S&P500

Snapshot of the US benchmark stock indices on Thursday:

* Dow -2.5%,

* NASDAQ -4.3%,

* S&P 500 -3.5% The S&P 500 closed at 5,268, within the range of 4,800 to 5,800

The stunning rally seen on Wednesday, after President Trump announced a 90-day pause on reciprocal tariffs for most countries, failed to carry into Thursday.

Major stock indices opened lower and remained in negative territory through the close, though losses were trimmed during the session. At their intraday lows, the Dow, Nasdaq, S&P 500, S&P 400, and Russell 2000 fell by 5.4%, 7.2%, 6.3%, 6.5%, and 6.5%, respectively, but ended the day down 2.5%, 4.3%, 3.5%, 4.1%, and 4.3%.

Thursday's sharp pullback was driven by a growing realization: the US economy is not "out of the woods" yet. This is still only a pause on retaliatory tariffs—the base 10% tariff remains in effect.

Meanwhile, a harsh tariff rate still applies to China. As clarified by the White House today, it stands at 145% (a 125% retaliatory tariff plus the existing 20% fentanyl-related tariff).

The stock market opened on Thursday with renewed sell-offs from nervous investors who saw Wednesday's rally as a gift, a chance to sell at higher prices and minimize the pain from losses following the tariff announcement on April 2.

Comments from several Fed officials made it clear the central bank is concerned about tariffs fueling inflation, and is therefore reluctant to cut interest rates anytime soon.

Disappointing earnings also weighed on sentiment. CarMax (KMX 66.43, -15.62, -19.5%) reported worse-than-expected results.

There is growing concern about the federal budget deficit. The House passed a budget resolution including tax breaks that some fear will not be offset by sufficient spending cuts, potentially driving the deficit even higher.

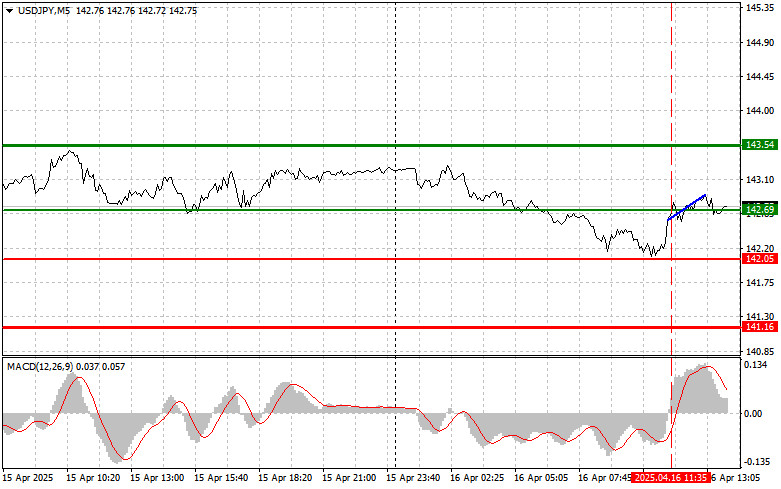

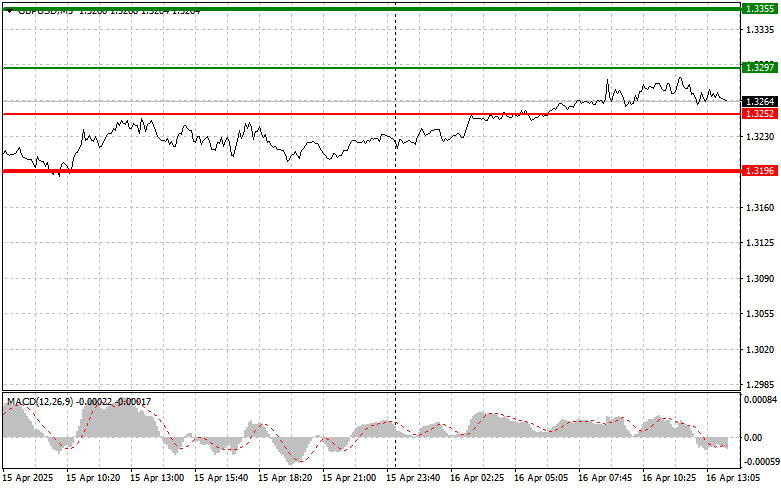

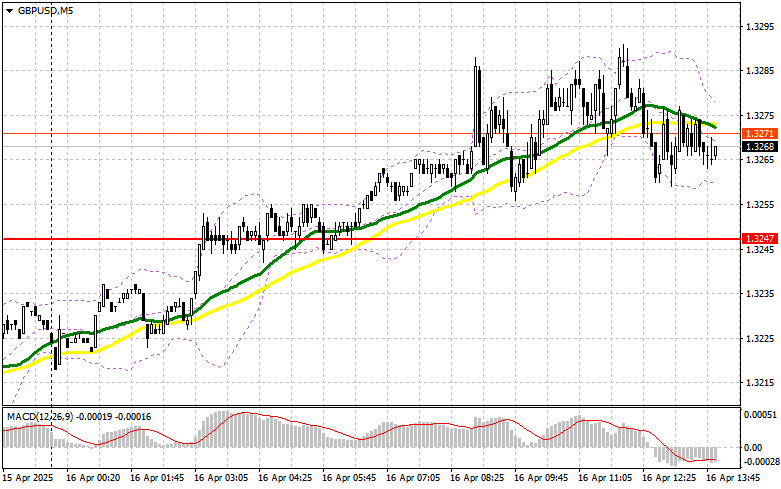

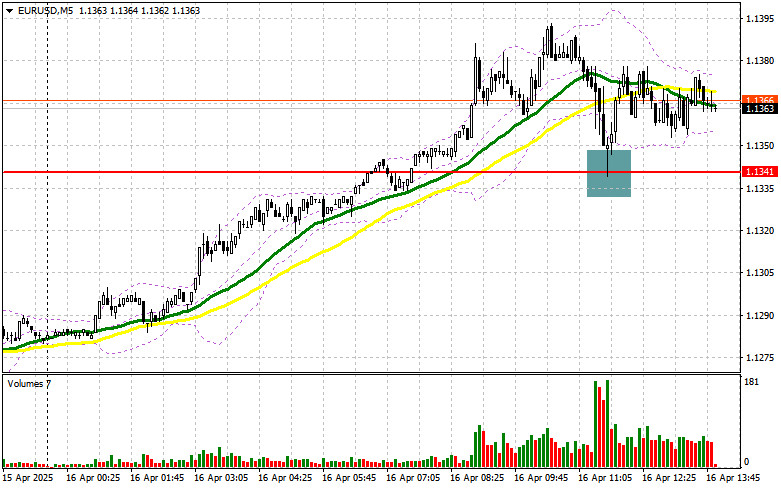

There was also a sharp drop in the US dollar against major currencies—likely triggered by fears about US growth prospects, deficit concerns, and declining foreign investor confidence amid political volatility. The US dollar index dropped by 1.9% to 100.98.

Notably, March's CPI report brought positive inflation news, but failed to lift market sentiment. Traders expect higher prices in the coming months as tariff impacts begin rippling through supply chains.

Ten of the eleven S&P 500 sectors ended the day in the red. The only gainer was consumer staples, considered a defensive play (+0.2%).

The energy sector was the worst performer (-6.4%), followed by information technology (-4.6%), consumer discretionary (-4.1%), communication services (-4.1%), and materials (-3.0%).

The Philadelphia Semiconductor Index, which jumped 18.7% on Wednesday, dropped 8.0% on Thursday. The Vanguard Mega-Cap Growth ETF (MGK), which surged 12.2%, declined by 4.1%.

On the NYSE, declining stocks outpaced advancing ones by more than 8 to 1; on the Nasdaq, by more than 4 to 1.

Year-to-date performance:

* Dow Jones Industrial Average: -7.1%

* S&P 500: -10.4%

* S&P Midcap 400: -14.0%

* Nasdaq Composite: -15.1%

* Russell 2000: -17.9%

Economic calendar on Thursday

* Headline CPI for March fell by 0.1% month-over-month (consensus: +0.1%) and rose 2.4% year-over-year, down from 2.8% in February.

* Core CPI rose 0.1% MoM (consensus: +0.3%) and 2.8% YoY, compared to 3.1% in February.

Main takeaway: While the CPI report was better than expected, it's not seen as a long-term improvement due to the looming effects of tariffs already moving through supply chains.

* Initial jobless claims for the week ending April 5 rose by 4,000 to 223,000 (consensus: 225,000).

* Continuing claims for the week ending March 29 fell by 43,000 to 1.850 million.

Conclusion from the data on jobless claims: Low initial claims continue to support the view of a solid labor market and an economy still in growth mode.

Treasury budget for March:

* Deficit of $160.5 billion, down from $236.6 billion in March of the previous year.

* March deficit driven by $528.2 billion in outlays versus $367.6 billion in receipts.

These figures are not seasonally adjusted and should not be directly compared to February's $307 billion deficit. Key takeaway: The FY2025 deficit is 23% larger than at the same point in FY2024.

Economic calendar on Friday

* 08:30 ET: March PPI (consensus: +0.1%; previous: 0.0%) and Core PPI (consensus: +0.3%; previous: -0.1%)

* 10:00 ET: Preliminary University of Michigan Consumer Sentiment Index for April (consensus: 54.8; previous: 57.0)

Energy market. Brent crude at $63.70 – oil remains consolidated in the $61–$65 range.

Conclusion: One analyst asked the right question: What spooked Trump into abruptly delaying broad tariffs for 90 days—on everyone except China? The answer is simple: Trump was alarmed by the sharp rise in US Treasury yields, which were about to break above 4.5%. This indirectly supports the hypothesis that Trump's true motive behind tariffs was to improve the US debt situation. Indeed, Trump said yesterday that he wants to use tariff revenue to reduce the national debt.

In any case, the S&P 500 is trading in a wide range between 4,800 and 6,000.

Our strategy: buy in the lower part of the range and lock in profits near the top.