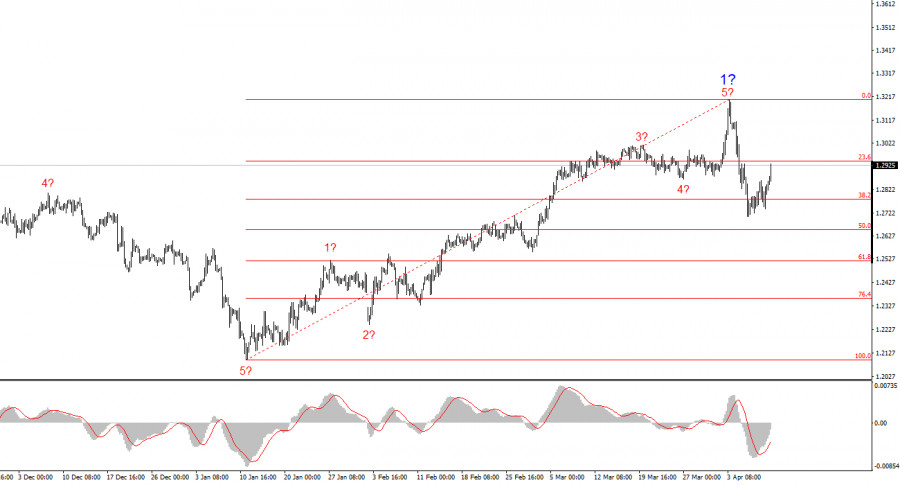

- The wave pattern on the 4-hour chart for the EUR/USD pair has shifted to a bullish structure. I believe there is no doubt that this transformation occurred solely

Author: Chin Zhao

20:24 2025-04-10 UTC+2

7

The wave structure for the GBP/USD pair has also shifted to a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to thatAuthor: Chin Zhao

20:21 2025-04-10 UTC+2

5

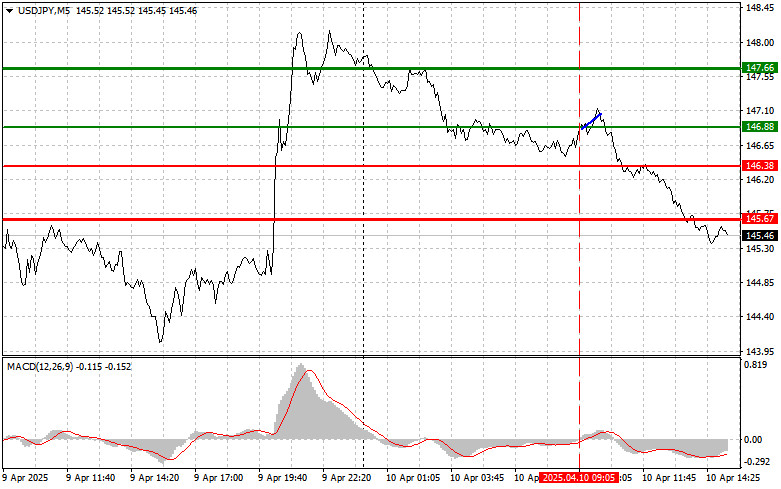

Trade Review and Tips for Trading the Japanese Yen The price test at 146.88 occurred when the MACD indicator had just started moving upward from the zero line, confirmingAuthor: Jakub Novak

20:19 2025-04-10 UTC+2

9

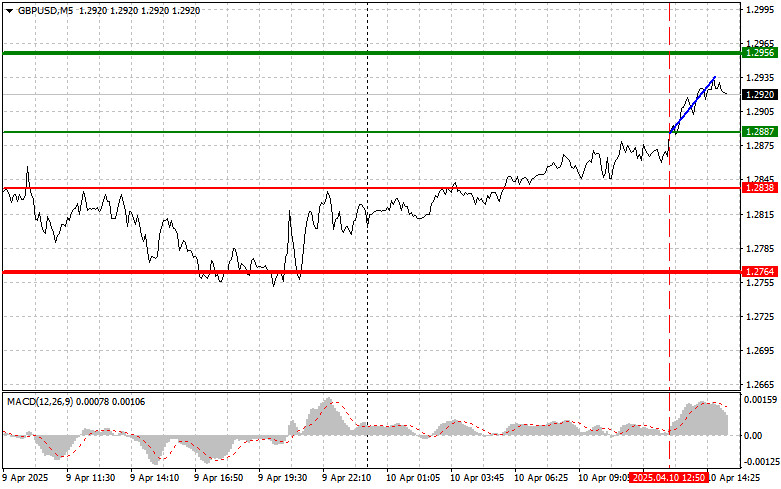

- Trade Review and Trading Tips for the British Pound The price test at 1.2887 occurred when the MACD indicator had just begun to move upward from the zero line, confirming

Author: Jakub Novak

20:16 2025-04-10 UTC+2

5

Trade Review and Tips for Trading the Euro The price test at 1.0974 occurred when the MACD indicator had just begun moving down from the zero line, confirming a validAuthor: Jakub Novak

20:13 2025-04-10 UTC+2

5

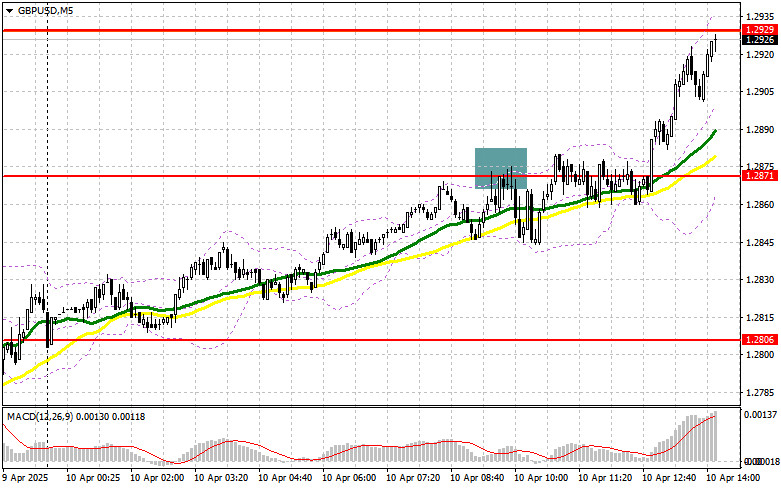

In my morning forecast, I highlighted the 1.2871 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happenedAuthor: Miroslaw Bawulski

20:11 2025-04-10 UTC+2

5

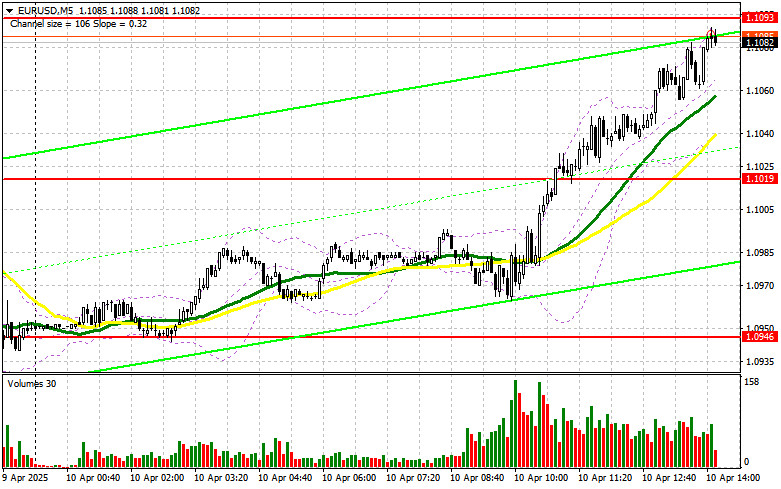

- In my morning forecast, I drew attention to the 1.1019 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart to understand what

Author: Miroslaw Bawulski

20:08 2025-04-10 UTC+2

5

Today, gold maintains a positive tone, trading above the $3100 level. Concerns about the escalation of the trade war between the U.S. and China, along with fears of a globalAuthor: Irina Yanina

20:05 2025-04-10 UTC+2

9

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a targetAuthor: Dimitrios Zappas

15:37 2025-04-10 UTC+2

15