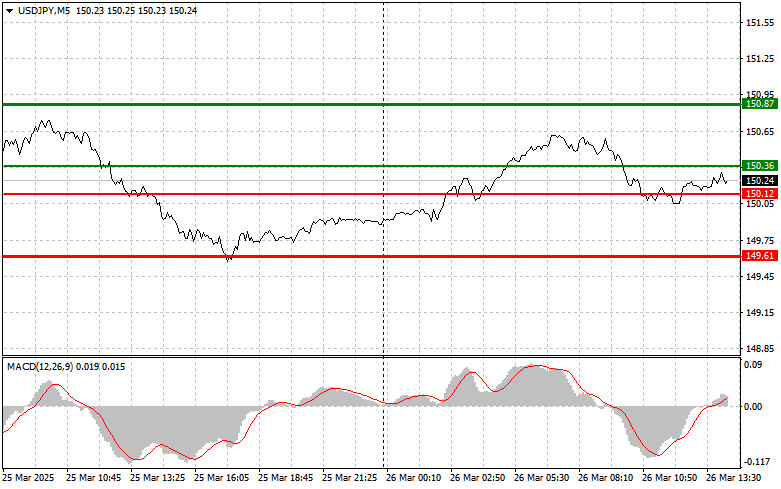

Trade Review and Trading Advice for the Japanese Yen There were no tests of the designated levels during the first half of the day. During the U.S. session, a seriesAuthor: Jakub Novak

18:35 2025-03-26 UTC+2

46

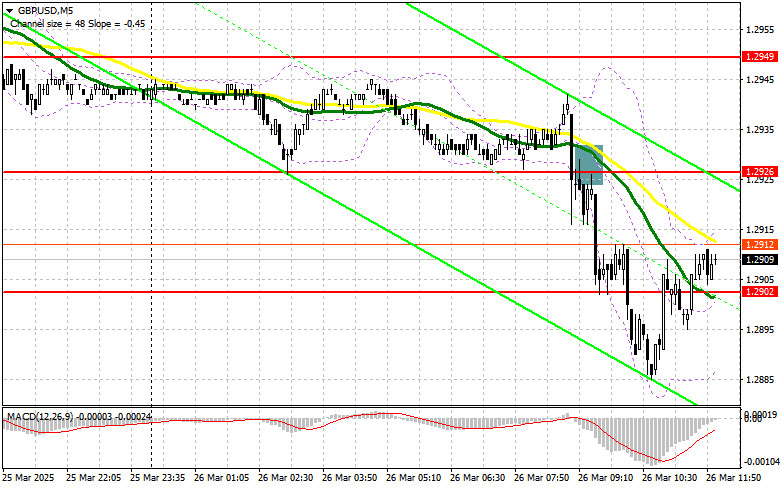

Trade Review and Guidance on Trading the British Pound The test of the 1.2927 price level occurred just as the MACD indicator began moving downward from the zero line, confirmingAuthor: Jakub Novak

18:29 2025-03-26 UTC+2

42

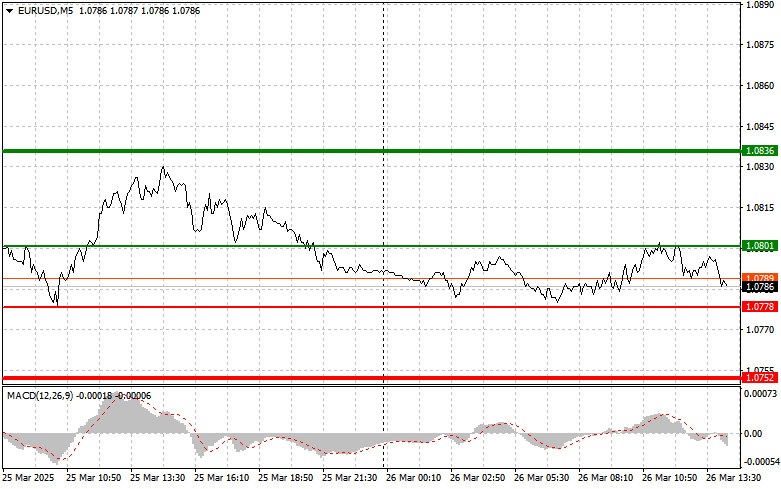

- Trade Analysis and Guidance on Trading the Euro There were no tests of the levels I indicated during the first half of the day. A lack of statistical data from

Author: Jakub Novak

18:27 2025-03-26 UTC+2

37

Trading planGBP/USD: Trading Plan for the U.S. Session on March 26th (Review of the Morning Trades)

In my morning forecast, I highlighted the 1.2926 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The breakoutAuthor: Miroslaw Bawulski

18:24 2025-03-26 UTC+2

36

Trading planEUR/USD: Trading Plan for the U.S. Session on March 26th (Review of the Morning Trades)

In my morning forecast, I highlighted the 1.0780 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. AlthoughAuthor: Miroslaw Bawulski

18:21 2025-03-26 UTC+2

8

- Technical analysis

Trading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it willAuthor: Dimitrios Zappas

16:13 2025-03-26 UTC+2

36

Technical analysisTrading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

41

United States President Donald Trump once again stirred confusion on Tuesday by announcing plans to introduce a series of exemptions to his sweeping tariff proposal. The announcement servedAuthor: Jakub Novak

12:36 2025-03-26 UTC+2

21