- Plan de négociation

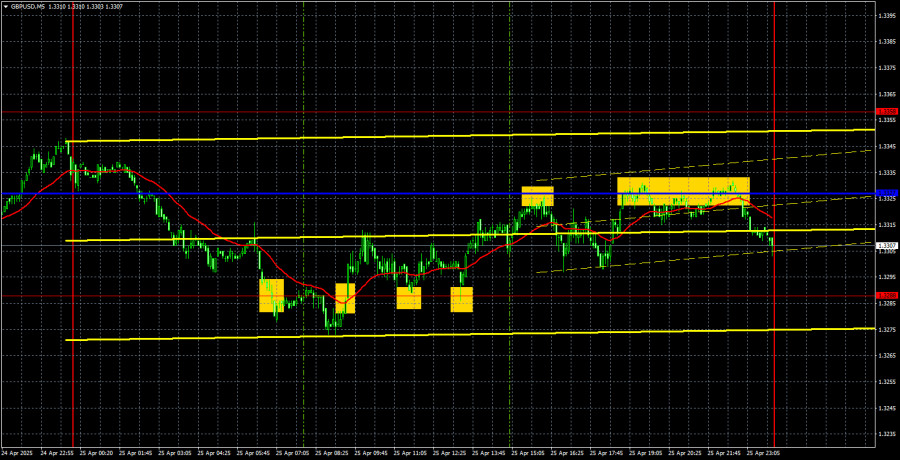

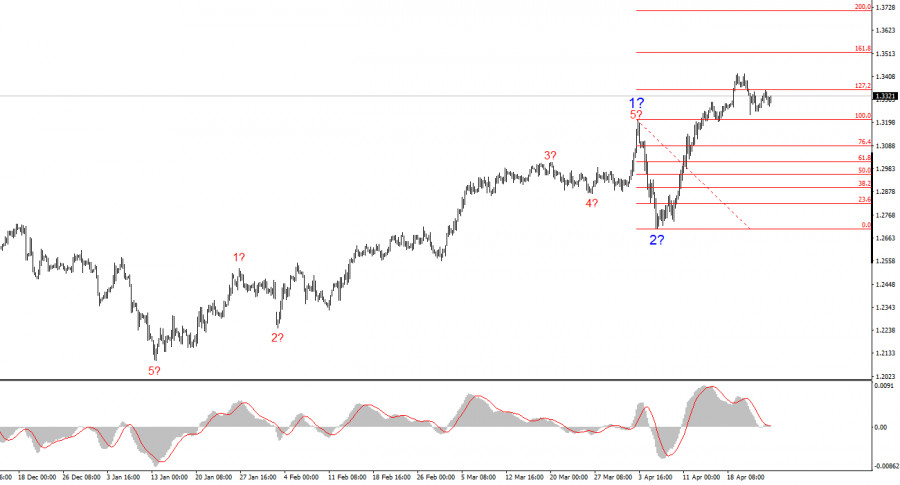

Recommandations de Trading et Analyse pour GBP/USD le 28 avril : La Livre ne Croit pas en une Désescalade

La paire de devises GBP/USD a poursuivi un mouvement latéral ce vendredi, se maintenant près des plus hauts de trois ans. Le fait que la livre sterling refuse mêmeAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

0

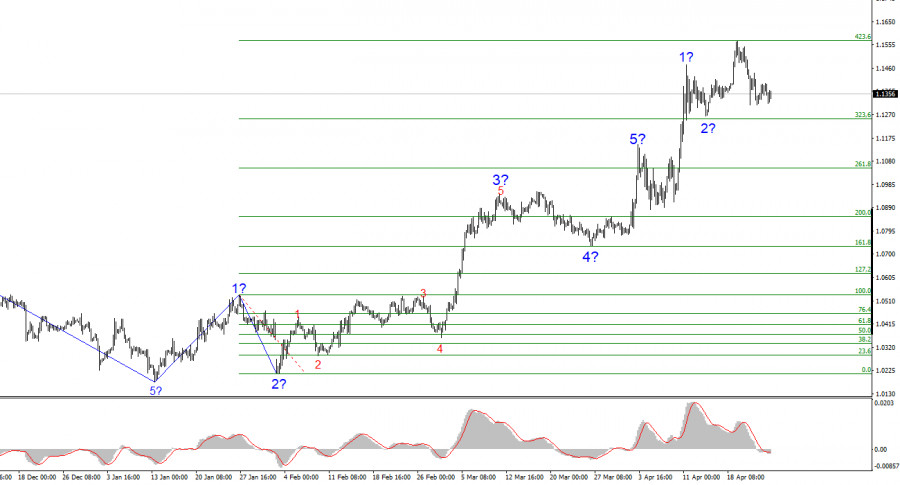

Plan de négociationRecommandations de trading et analyse pour EUR/USD le 28 avril : La stagnation se poursuit

La paire de devises EUR/USD a continué de se négocier de manière latérale tout au long de la journée de vendredi. Dans la seconde moitié de la semaine dernière, l'euroAuthor: Paolo Greco

04:13 2025-04-28 UTC+2

0

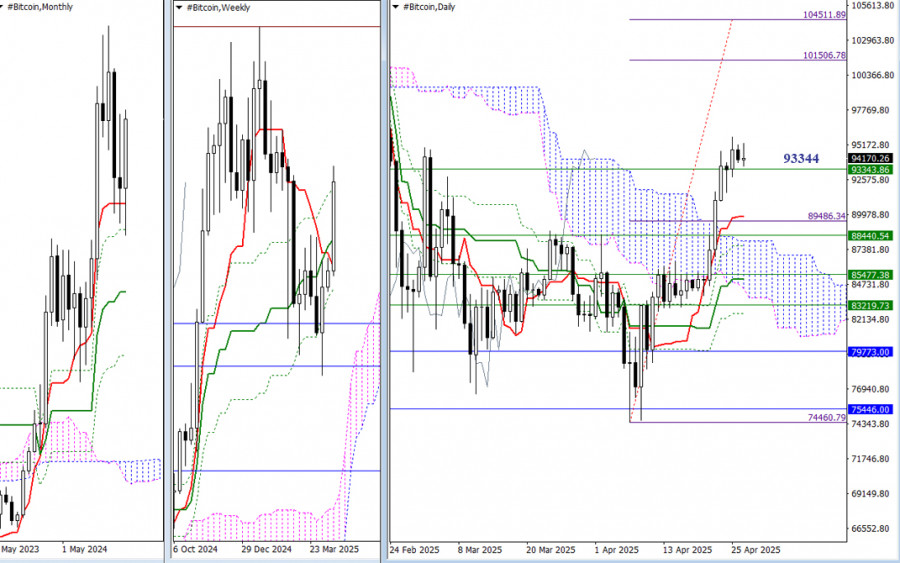

La semaine dernière, le marché a atteint un nouveau point bas, mais les vendeurs n'ont pas réussi à poursuivre le mouvement baissier pleinement. Cela pourrait être dû au faitAuthor: Evangelos Poulakis

03:51 2025-04-28 UTC+2

4

- Actuellement, les acteurs haussiers tentent de renverser la situation et d'atteindre un optimisme haussier pour le mois d'avril. La semaine dernière, la résistance au niveau final du croisement hebdomadaire

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1

Les États-Unis affrontent une semaine importante, mais il est peu probable qu'elle soit déterminante pour le dollar américain. Des rapports significatifs sur le marché du travail, les offres d'emploiAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

3

La livre sterling britannique se porte encore mieux que l'euro. Le marché continue de trouver des raisons supplémentaires pour augmenter la demande de la livre, même lorsque l'euro reste stagnantAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

3

- Le modèle des vagues sur le graphique de 4 heures de l'EUR/USD a évolué vers une formation haussière. Il est raisonnable de dire que cette transformation s'est produite uniquement

Author: Chin Zhao

20:26 2025-04-25 UTC+2

49

Le modèle de vagues sur le graphique GBP/USD s'est également transformé en une structure haussière et impulsive — "grâce" à Donald Trump. La configuration de vagues ressemble de prèsAuthor: Chin Zhao

20:21 2025-04-25 UTC+2

50

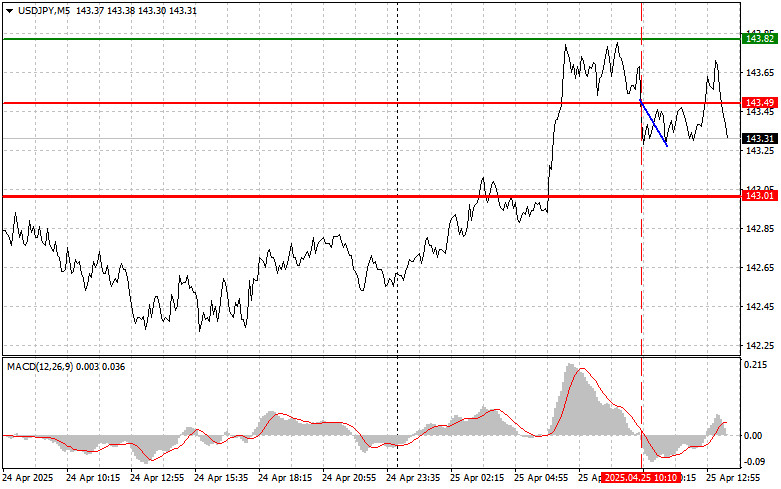

Analyse et Conseils de Trading pour le Yen Japonais Le test du prix à 143.49 s'est produit juste au moment où l'indicateur MACD a commencé à descendre de la ligneAuthor: Jakub Novak

20:09 2025-04-25 UTC+2

45