- After a sharp rise during the Asian session, the euro and the pound grew through the European trading hours. However, by the mid-U.S. session, demand for risk assets declined, leading

Author: Miroslaw Bawulski

07:46 2025-04-22 UTC+2

2

Fundamental analysisWhat to Pay Attention to on April 22? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simplyAuthor: Paolo Greco

07:46 2025-04-22 UTC+2

5

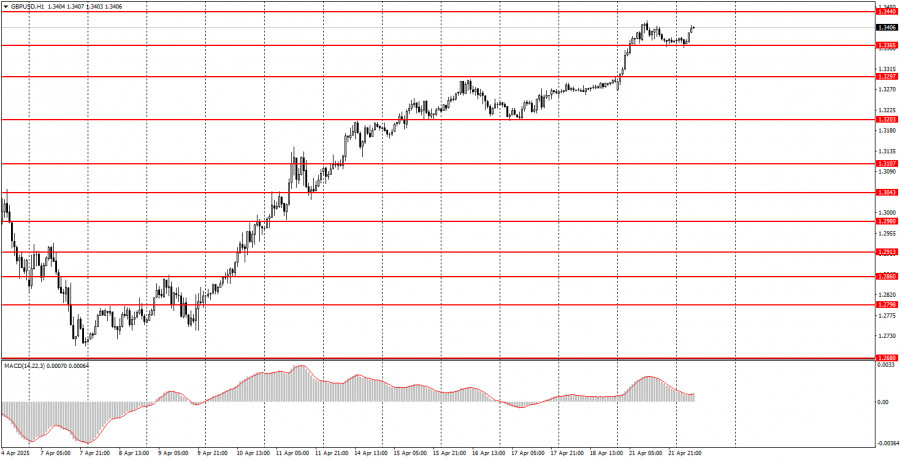

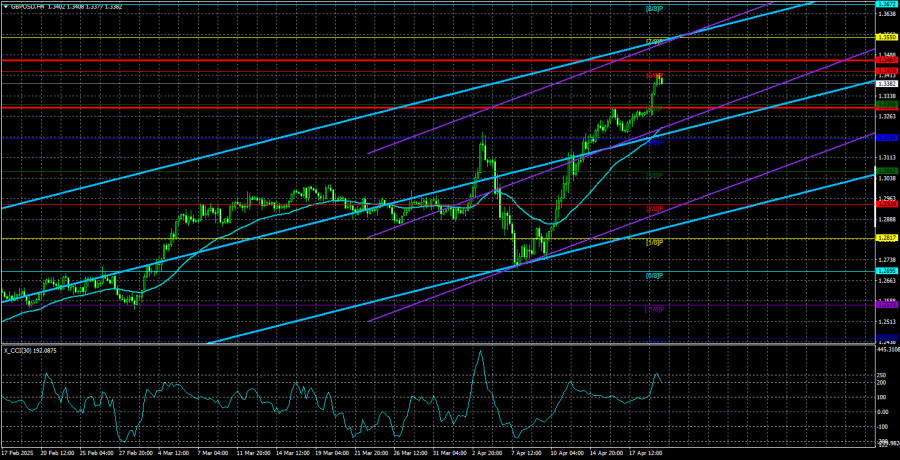

Trading planHow to Trade the GBP/USD Pair on April 22? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade with substantial gains throughout Monday. On the first trading day of the week, there wereAuthor: Paolo Greco

07:46 2025-04-22 UTC+2

4

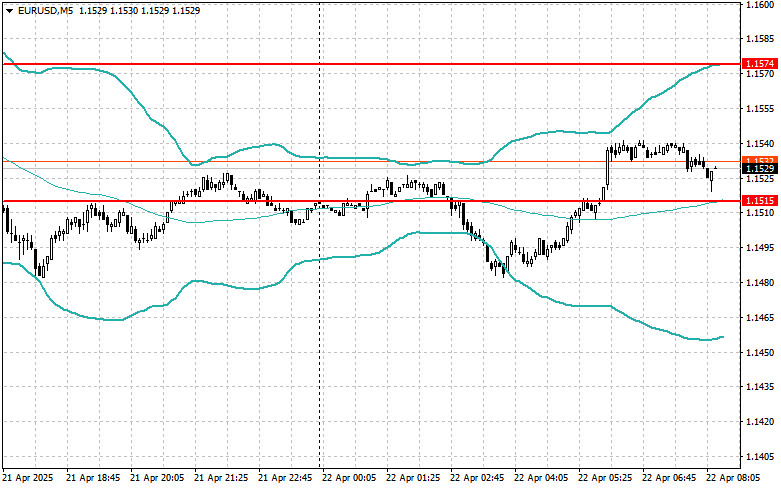

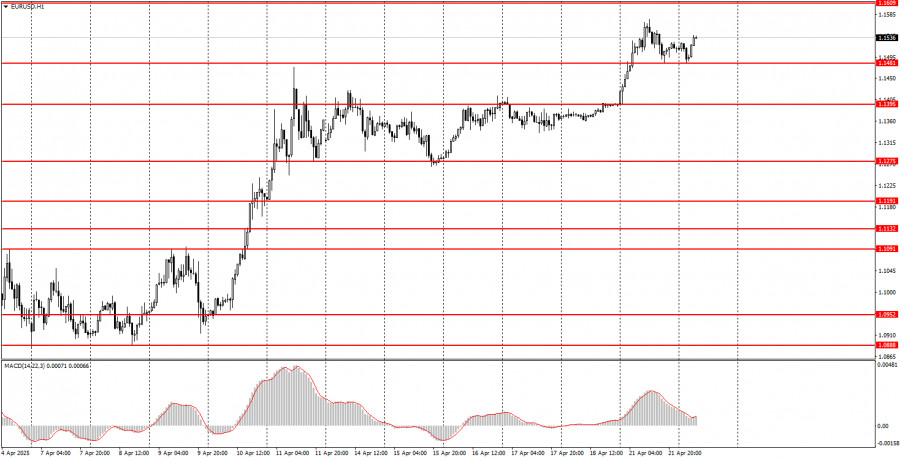

- Trading plan

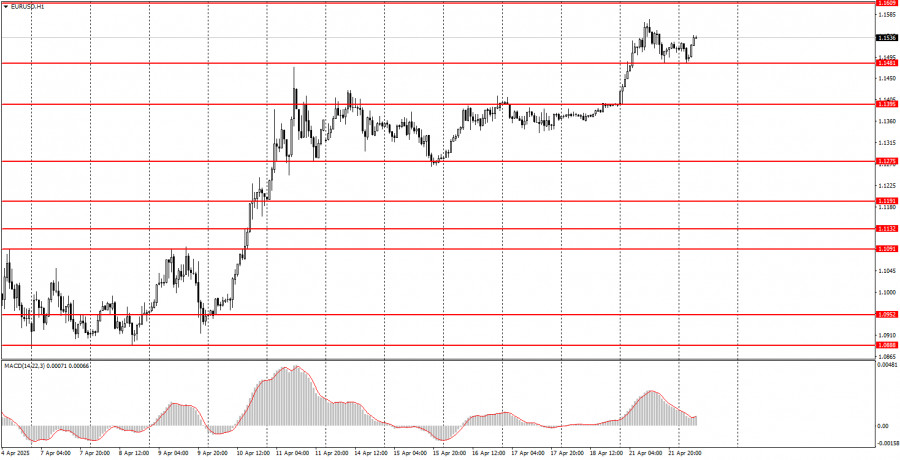

How to Trade the EUR/USD Pair on April 22? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded moreAuthor: Paolo Greco

07:46 2025-04-22 UTC+2

5

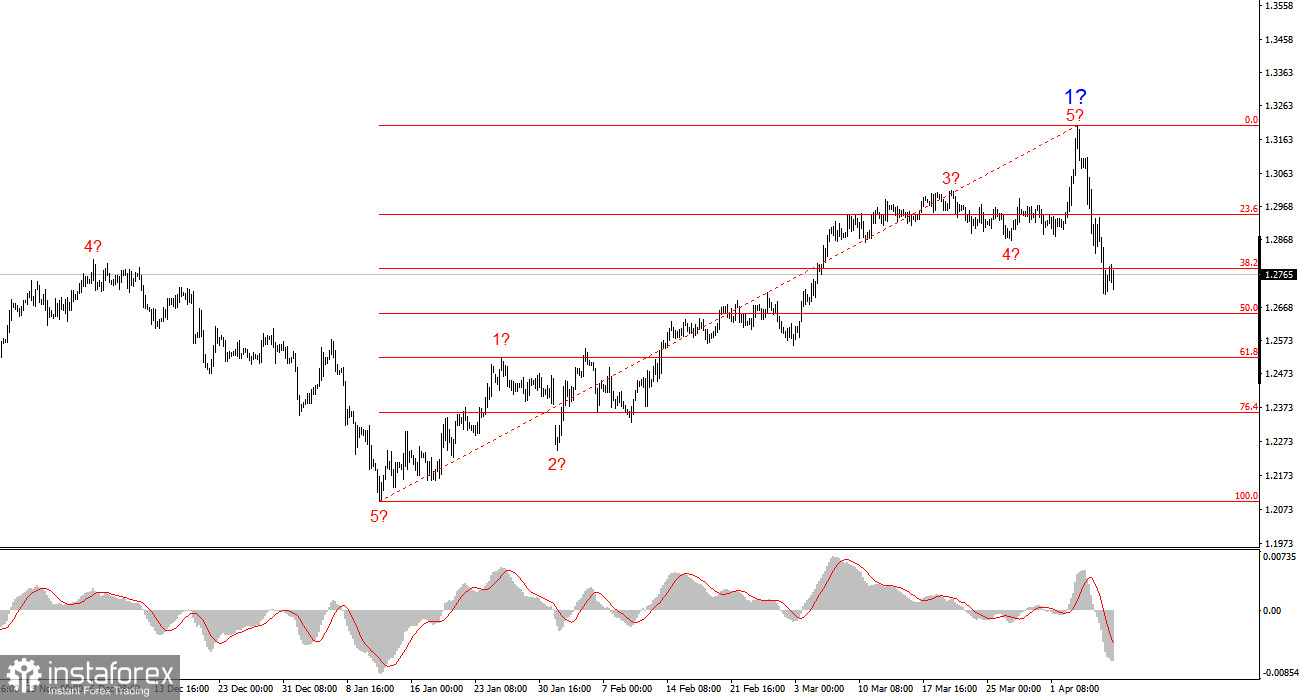

Technical analysisTechnical Analysis of Intraday Price Movement of GBP/CHF Cross Currency Pairs, Tuesday April 22, 2025.

If we look at the 4-hour chart of the GBP/CHF cross currency pair, there are several interesting facts. First, the appearance of a Triangle pattern followed by the movementAuthor: Arief Makmur

06:58 2025-04-22 UTC+2

6

Technical analysisTechnical Analysis of Intraday Price Movement of AUD/CAD Cross Currency Pairs, Tuesday April 22, 2025.

With the price movement of the AUD/CAD cross currency pair moving above the WMA (21) which has an upward slopes and the appearance of Convergence between the price movementAuthor: Arief Makmur

06:58 2025-04-22 UTC+2

6

- Fundamental analysis

GBP/USD Overview – April 22: Dollar Decline Neutralizes Any Positive Economic Changes

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euroAuthor: Paolo Greco

03:12 2025-04-22 UTC+2

15

The EUR/USD currency pair began Monday with a sharp drop from the opening. Interestingly, this time, the fall of the US dollar wasn't triggered by the American president. Any specificAuthor: Paolo Greco

03:12 2025-04-22 UTC+2

14

Trading planTrading Recommendations and Analysis for GBP/USD on April 22: Nothing Has Changed for the Pound

The GBP/USD currency pair continued its upward movement on Monday as it did last week. The only difference was the strength of the movement. On Monday, volatility was very high—withoutAuthor: Paolo Greco

03:12 2025-04-22 UTC+2

15