- Forecast

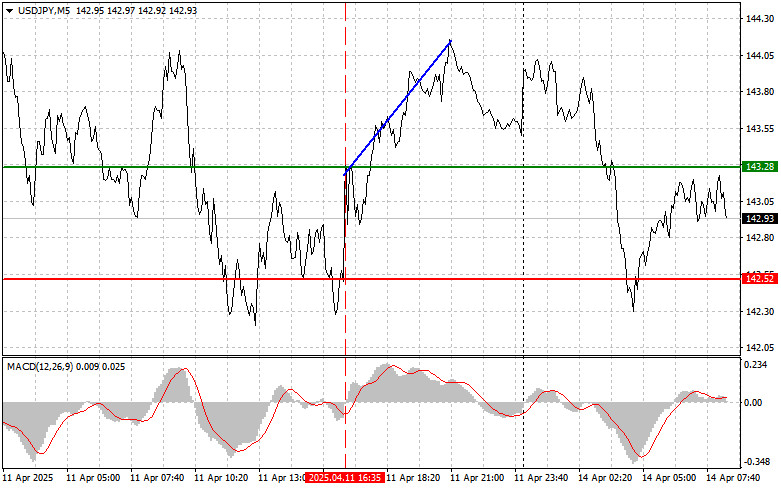

USD/JPY: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

The price test at 143.28 occurred when the MACD indicator had just started moving up from the zero line, confirming a valid entry point for buying the dollarAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

0

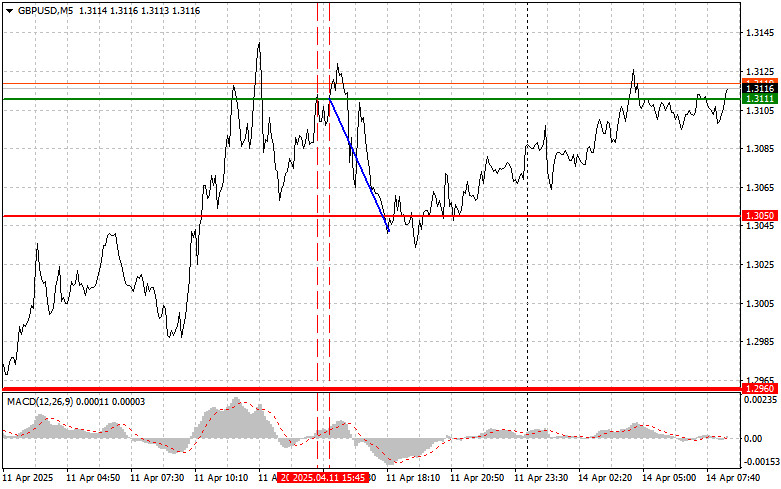

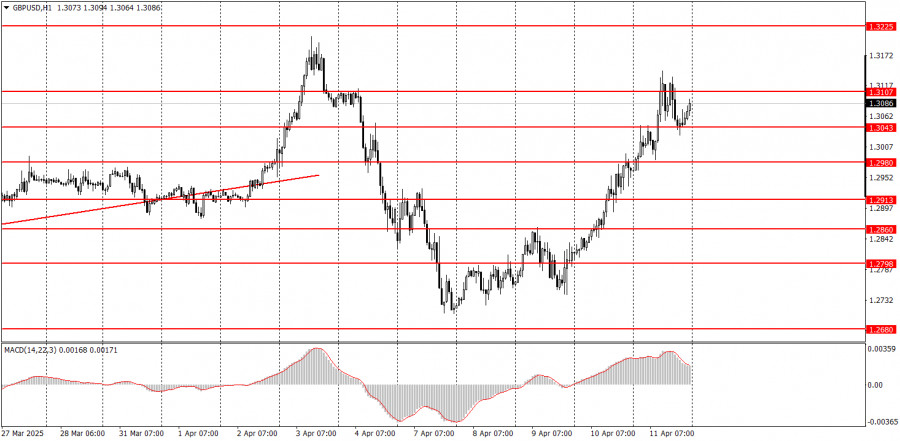

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

The price test at 1.3111 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential at the end of the weekAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

0

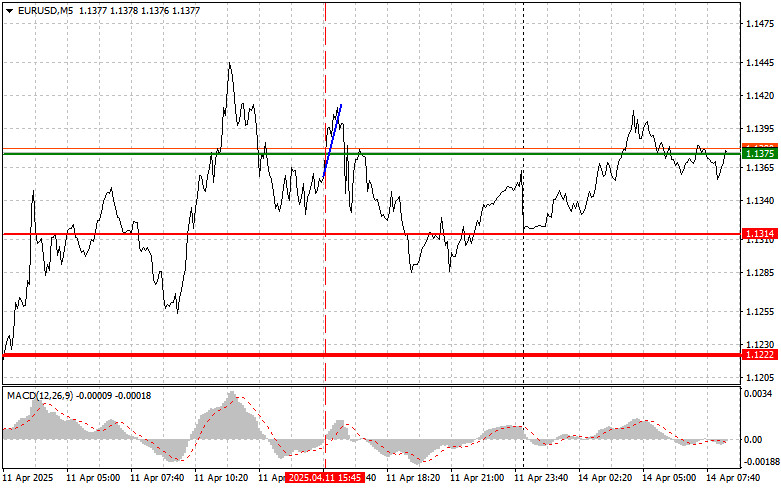

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on April 14. Review of Yesterday's Forex Trades

The price test at 1.1375 occurred when the MACD indicator had just started moving upward from the zero mark, confirming the validity of a long entry point in supportAuthor: Jakub Novak

08:12 2025-04-14 UTC+2

1

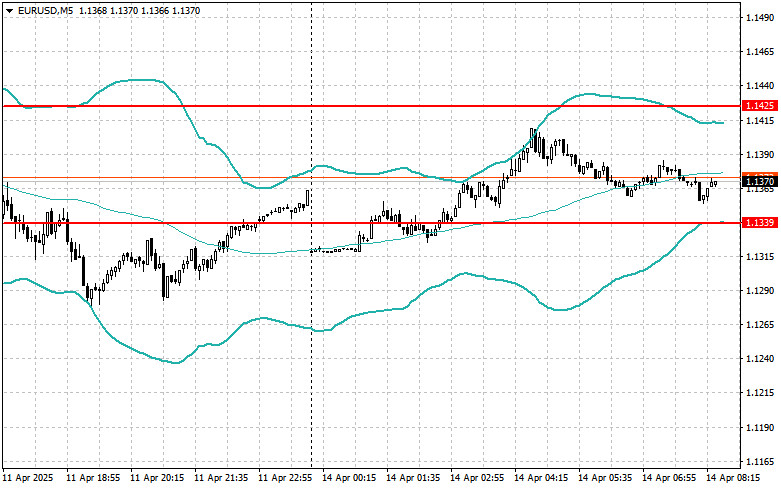

- The euro and the pound held their positions against the U.S. dollar, rebounding after news that U.S. producer prices in March fell sharply—just like the previous day's core inflation data

Author: Miroslaw Bawulski

07:31 2025-04-14 UTC+2

7

Technical analysisTechnical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Monday April 24, 2025.

On the 4-hour chart of the Crude Oil commodity instrument, the Inverted Head & Shoulders pattern and Bullish Pattern 123 and Divergence between the #CL price movement and the StochasticAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

11

Technical analysisTechnical Analysis of Intraday Price Movement of Palladium vs USD Commodity Instrument, Monday April 24, 2025.

With the appearance of Divergence from the Stochastic Oscillator indicator with the XPD/USD price movement on its 4-hour chart and the appearance of a Bullish 123 pattern followedAuthor: Arief Makmur

07:19 2025-04-14 UTC+2

8

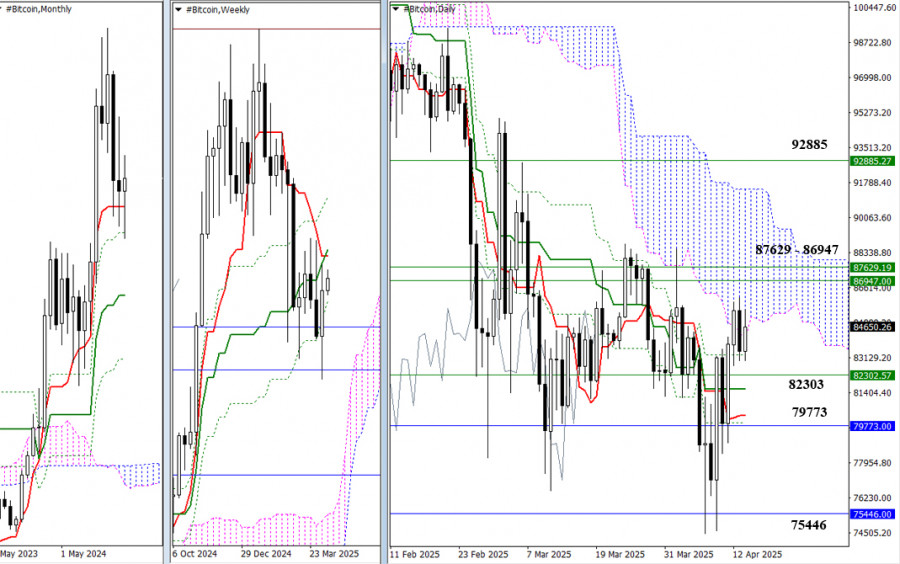

- Last trading week, the market indicated a potential opportunity for bulls to regain control. Whether this potential is realized now depends on whether the bulls can exit the previous consolidation

Author: Evangelos Poulakis

06:37 2025-04-14 UTC+2

9

Fundamental analysisWhat to Pay Attention to on April 14? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for Monday. However, the macroeconomic background is not of much interest to traders at the moment. At the very least, it does not driveAuthor: Paolo Greco

06:08 2025-04-14 UTC+2

12

Trading planHow to Trade the GBP/USD Pair on April 14? Simple Tips and Trade Analysis for Beginners

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair also continued its upward movement. The reasons are the same as for the EUR/USD pair. The entireAuthor: Paolo Greco

06:08 2025-04-14 UTC+2

12