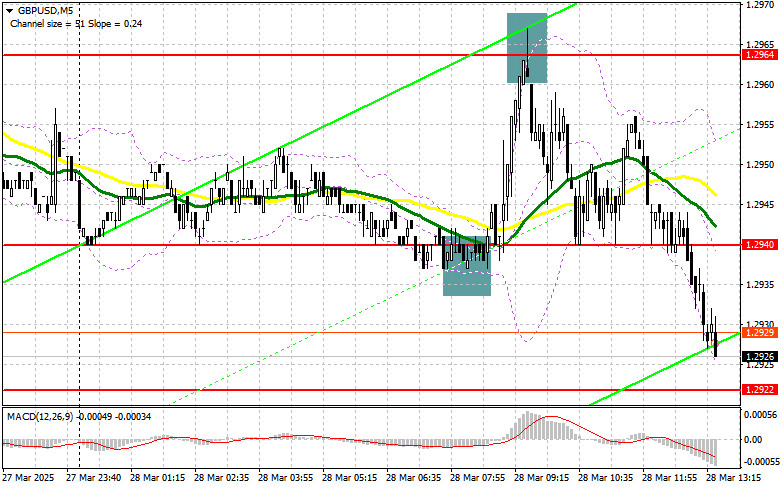

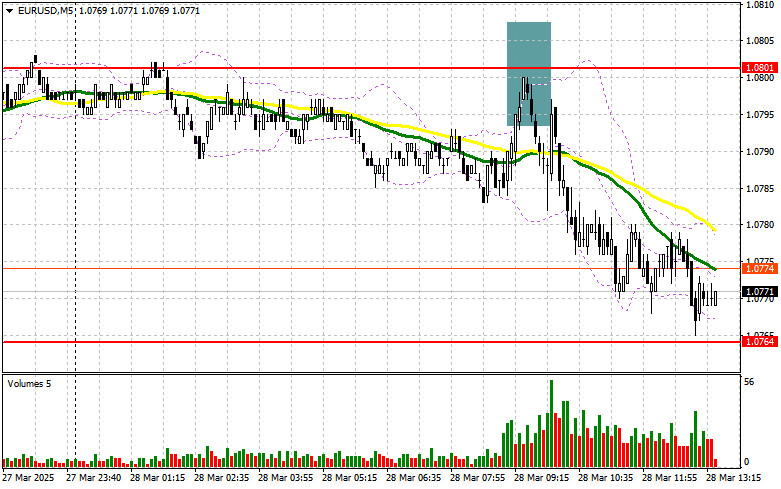

EUR/USD 5-Minute Analysis

The EUR/USD currency pair traded with minimal losses throughout Wednesday, while the overall trend on the hourly time frame remains bearish following the price's exit from the ascending channel. The euro's decline is weak, with frequent pullbacks, but at the same time, relatively stable. Overall, we believe the euro's decline is the most logical development right now, as the euro has grown too strongly in recent weeks, which does not align with the macroeconomic and fundamental backdrop. As a reminder, the market has been responding solely to the "Trump factor" in recent weeks, while all other releases and events are being ignored. The U.S. dollar has decreased significantly, and this decline is unwarranted.

Yesterday was another great example of how the market reacts to macroeconomic data. The only report of any significance for the day—durable goods orders—essentially triggered no reaction. After the report was released, the dollar fell by 22 pips, and overall volatility remained very low throughout the day. So, the market showed no response to a reasonably important release. Orders rose by 0.9% against a forecast of -1.0%. Therefore, the dollar had every reason to gain at least 50 pips. But that didn't happen, which by now is no longer surprising. We are seeing a purely technical, weak correction.

Not a single trading signal was generated yesterday in the 5-minute time frame. The price didn't approach any levels or Ichimoku lines, so there were no valid entry points into the market.

COT Report

The latest Commitment of Traders (COT) report is dated March 18. As shown in the illustration, the net position of non-commercial traders remained bullish for a long time. The bears only recently gained a slight advantage, but now the bulls are back in control. Bearish positioning has quickly eroded since Trump assumed office and the dollar collapsed. We can't definitively say the dollar's decline will continue, and COT data reflects the sentiment of large players, which can shift rapidly in current conditions.

We still don't see any fundamental factors supporting euro strength, but there is now one powerful reason for dollar weakness. The pair may continue to correct for several weeks or months, but the 16-year downtrend won't reverse quickly.

Currently, the red and blue lines have crossed again, indicating a bullish trend. In the most recent reporting week, the number of long positions in the non-commercial group increased by 300 contracts, while the number of short positions fell by 46,000 contracts. As a result, the net position rose by 45,700 contracts.

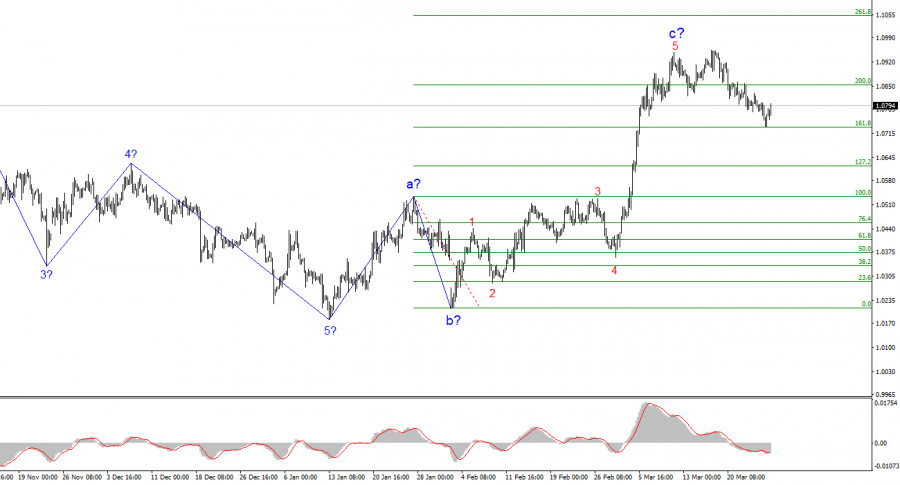

EUR/USD 1-Hour Analysis

On the hourly time frame, the EUR/USD pair remains inclined toward a downtrend, which we fully support. However, the decline is very weak and corrective. We believe the drop will resume in the medium term due to the divergence in monetary policy between the ECB and the Fed. However, it's unclear how long the market will continue to trade based solely on the "Trump factor." Traders ignore many reports and headlines; the dollar is being sold off at every opportunity and can't even rise when it has good reasons to.

Trading levels for March 27 are: 1.0340–1.0366, 1.0461, 1.0524, 1.0585, 1.0658–1.0669, 1.0757, 1.0797, 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, along with the Senkou Span B (1.0880) and Kijun-sen (1.0815) lines. The Ichimoku indicator lines may shift during the day, which should be considered when identifying trading signals. Don't forget to set your Stop Loss to breakeven if the price moves 15 pips in the right direction—this will protect you from potential losses in case of a false signal.

On Thursday, the U.S. will release reports on GDP and jobless claims. The latter is a non-event, while the former will be the third (final) estimate. If the GDP figure is revised downward, the dollar may easily weaken again. However, it's unlikely to rise even if the data is positive, as the market continues to ignore strong U.S. data and is waiting for next week when new tariffs from Donald Trump are expected to be announced. In the eurozone, ECB President Christine Lagarde is scheduled to give a speech, which is anticipated to be largely ceremonial.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.