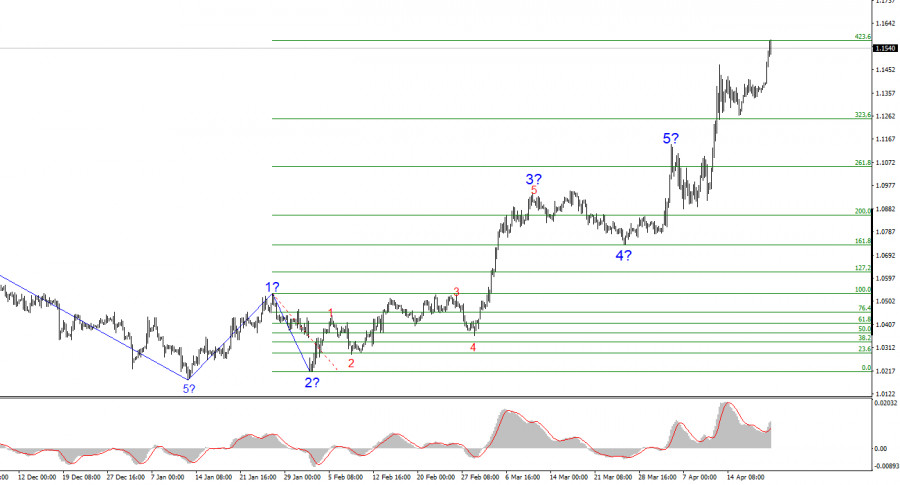

- The wave structure on the 4-hour chart for EUR/USD has transformed into a bullish formation. I believe there's little doubt that this transformation occurred solely due to the new U.S

Author: Chin Zhao

19:46 2025-04-21 UTC+2

25

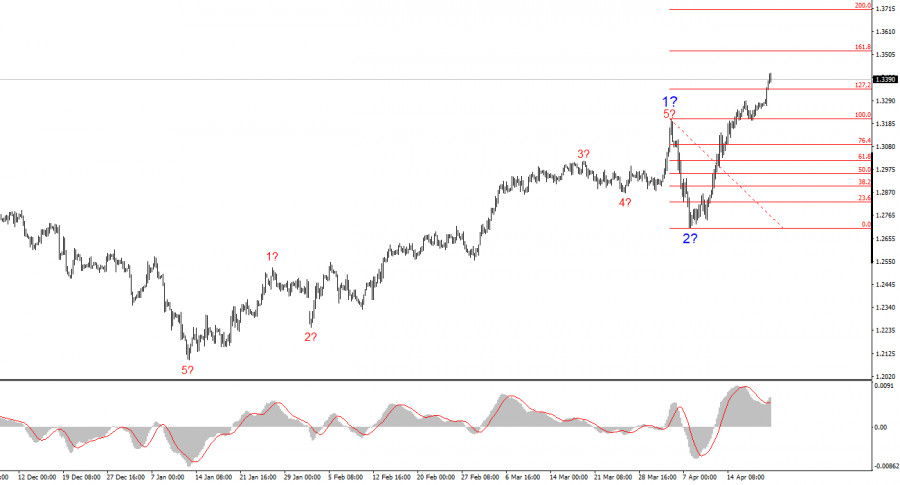

The wave structure for GBP/USD has also transformed into a bullish, impulsive formation—"thanks" to Donald Trump. The wave picture is nearly identical to that of EUR/USD. Up until FebruaryAuthor: Chin Zhao

19:44 2025-04-21 UTC+2

21

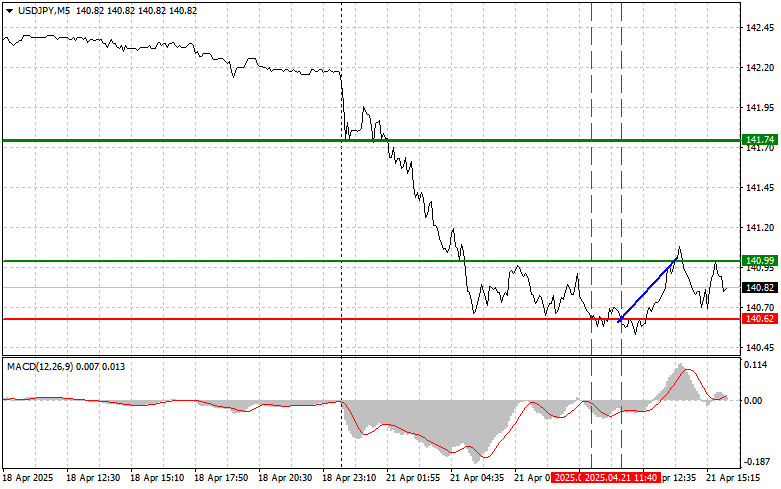

Trade Breakdown and Trading Tips for the Japanese Yen The first test of the 140.62 price level occurred when the MACD indicator had already fallen significantly below the zero lineAuthor: Jakub Novak

19:41 2025-04-21 UTC+2

17

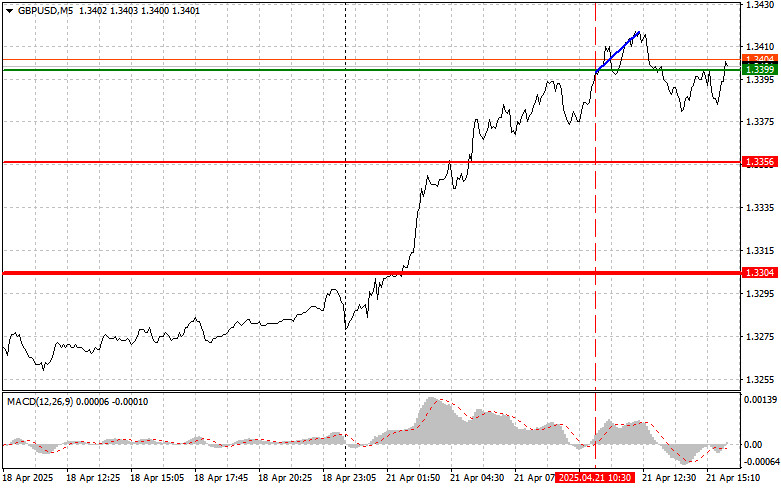

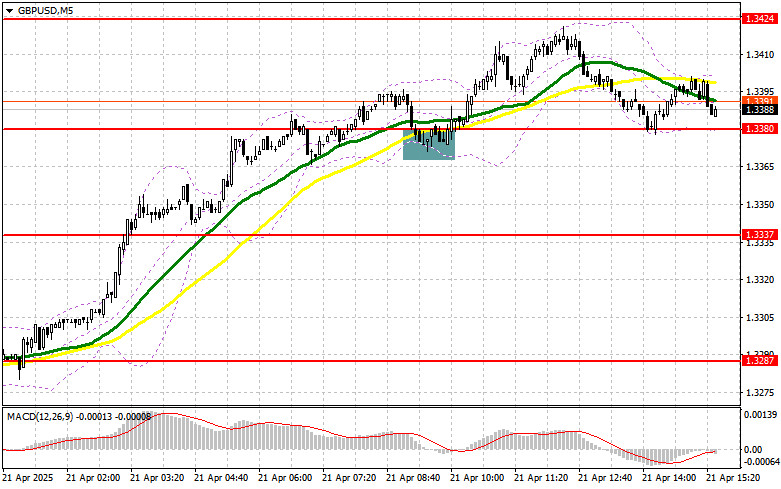

- Trade Breakdown and Tips for Trading the British Pound The price test at 1.3399 coincided with the MACD beginning to rise from the zero line, confirming a valid entry point

Author: Jakub Novak

19:39 2025-04-21 UTC+2

18

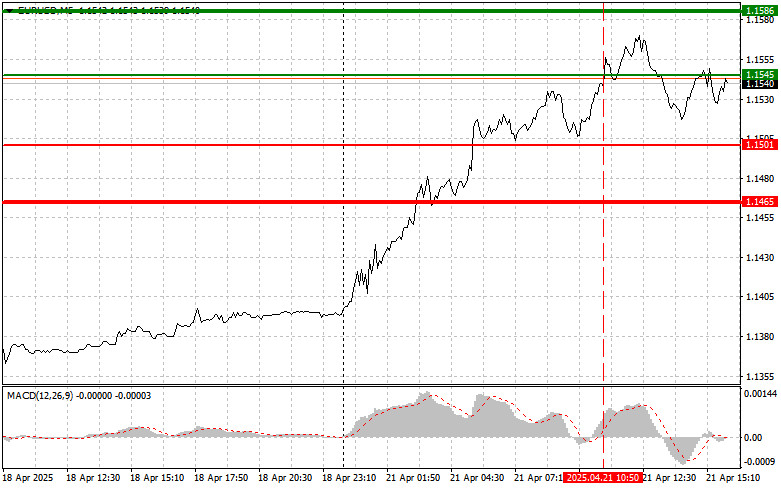

Trade Breakdown and Tips for Trading the Euro The price test at 1.1545 occurred when the MACD indicator had already moved far above the zero line, which limited the pair'sAuthor: Jakub Novak

19:29 2025-04-21 UTC+2

17

In my morning forecast, I highlighted the 1.3380 level and planned to make entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. A declineAuthor: Miroslaw Bawulski

19:24 2025-04-21 UTC+2

16

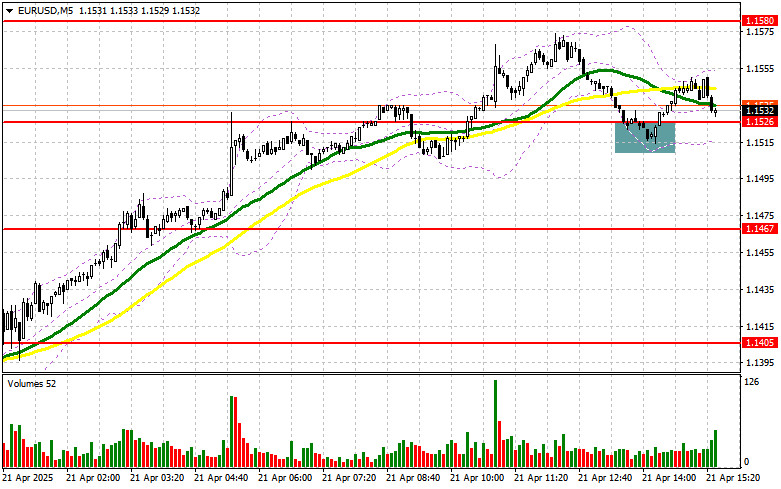

- Trading plan

EUR/USD: Trading Plan for the U.S. Session on April 21st (Analysis of the Morning Trades)

In my morning forecast, I highlighted the level of 1.1526 and planned to make entry decisions based on it. Let's look at the 5-minute chart and see what happenedAuthor: Miroslaw Bawulski

19:19 2025-04-21 UTC+2

13

Gold continues to show strong demand, trading near its all-time high, just below the key psychological level of $3400. The hardline international trade policy pursued by U.S. President Donald TrumpAuthor: Irina Yanina

19:15 2025-04-21 UTC+2

32

The strengthening of the pair is linked to the euro's rise amid U.S. dollar weakness, driven by concerns over a potential recession in the U.S. and questions about the FederalAuthor: Irina Yanina

12:17 2025-04-21 UTC+2

25