Analysis of Friday's Trades

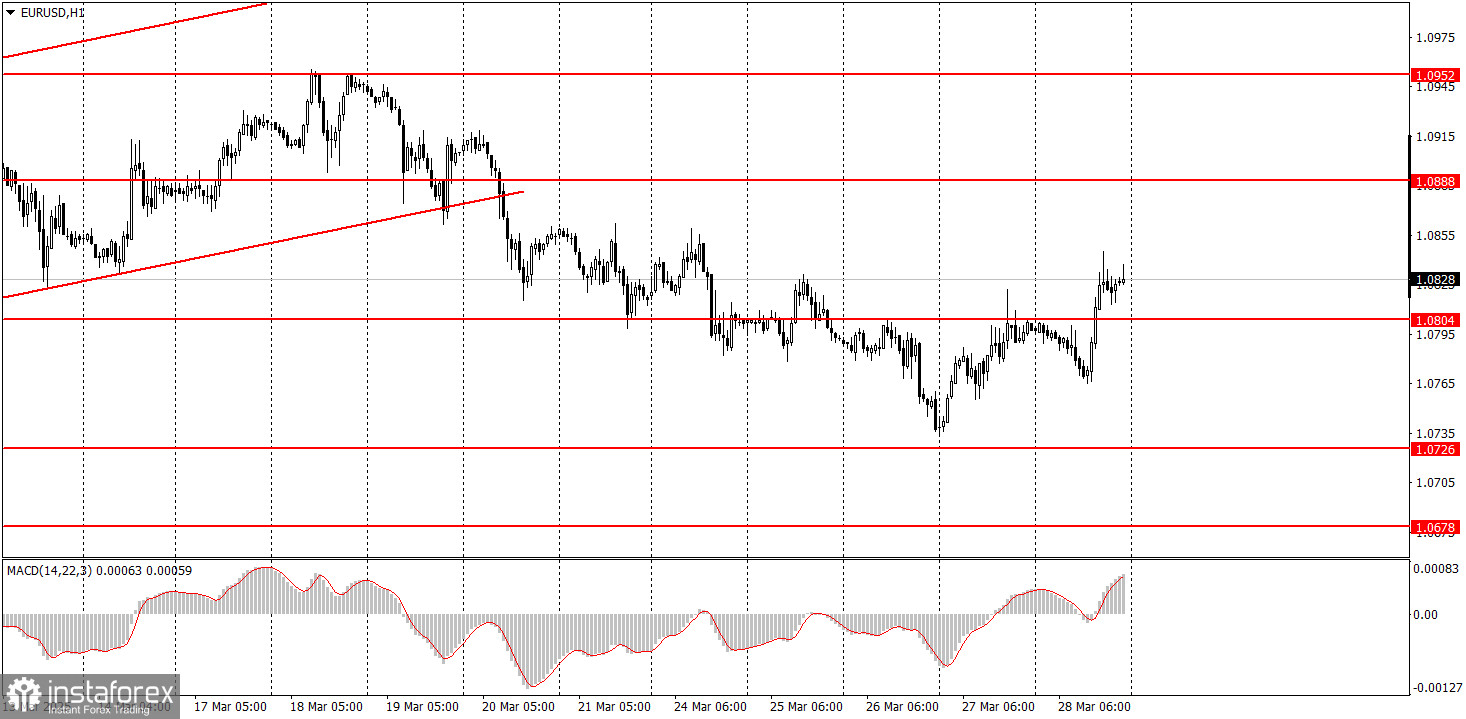

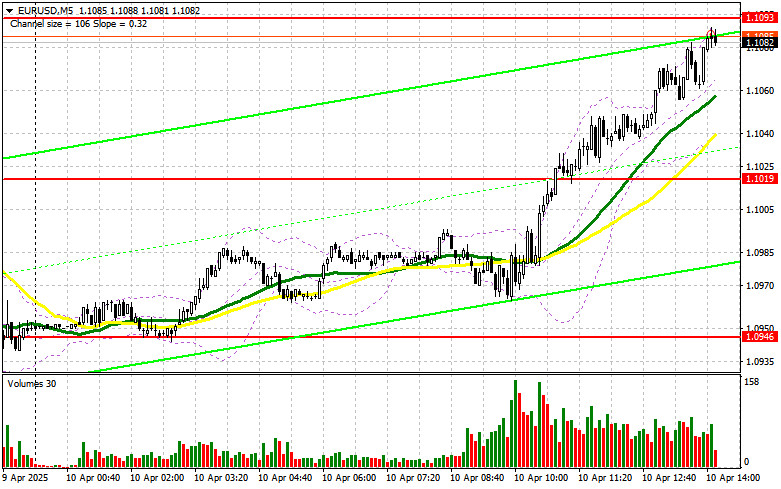

1H Chart of EUR/USD

On Friday, the EUR/USD currency pair once again traded higher. We can't say that macroeconomic events justified this movement. At this point, it's unsurprising that the dollar could drop at any moment. As a reminder, the U.S. currency remains under heavy pressure from Donald Trump. On Thursday, he implemented new tariffs, which resulted in another decline in the dollar's value. On Friday, however, the unemployment rate in Germany rose, and the number of unemployed increased more than forecast. These two reports alone should have triggered a decline in the euro. In addition, the PCE index — a proxy for inflation — rose more than expected, which implies a higher probability of a hawkish stance from the Federal Reserve throughout 2025. So, the dollar should have strengthened, not weakened. Only the University of Michigan Consumer Sentiment Index came in significantly weaker than forecast — and it was released after the dollar had already started to fall.

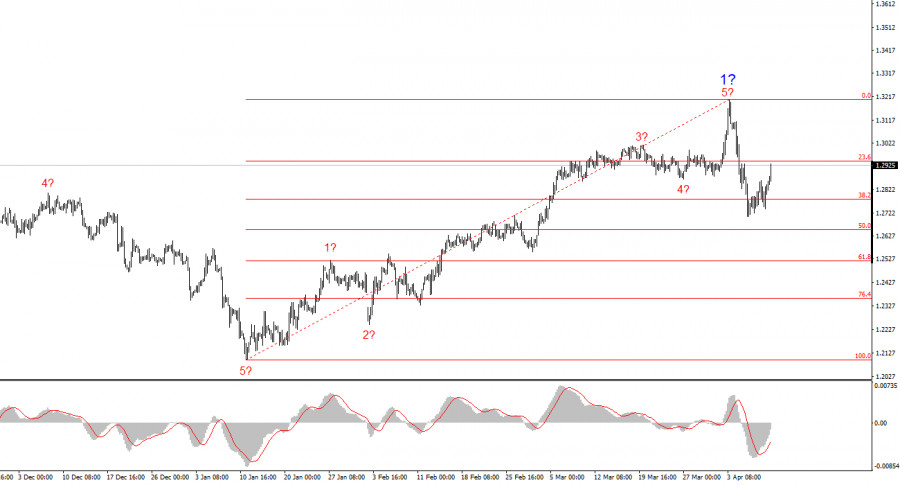

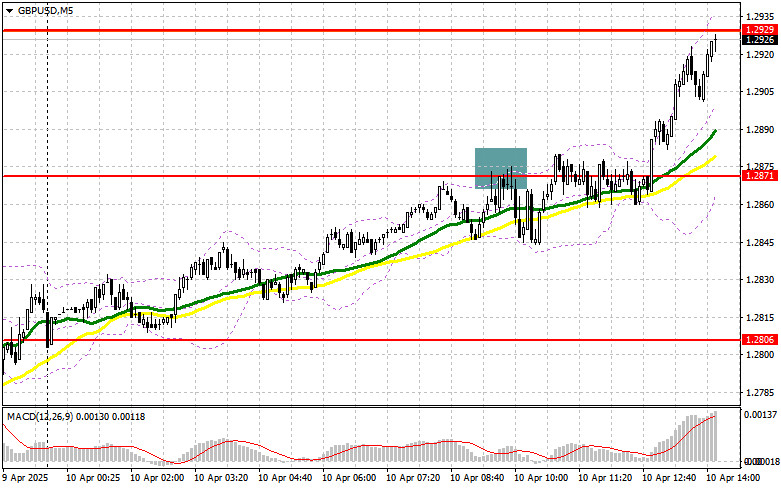

5M Chart of EUR/USD

On the 5-minute timeframe, two trading signals were formed on Friday. First, the pair bounced off the 1.0797–1.0804 area and dropped 20 pips. It's unlikely traders profited much from this trade — if at all. Then, the price broke above this area and increased by about 30 pips. This second trade could yield a modest profit of 10–15 pips, as the price remained above the 1.0797–1.0804 zone until the end of the session.

Trading Strategy for Monday:

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of that trend resuming are decreasing. Since the fundamental and macroeconomic backdrop still favors the U.S. dollar more than the euro, we continue to expect a decline. However, Donald Trump keeps dragging the dollar down with his ongoing tariff decisions and statements about reshaping the global order in the U.S.'s favor. Politics and geopolitics currently overshadow fundamentals and macroeconomics, so we don't expect strong dollar growth.

On Monday, the euro could resume its decline, as a downtrend has begun on the hourly chart. The dollar is oversold and has depreciated too much and too unjustifiably lately. Continuing the correction is possible — but Donald Trump is still around...

On the 5-minute chart, the following levels should be monitored: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048. Germany will release retail sales and March inflation data on Monday — interesting reports, although not the most critical ones. The U.S. economic calendar is empty.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.