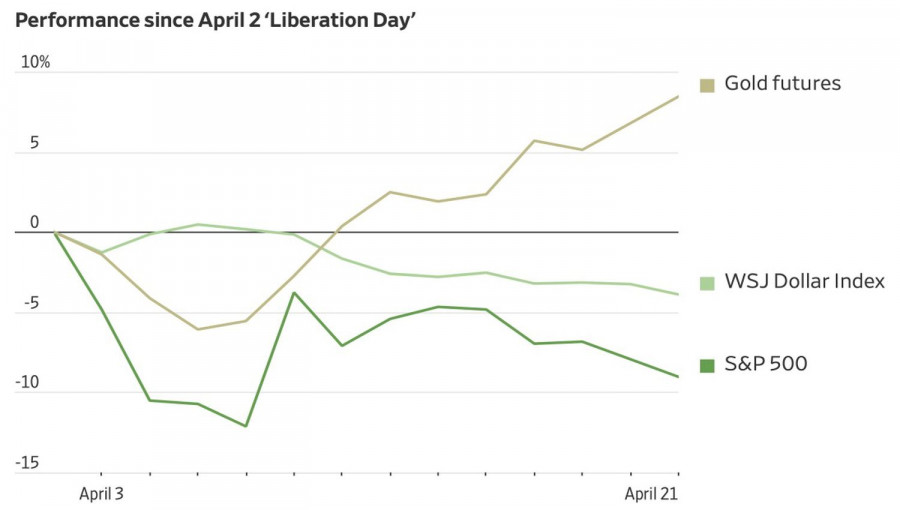

The US benchmark stock indices closed the New York session on Friday in the red. The S&P 500 plunged by 5.97%, while the Nasdaq 100 lost 5.92%. The industrial Dow Jones decreased by 5.5%. All of this is a reaction to the tariffs announced by President Trump.

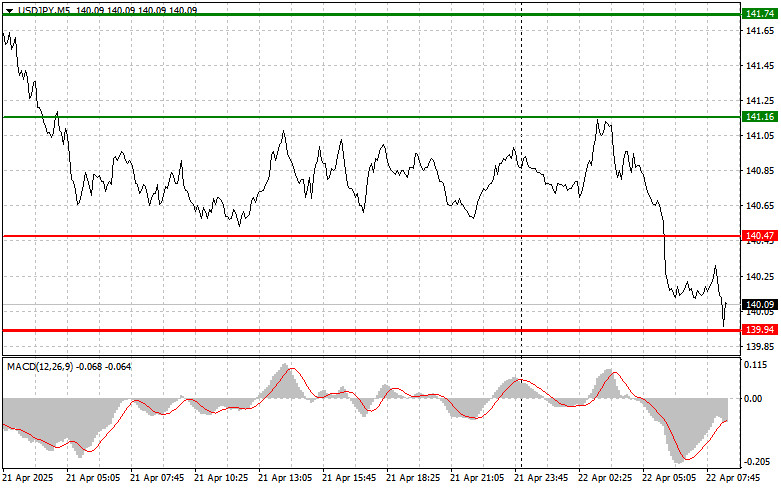

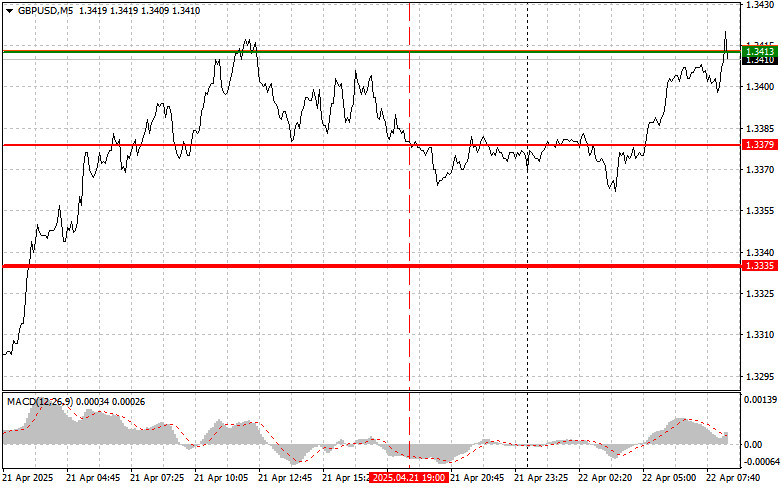

The outflow of funds from global equity markets accelerated on Monday. Investors flocked to safe-haven assets as the consequences of President Trump's tariffs intensified after China announced retaliatory measures. Futures for US and European stock indices fell by more than 3.6%. Oil retreated along with the yield on two-year Treasury bonds. The US dollar traded somewhat ambiguously against other currencies. Meanwhile, traditional safe-haven currencies, such as the yen and Swiss franc, showed growth.

It is clear that investors condemned Trump's decision to impose extensive global tariffs in an attempt to change world trade in Washington's favor. Federal Reserve Chairman Jerome Powell made it clear last Friday that the central bank would not rush to react to tariffs, which are likely to have a significant impact on the US economy, including slower growth and higher inflation. Many were hoping for support from Powell, so it's not surprising that the market's decline continued.

Investors, hoping for more decisive action from the Federal Reserve, began shedding assets, leading to falling stock indices and rising bond yields. Analysts note that Powell's restrained position reflects his unwillingness to interfere in political matters related to the trade war and his confidence in the resilience of the US economy. However, many economists express concern that the Fed's inaction could aggravate the negative consequences of the trade wars. They believe that tariff hikes will inevitably lead to higher prices for imported goods, affecting consumers and businesses. This could, in turn, reduce consumer demand and investment, negatively impacting economic growth. Despite the criticism, Powell remains committed to his approach, emphasizing that the Federal Reserve will closely monitor the situation and make decisions based on incoming data. He also noted that the central bank has adequate tools to mitigate the negative effects of the trade war, should it become necessary.

Clearly, this week, the market consequences of the tariffs will continue to be felt more strongly, as officials from the Trump administration have made it clear that they do not plan to make any changes in policy to address the stock market sell-off. Against this backdrop, many companies have rushed to revise their business plans, and analysts are updating forecasts, as investors remain fearful of the consequences of the "eye for an eye" tariffs. According to JPMorgan's Chief Economist Bruce Kasman, the tariffs are likely to lead to a recession in 2025 in the US economy and possibly in the global economy if they remain in place.

However, as mentioned above, Trump and his economic team have dismissed investors' concerns about inflation and recession, offering no apologies for the market upheavals and insistently maintaining that a boom is just around the corner. Trump, speaking on Sunday, continued to defend the tariff policy, stating that it would make the US economy even stronger.

But evidently, investors see things differently. On Friday, the S&P 500 experienced its worst two-day drop since March 2020 as the sell-off wiped more than $5 trillion off its value, and the index plunged by 6%. The Nasdaq 100 entered a bear market.

In addition to imposing new tariffs in response to Trump's latest actions, China promised decisive steps to protect its economy over the weekend. These measures will include decisive actions to safeguard its sovereignty, security, and other interests, according to the state news agency Xinhua.

Meanwhile, Japanese Prime Minister Shigeru Ishiba stated that he would visit the US as soon as possible to present Trump with a large-scale deal. The president had previously said he was open to lowering tariffs if other countries offered something "phenomenal."

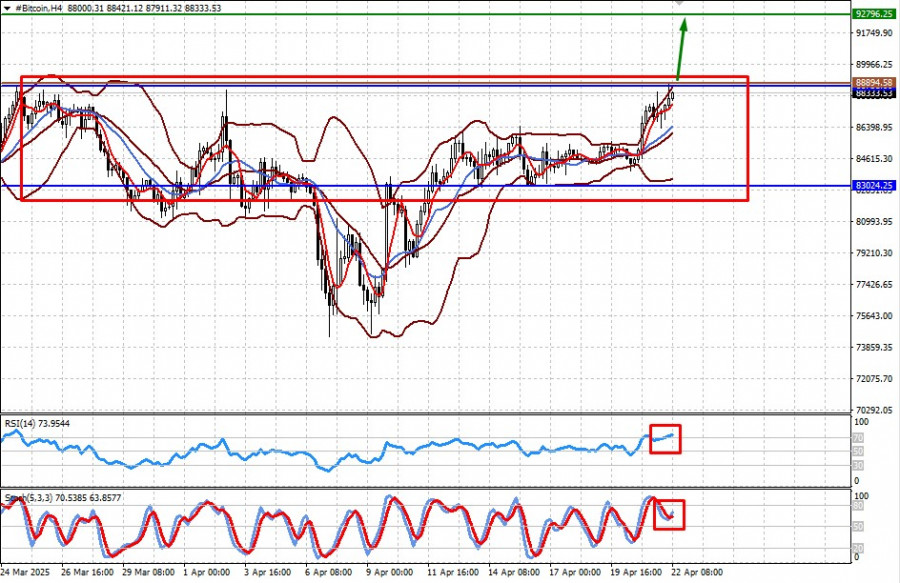

In the commodity market, copper and other metals recovered from previous declines. Oil prices dropped after Saudi Arabia cut the price of its flagship crude oil by the most in two years. Cryptocurrencies plummeted, highlighting a clear risk-off sentiment across all markets.

Technical outlook for S&P 500

The decline continues. The primary task for buyers today will be to break through the nearest resistance at 4,943. This will help continue the upward movement and open the door to a potential push to a new level at 5,011. Another priority for the bulls will be to control 5,084, which would strengthen their position. If the market moves downward amid a decreased appetite for risk, the buyers must assert themselves around 4,818. A break below that would quickly push the instrument back to 4,781 and open the way to 4,751.