The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

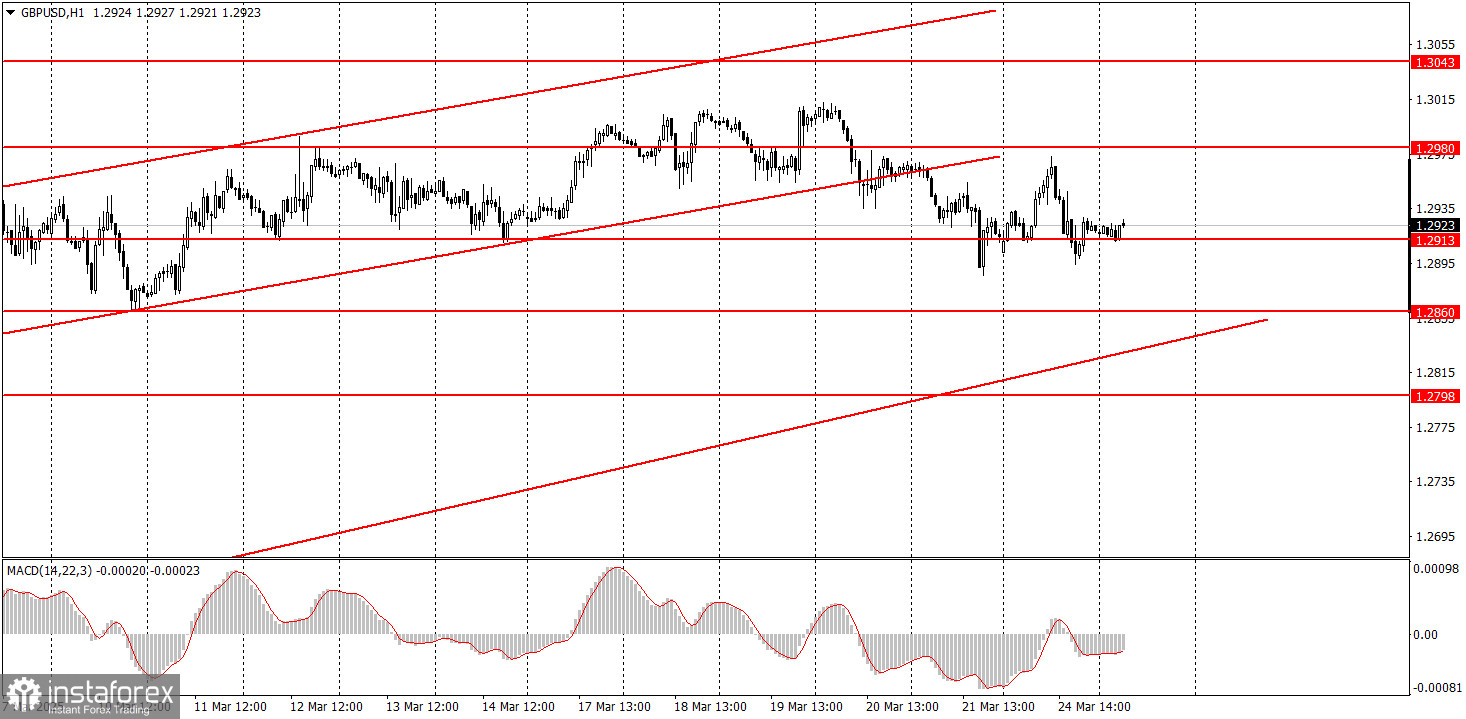

The GBP/USD pair traded both up and down on Monday. The uptrend remains intact thanks to the ascending trendline, which has been relevant for over a month—quite a rare occurrence for the hourly timeframe. The price has exited the ascending channel, so a correction toward the trendline is possible. The euro has also entered a corrective phase, so we believe the dollar will strengthen this week. Monday's macroeconomic backdrop was unusually contradictory, as the UK and U.S. business activity indices delivered conflicting signals in terms of character and the relationship between forecasts and actual results. As a result, the U.S. dollar barely gained by the end of the day. The British pound continues to demonstrate impressive resilience against the dollar, largely thanks to the Bank of England, which adopted a more hawkish stance on monetary policy during its latest meeting. Nevertheless, the pair cannot continue rising indefinitely without corrections.

On the 5-minute timeframe on Monday, several trading signals were formed. Early in the European session, the price bounced off the 1.2913 level and climbed about 50 pips. Unfortunately, it missed the nearest target level by just seven pips, so the trade couldn't be closed by Take Profit. Then, there was another bounce from 1.2913, followed by a breakout of this level. Technically, all signals were false since the target levels weren't reached. However, no losses were possible, as the price moved at least 20 pips in the correct direction each time. It was best to ignore the third signal.

The GBP/USD pair should have already begun a downtrend on the hourly timeframe, but Trump is doing everything to prevent that. In the medium term, we still expect the pound to decline toward 1.1800, but it's unclear how much longer the dollar's "Trump-induced" plunge will last. Once that move ends, the technical picture on all timeframes may change drastically, but long-term trends still point south. The pound has risen for a reason, but again, far too strongly and irrationally.

On Tuesday, GBP/USD may continue declining, as the technical setup of the hourly timeframe supports this view. The pound is once again overbought and unjustifiably expensive.

On the 5-minute chart, the following levels are relevant for trading: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107. No important events or reports are scheduled in the UK on Tuesday, and the only release in the U.S. is the new home sales report. Therefore, macroeconomic influence on the pair's movement will be minimal today.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

InstaSpot video

analytics

Daily analytical reviews

InstaSpot

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.