- West Texas Intermediate (WTI) crude oil prices are attempting to attract buyers, but the market remains in a state of uncertainty. Concerns over President Trump's aggressive trade tariffs are putting

Author: Irina Yanina

12:39 2025-03-31 UTC+2

28

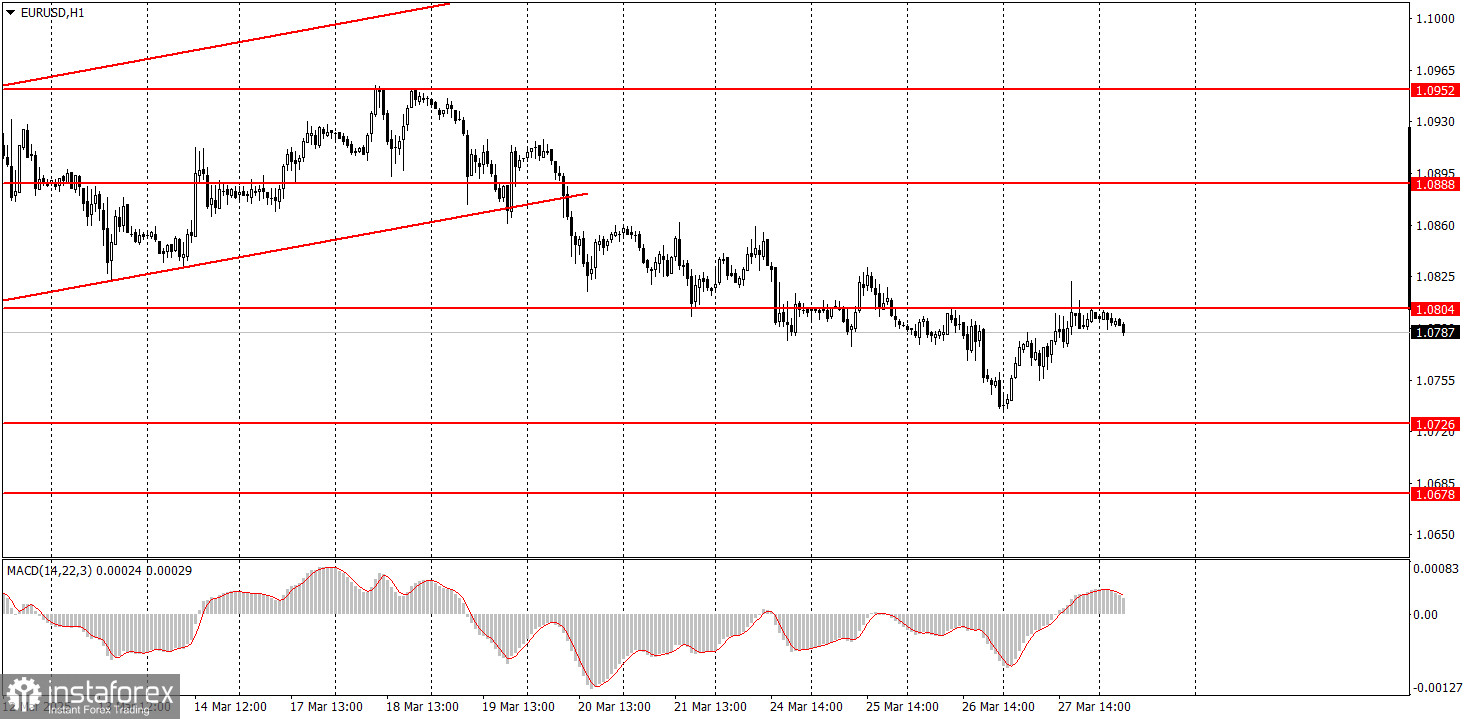

At the start of the new week during the Asian session, the EUR/USD pair attempted to attract buyers, but this was unsuccessful. The euro received support from easing concerns aboutAuthor: Irina Yanina

12:35 2025-03-31 UTC+2

12

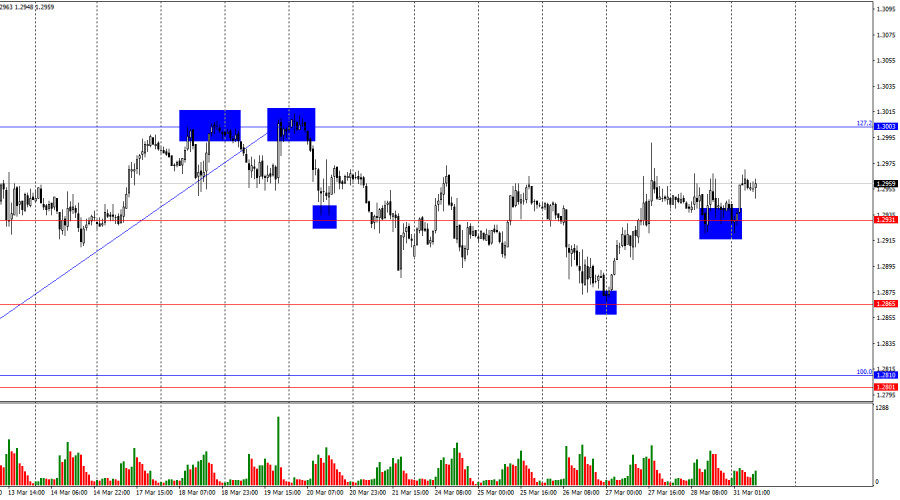

On the hourly chart, the GBP/USD pair traded sideways on Friday, but two rebounds from the 1.2931 level allow for some potential growth toward the 127.2% Fibonacci corrective levelAuthor: Samir Klishi

12:28 2025-03-31 UTC+2

10

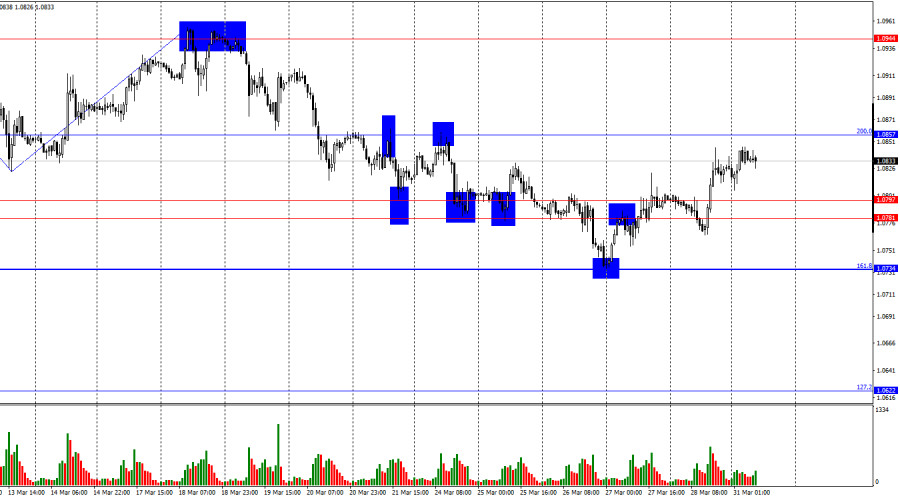

- On Friday, the EUR/USD pair consolidated above the 1.0781–1.0797 zone, allowing the upward movement to continue toward the 200.0% Fibonacci level at 1.0857. A rebound from this level would favor

Author: Samir Klishi

11:58 2025-03-31 UTC+2

15

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, and #Litecoin as of March 31

In the coming days, a flat phase in the movement of the British pound is expected to come to an end. In the second half of the week, a reversalAuthor: Isabel Clark

11:43 2025-03-31 UTC+2

9

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, and #Ripple – March 31

In the coming days, a completion of the downward movement in the euro exchange rate is likely, potentially reaching the lower boundary of the calculated support zone. A reversalAuthor: Isabel Clark

11:12 2025-03-31 UTC+2

10

- Bitcoin and Ethereum resumed their decline over the past weekend. There was no significant growth last week either, suggesting a continued correction in the crypto market. Ethereum was hit particularly

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

10

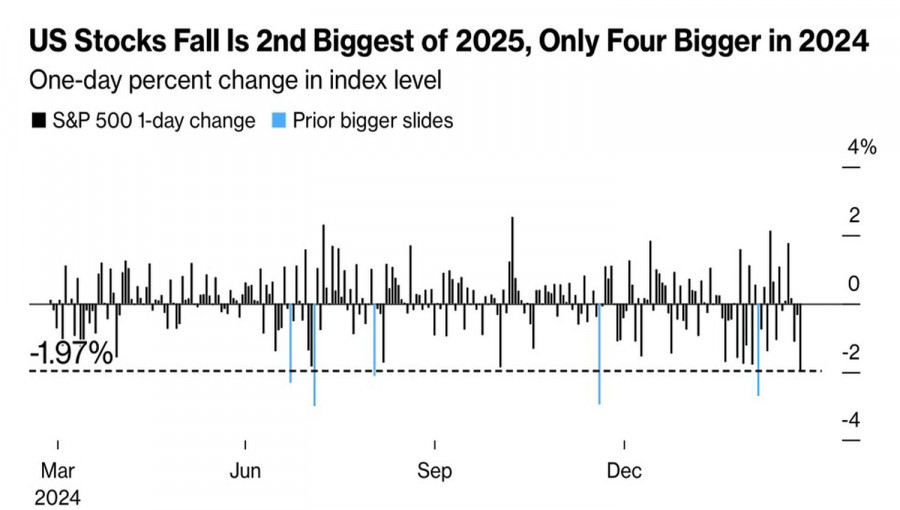

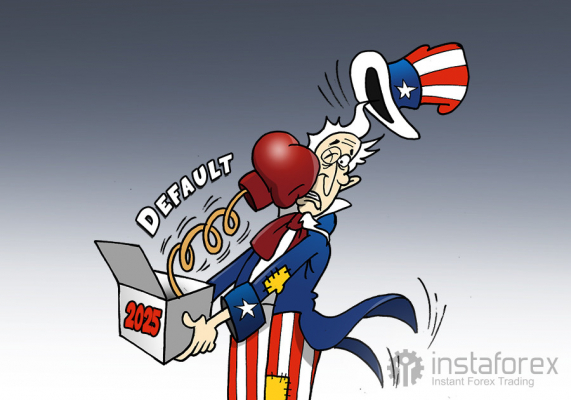

Rumors about mutual tariffs and another blow to consumer confidence triggered the second-worst sell-off of the S&P 500 this year. Investors are still holding piles of US stocksAuthor: Marek Petkovich

10:58 2025-03-31 UTC+2

7

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuthor: Sebastian Seliga

10:50 2025-03-31 UTC+2

15